Introduction

Technology is pervading every aspect of modern life –the way we work, socialize with friends, book our holidays, buy our groceries. We’re using technology to monitor our lives, to track our footfall, record the calories we burn, compare and contrast our performance with both our peers and those that we admire and aspire to emulate. We can scientifically assess our driving ability and character behind the wheel as well - computers can control a car more precisely than we can ever hope to. No surprise that technology can now discern how well we drive our vehicles.

Cars with GPS are now a given, and those with embedded software to track every relevant event are already on the road. In the face of such drastic changes, the motor insurance industry needs to take a deep look at how its products are structured in order to stay relevant. They need to adapt to reflect our changing world. To succeed, the insurance industry will need to deliver far more value to policy holders in future than it is doing today and it will need to embrace telematics and predictive analysis from big data if it is to compete with competition from vehicle manufacturers, telecom players and other sectors. Organizations that fail to embrace the opportunities that these technologies are creating will become increasingly marginalized and irrelevant. Customers will migrate to smarter solutions that reflect their personal needs, profile and preferences.

Is Telematics the Game Changer?

In a world where wireless and mobile connectivity has achieved ubiquity, telematics is a technology whose time has come.

The historical telematics approach has been to install a wireless device or a “black box” in the vehicle that transmits data in real-time. The platform can trigger immediate alerts when a collision is detected, triggering the chain of communications required to orchestrate the complete post-accident fulfillment process including the emergency services, the insurer and their supply chain partners.

The technology has relevance beyond crisis and event management allowing users to monitor and act upon the more mundane data our vehicles generate such as maintenance schedules, service requirements and the quality of driving itself. The black box is already being usurped by embedded telematics in vehicles. Monitoring system failures and vehicle performance will become automatic and inescapable allowing the driver and vehicle to connect wirelessly to a host of related services. Analyst firm iSuppli predicts that by end 2018, 80% of new vehicles in the US will be sold with embedded telematics, with the global figure being lower but still a substantial 46%. Such growth is unsurprising given the potential for telematics to do so much more. It will change the insurance game altogether. Policyholders in future will not all be painted with the same brush. Underwriting and rating will shift away from the historical rating proxies of age, zip code, vehicle make, vehicle model and other basic data, and will shift to more insightful, real-time assessment of how well or not a driver controls their vehicles.

Insurance providers will favour safe drivers with more appealing terms and lower premiums while poor drivers with higher risk profiles will find themselves part of a feedback loop that will encourage them to adapt their driving style. Those that reject this approach will accept reduced cover and higher premiums or will find themselves shopping for cover elsewhere. Telematics will underpin the majority of insurance propositions. Analyst firm Gartner highlights the suitability of telematics platforms for usage-based insurance, pay-per-use insurance, Pay–As-You-Drive (PAYD) insurance, Pay-How-You-Drive (PHYD) programs for fleet insurance and several other types of insurance products.

More Accurate info, Less Fraud

Insurance providers that want to stay ahead of the race will go even further. They will gather more information about the safety of our roads than ever before, dramatically improving their ability to not only deal with the aftermath of accidents but to actually improve road safety and contribute to collision avoidance.

Social media in combination with data science will allow insurers to share knowledge of accident black spots, educate customers about safer route selection and collision avoidance. Insurers may even assist customers with future vehicle choice, extending their role as guides.

Despite all the advances in technology, accidents will continue to happen. Having the right information on hand and organizing data in the right ways will help insurance companies arrive at useful insights. The data will allow insurers to look for patterns to detect vehicle defects, make associations between certain types of locations, incidents, and types of vehicle, while helping them combat fraud.

Data certainty provides insurers and their customers with a tremendous platform for counter fraud. For instance, take the case of a policyholder who attributes an accident to mechanical failure. Telematics data gives insurers unparalleled ability to support the contention, to assist the customer and to forensically analyze the causes. At the same time the data dramatically raises the bar and acts as a huge deterrent to those

Monitor Fraud

The more data you have the greater the potential to successfully identify fraud.

customers who might otherwise misrepresent the facts. Insurers deal with a constant stream of cases like this on a day-to-day basis – incidents that appear simple on the surface but under closer examination prove to be far more complex. Solid data allows insurers to make rapid and accurate assessments and to discern veracity and authenticity. Faster and more accurate decision making lies at the very heart of good claims management and is essential to create a positive customer experience.

Telematics is the most exciting thing to happen to motor insurance since the direct-selling revolution of the 1980s - an opportunity for insurers to participate in the machine-to-machine data revolution that will sweep across society in the coming years.

The ability of insurers to engage with customers through their smartphones and their wearable tech, to interpret behavior, character, needs and demands through real-time evaluation of their location, speed and the appropriateness of that speed to the surrounding environment, will be fundamental to success and will drive customer engagement.

