Energy utilities across the world are undergoing transformational changes caused by the rise of smart sensors, Advanced Metering Infrastructure (AMI), bi-directional grids and an evolving consumer with a digital mindset. It is unlikely that any utility can stay sheltered from the changes being driven by sensors and digital technologies. These changes call for fresh action. Utilities were once stable and centralized. They dictated how consumers bought, used and paid for energy. Now, they are losing their grip on how consumers buy and pay. They must re-engineer themselves to stay relevant. Distributed generation, rooted in alternate sources of energy, is another powerful change agent. Solar energy was once expensive. It could not compete with coal-fired plants. It was therefore dismissed as a non-entity by the industry. Governments were forced to step in and incentivize solar generation. Today, alternate sources of energy continue to grow, despite the incentives being largely withdrawn, hurting the traditional utilities. In Australia it is already causing revenue losses to energy utilities. Last year, one of Australia’s largest energy companies reported a 21% decline in earnings. The company identified solar generation and energy inefficiencies as the cause. Clearly, renewables cannot be dismissed as non-entities any longer.

Non-traditional players shaping the future

Utilities have other problems. Never known for being customer friendly, they struggled to build relationships with their customers. Their focus was on building generation and distribution infrastructure. Now, with digitization of business and infrastructure, utilities are finding that non-traditional competitors are talking to customers, taking away mindshare. Growing competition from non-traditional players such as distributed generators, third-party demand management solution providers and various value added (e.g. appliance insurance) and bundled (e.g. telecom) solution providers are making the situation even more acute. The impact is simple: energy utilities must reboot themselves for the new world reality. In Australia, a handful of community power networks are already showing what utilities must prepare for. As communities manufacture their own energy and go off the grid, often creating surplus energy, the need for energy trading exchanges is evolving.

A federated future demands dramatic solutions

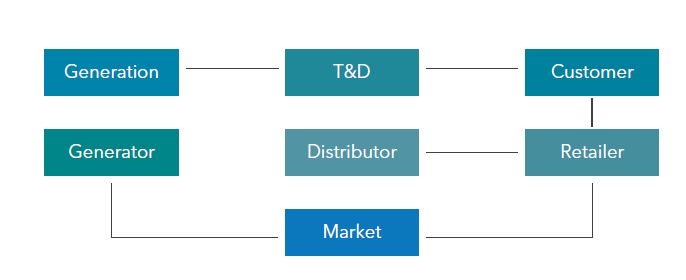

The new model calls for the energy utility to understand that there is a shift towards a federated energy economy. Energy can be acquired from a number of sources and distributed over the same networks through multiple ownership. The notable fact here is that utilities will have no control over these new providers and network demand. Figure 1 represents the current model. It shows the delivery of power and the flow of revenue back from customers. It’s a simple and stable model, and it applies to both regulated and deregulated markets

Figure 1: The traditional utilities model with the

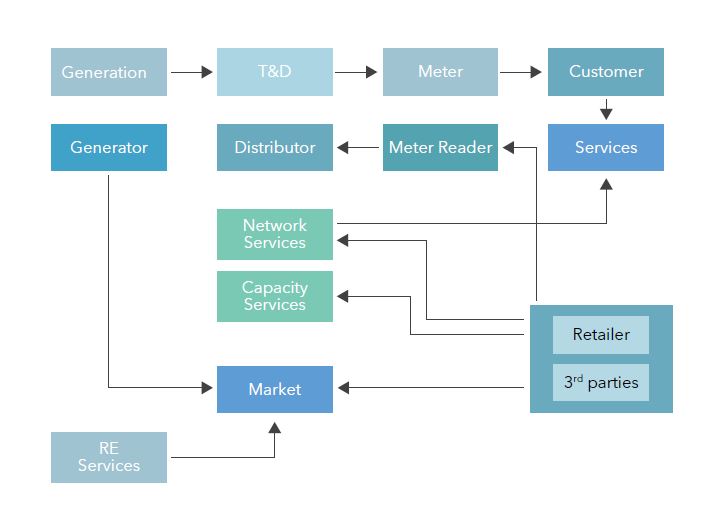

Figure 2: The new utilities model where anyone can

The need for utilities to consider energy as a service is urgent. The market will rapidly get flooded with providers like Google and Opower that provide consumers with ways in which to identify, address and manage energy efficiency and costs. This will lead to further loss of control over business. In several instances for example, with the rise of community generation in Australia, utilities will even need to reduce their traditionally spread out transmission infrastructure and increase focus on intra-customer exchanges, and grids that serve as a back-up.

The new opportunities before utilities

Amidst the gloom and confusion of a changing future is a very real opportunity for utilities. Energy markets will not disappear. Instead, they may even expand. Revenues from delivering power may dwindle, but new revenue opportunities from services will be on the rise. These opportunities could include:

The customer focused 21st century utility services model

Service orientation will be the need for de-regulated markets. Regulated markets will need to change as well. For these markets, much depends on the pro-activeness of the regulator. Some geos such as California and New York, where change is gaining momentum, are showing the way. Here, for the last decade, plans have been focused around energy efficiency, conservation, reduced emissions, renewables and new efficiency standards for appliances. These states are reaching tipping point and will soon see the emergence of 21st century energy as a service models. These models will be more customer-focused and reliant on smart grids that accommodate distributed energy resources (DER). While the change is dramatic in pockets of the energy market, it won’t stay localized for long. The changes will sweep across the industry. Over the next few years, energy utilities will be forced to re-orient themselves towards services. This implies a change in operating model, business model, and a higher reliance on IT than utilities are currently accustomed to. The technology aspect, although appearing distant at the moment, cannot be over emphasized: without a technology mindset, utilities will be handicapped and unable to make quick progress towards a services model.

Anjan Lahiri has over 20 years of global experience in supporting utility business transformation across the value chain, implementing solutions for asset improvement, field force automation, IT-OT integration and distribution automation. He has worked with global customers in leading roles and has been a resident in the UK and the US during large transformation journeys.

Anjan is currently responsible for leading the domain competency team focusing in the areas of Conventional and Renewable Generation, Smart Grid, Operational Systems and IT-OT integration. A key area of interest and responsibility is also the rapidly changing Utility business model, rise of active customers, Digital, IOT and impact of federated generation and behind the meter innovations. Anjan has also been playing an active role in developing the IOT strategy for the Utility business vertical and on creating leading edge solutions for evolving distributed energy market.