The history of the energy industry is marked by key years and events that have altered the industry’s trajectory.

1893 saw the AC vs DC War of the Currents swing decisively in favour of the former as the de facto transmission standard. The electric industry hasn’t been the same since.

1911, another momentous year, saw the forced dissolution of almighty Standard Oil into 34 smaller companies which led to the subsequent evolution of Exxon, Mobil, Chevron, Amoco, Marathon and others.

The 2008 financial crisis and the years immediately following saw historically cheap credit fueling the shale oil boom, which again changed the course of the industry.

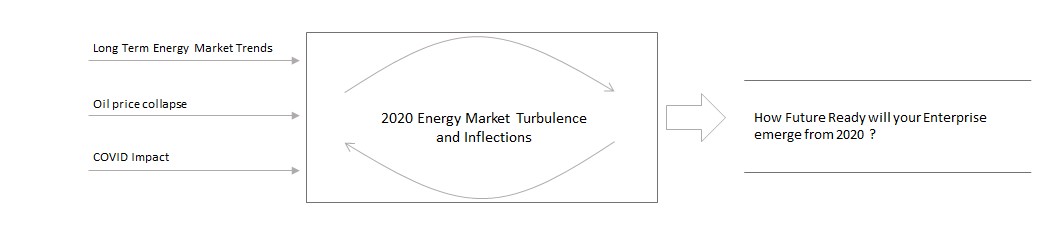

2020 may turn out to be another trajectory-altering year for the energy industry. Energy 2020 – the unique set of circumstances this year – may change the industry’s priorities and the strategies and fortunes of energy enterprises.

An industry already in transition

The past few years have already seen remarkable change. Favorable renewable energy economics, more coordinated policy pushes, growing public awareness of energy choices and maturing carbon credit markets have accelerated decarbonization, decentralization and democratization of energy.

Those trends, driven initially by policy nudges and early-adopter customer preferences, are here to stay. Additionally, bold investments and rapid innovation in green mobility and behind-the-meter products have met with great consumer interest.

In reaction, oil and gas behemoths are operationalizing their strategies for diversification and energy transition de-risking with big ticket investments in renewables and electric consumer markets. Changes are widespread in electric transmission and distribution (T&D), too. For example, microgrids are quickly achieving technical and commercial viability while utility-scale solar-plus-storage is helping to manage solar intermittency and enabling new system balancing and dispatch options. New business models continue to emerge; demand aggregators provide flexible demand response capabilities while nimble and all-digital energy retail start-ups are catching the fancy of customers in sizeable numbers. All the while, network and system operators are having to continuously adapt and re-adapt to shape-shifting supply and demand topologies that are testing T&D control room capabilities.

The 2020 reset

Two new forces - the COVID-19 pandemic and collapsing oil prices – add new complexity and opportunity that even the most extensive corporate scenario-planning and war-gaming have not anticipated.

The oil price collapse, caused by a geopolitics-driven supply glut combined with a pandemic-triggered demand collapse, will have immediate, wrenching consequences. Bankruptcies, especially in shale oil, are already visible. The increasing unpredictability and unreliability of oil prices and revenue will also hasten oil companies' energy transition investments.

The near-term impact of the COVID-19 pandemic, beyond the widespread human cost, is already large. By the end of March 2020, electricity demand, a proxy measure of economic health, had fallen by 14% in New York City relative to February 2020 averages and by about 25% in Italy. Global demand for oil in April 2020 is expected to reach 1995 levels. Longer-term, the pandemic’s long shadow will impact government policy, business strategies, economic priorities, international affairs and individual mindsets and behaviors.

Questions energy companies must consider

The 2020 reset demands that every player in the energy chain – oil companies, power generators, energy retailers, T&D networks, renewable operators and beyond - reconsider how they will do business in the future.

1. Consumers will be different, but how? As the crisis eases, will consumers race back to the pump for cheaper gasoline? Or will they shift towards working from home and prioritize planet-friendly renewables and low-carbon energy? How will these changes in consumer behavior vary across markets and geographies? Will lingering virus infection concerns hurt the ride-sharing industry?

2.Will the shift to digital be permanent? Lockdowns have made entire countries almost completely reliant on digital channels for customer support, telemedicine, learning, leisure and more. Energy companies may have a once-in-a-generation opportunity to encourage customers to shift to more efficient digitally-enabled customer engagement channels.

3. How resilient and agile are your operations? By now, the current crisis has no doubt revealed surprising strengths and worrying weaknesses as your organization has raced to adjust. Now is a critical moment to undertake a deep and strategic review of your systemic capabilities, to build on organizational strengths and address glaring deficiencies.

What’s more, it’s an ideal time to build your organization’s agility, remote working and cross-functional collaboration capabilities. Investing in enterprise capabilities driven by IoT, AI, digital twins and augmented reality will allow your employees to do more and better work remotely.

4. How much must you rethink your global supply chain? 2020 is stress-testing supply chains thanks to global risks exposed by the pandemic. Enterprises will need to examine supply chain risks and, where necessary, re-define sourcing strategies, logistics, planning, governance and contracts. Exemplar companies will quickly establish more resilient, agile, de-risked supply chains.

5. Are you ready to deliver what customers will want next? Opportunities for new products and solutions aligned to new realities in customers' lifestyles and businesses are a threat to incumbents and an opportunity for start-ups. Speed of innovation and a bias for action will be essential for energy companies to quickly seize the advantage. Companies will also have the opportunity to burnish their reputation through proactive, purposeful and empathetic engagement with customers, suppliers and policymakers as all stakeholders navigate these uncertain waters. Collaboration in non-competitive areas amongst energy companies may become a necessity as the industry seeks to transform. Companies that choose to proactively facilitate such collaboration will stand out.

Whatever customers demand, you’ll need world-class data and digital capabilities to compete and win. This must include prioritized reinforcements and investments in platformed and agile analytics, automation, IoT, digital experience and service design capabilities, all enabled by mature enterprise cloud adoption.

Energy 2020 - A watershed moment for the energy industry

Energy 2020 is a rare, industry and career-defining moment. Think of it is a "cosmic wormhole" that can transport you dramatically faster to a dramatically more desirable future state.

This is your moment. What will you make of it?

Wipro's Energy 2020 Thought Leadership Series, starting with this post, will examine many of the above viewpoints in additional detail. In subsequent posts we will share our thinking on how the post-2020 energy consumer will be different and the capabilities that the energy enterprise should invest in to make the best of that change.

Please reach out to us at info.energy2020@wipro.com with your questions

Shirish Patil

Head of Domain & Consulting – Utilities, ECO & GIS, Wipro

Shirish has worked in the utility industry for more than 28 years. He is a Global Head of Domain & Consulting business for Wipro’s Utilities, ECO and GIS sectors. He has championed and architected many large transformation deals working with clients across power, gas and water sectors globally and worked across continents including Australia, UK, Germany, US, Middle East. As an industry leader for Wipro’s Utilities, ECO & GIS sectors, Shirish’s priorities are to help customer develop and operationalize digital and operational technologies for business transformation, data monetization and new business models.