Propositions founded on this technology will win the telematics battle – delivered via smart devices, hybrid solutions and technologies like Near Field Communication (NFC) and Bluetooth 4.0. The business that can calculate premiums and service customers directly from, and through the smartphone will win. They will become the new yardsticks against which others will be measured. It will be these solutions that customers will demand to see integrated with their vehicles and dashboard infotainment systems.

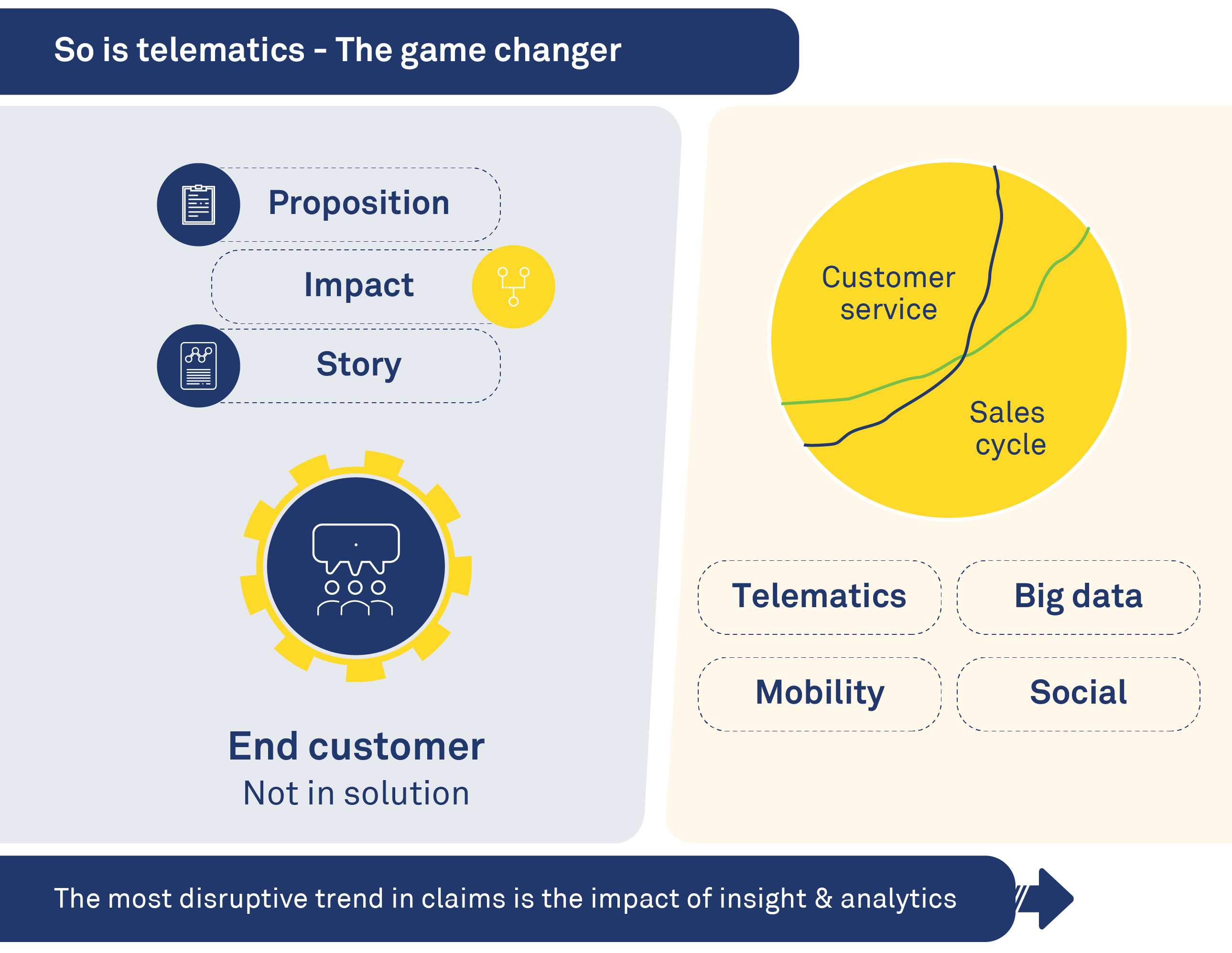

In isolation telematics will not be the big game changer in claims. What will change the game is the way in which telematics is fused into an overall proposition and the way that proposition is sold to end-users.

Photos Aren’t Just Images

With a smartphone they come with GPS Co-ordinates, Time-day-date stamp, as well as direction and orientation.

Where is Claims Management headed?

Motor insurance stands on the cusp of a technology revolution – a revolution driven by mobile devices, telematics and data. We are headed for a fully integrated, machine-to-machine utopia, where drivers will be passengers, cars will not permit us to crash and claims just won’t happen.The intelligent in-vehicle-technology that we have seen so far will be nothing compared to what is to come. Passive and active safety systems are being introduced constantly – driverless cars and road trains are already a reality. Leading universities are showing us that it’s possible to create auto-drive on a smartphone.

A commercially viable driverless car is less than 8 years away but it could happen much sooner. Already, Google has a fleet of driverless cars on the roads in some cities in the US, demonstrating the power of the internet and connectivity to steer vehicles on the right path with near-absolute safety

Meanwhile, several leading vehicle manufacturers are talking about ‘autopilot’ as their intermediate goal. So, for the foreseeable future, cars will still crash, lives will be changed, vehicles will require repair, and claims will need to be negotiated. But technology will increasingly influence the way in which we cover the claims journey.

Telematics and smartphones will become the new channel to market, offered in conjunction with consumer propositions like Waze (the Mobile Navigation App recently purchased by Google), or Quid Co (where word of mouth and recommendation are driving the consumer agenda as they look for value, savings and reward). Customers today are increasingly looking for solutions that are relevant, easy, convenient personal.

In Japan,Tokio Marine & Nichido are already marketing ‘One Day Auto Insurance’ that can be purchased anytime and anywhere via mobile phone so that a customer who only needs a few days cover can borrow a vehicle from a relative or friend. The advances in lifestyle and technology will have a profound effect on the way the insurance sector manages claims. The winners will be those that are able to underpin the sales cycle with continuity of service, which extends into the claims environment. This will be achieved by combining telematics with data and analytics to improve and automate the customer journey. And that brings us back to the other big trend that will impact the way claims are serviced.

Disruption is the Name of the Game

While telematics may be the most exciting development in insurance, the most disruptive trend in claims is the role of analytics. Organizations are automating the cerebral, intellectual processes, applying big data and analytics to make real-time decisions better, more consistent and more intuitive. And it is this ability that will have a profound impact on how we transform the motor claims journey and deliver the potential of telematics.

As more data is generated about the car user, data science will allow insurers to calculate risk more precisely. Analytics will enable insurance companies to streamline and automate claims processes with real-time alerts, thus cutting down expenses. Consumers will benefit too, as the data will enable companies to price their premiums more accurately, with positive behavior rewarded by rewards, incentives and discounts.

Working together, telematics and analytics will allow insurance companies to deliver a faster and more accurate service to consumers.

We will see the industry flexing historical data and more insightful data in combination with new data from telematics, M2M and digital imagery. Photos taken with a smartphone already come with GPS co-ordinates, time-day-date stamp, as well as direction and orientation. It is already possible to calculate a repair cost estimate simply by taking a photo of a damaged vehicle. Such data incorporated into the notification process will save huge amounts of time and dramatically improve accuracy

Embrace Big Data and Analytics

Analytics will allow the motor insurance industry to understand the cost and pricing implications and to secure the consumers’ involvement not only in the way their claim is managed but in understanding how it has been managed. The motor insurance industry needs to embrace telematics and big data in a big way. Organizations taking telematics seriously today will enjoy an advantage over those that don’t. They will not only attract more customers but will be better prepared for the increasing sophistication and miniaturization of devices that will come sooner rather than later.

Bill ZU-Jewski at AXEDA, the Machine to Machine specialists, talks of the characteristics in the machines of the future, and some are already in place. They are connected and remotely serviceable. Many now have GPS or some other means to locate them, making them traceable. Their data is available via an agent or gateway, allowing us to collect and send data and enable machines to be:

This machine data is also being made available via APIs, enabling them to be App-centric.

Our future tech will not only be eco-friendly and energy-efficient but will also be part of a larger collaborative system. As connected cars become a seamless part of our connected lives, automakers, motor and life insurers, service providers, data centers, smart phone companies are forming a new and expanding eco-system.

They need to work together not only to mine customer data and behavior but to use that data to offer more precise pricing and customized service to consumers. By embracing telematics, by utilizing the power and insight that big data offers, the motor insurance industry can respond to customer demand and lay the foundation needed to embrace the internet-of-things. M2M will allow the industry to step up to the next level – to create integrated, collaborative, app centric propositions.

Conclusion

In the unpredictable and ever-changing economic environment, insurance companies need to gear up with new products, perhaps even change their business models, and the way in which they win and retain customers. Vehicle insurance as an industry will change forever in a world of driverless cars. That this day will come is not in doubt, the only way that organizations can be sure that they will be able to meet this challenge is to be part of making this change happen. Now is the time to start preparing for that day