The Importance of the Data Hub

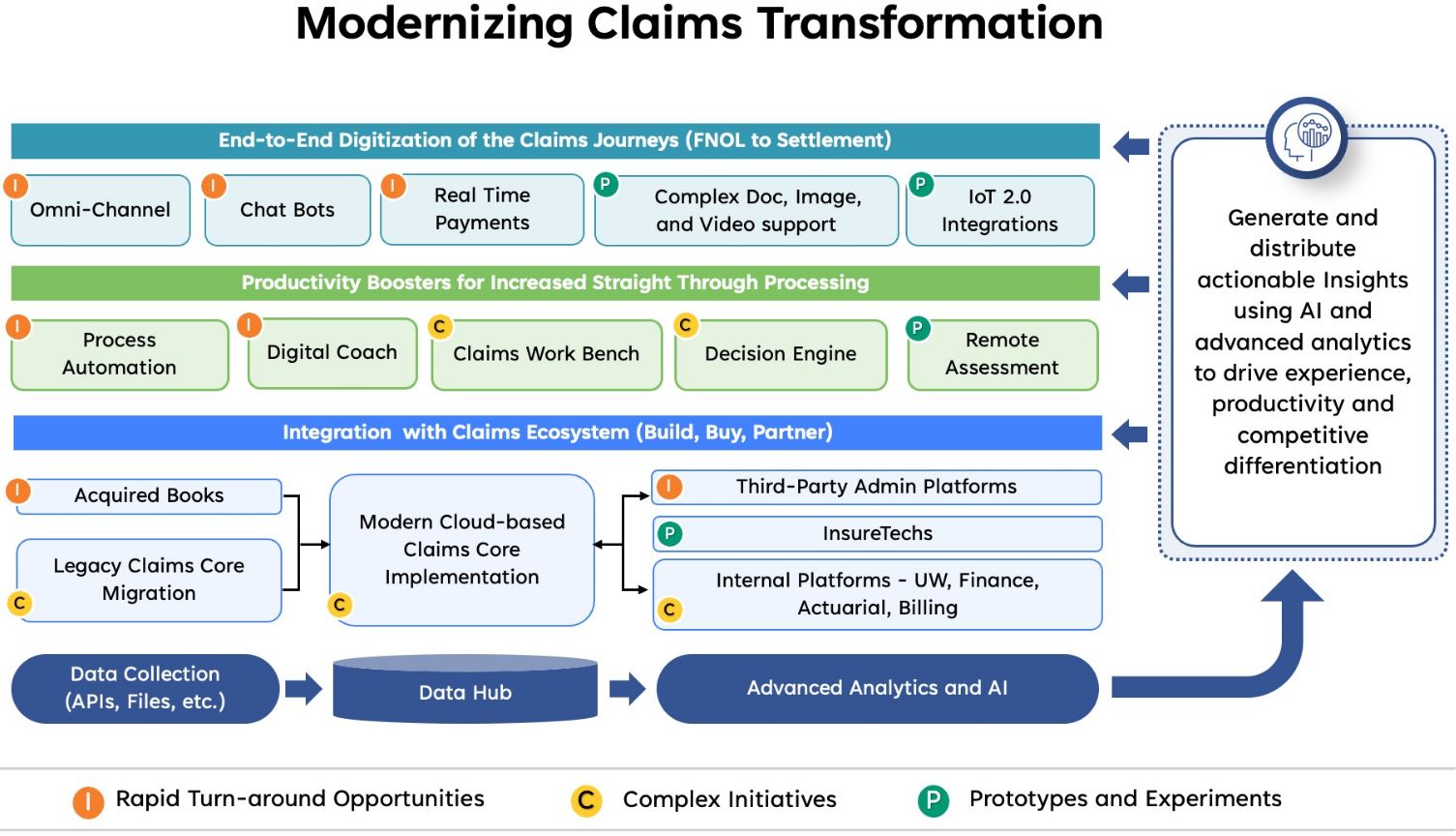

Insurers are increasingly harnessing a data-driven transformation strategy for claims. This approach, which requires investments in building on their underlying data and analytics capabilities, can promote faster resolution, reduced leakage, and improved customer satisfaction scores while migrating to cloud-based platforms. By leveraging data and analytics, insurers can gain deeper insights into their claims processes, identify areas for improvement, and make more informed decisions, ultimately leading to better customer experiences and operational efficiency.

A cloud-native data hub with strict access controls and data protection can be a game-changer for claims transformation. For regulatory reasons previously discussed, insurers cannot quickly lift and shift their data assets to the public cloud. A data hub allows for a more incremental approach. Isolated datasets can be catalogued and pulled into a data hub to drive specific micro-transformations. As these efforts scale, the amount of data subject to best-in-class data quality and data governance grows, and the resulting capabilities of the data hub become more robust.

A robust data hub also democratizes data, making trusted data available across the enterprise, which can lead to previously unrealized capabilities. New applications can be built specifically to plug into the data hub. Clear access and control protocols can also prevent this data from being misused — and the data hub’s data governance and access control often make it more secure than the legacy system that feeds it data. A multi-tenant architecture, for example, can separate the data from the insurer’s claims from the claims of other insurers where it acts as a third-party administrator (TPA). Similarly, the data hub can be segregated into domains with specific purposes for staging, transforming, testing, and providing data to the claims applications.

Data hubs can also be leveraged to reduce the complexity of legacy applications by removing reporting and analysis workloads from the core systems. The reduced complexity speeds up the modernization of the claims platforms as these reporting requirements were often built as “mods” or customizations to the vendor product. These are difficult to upgrade and are usually not supported in cloud-native/SaaS versions of the vendor platforms.

At a leading workers' benefit provider in North America, we created an innovative solution using adaptive data mapping techniques to harmonize the data required for reporting across legacy on-prem and the cloud-native claims platform. This solution enabled seamless upgrades of the claims platform in phases without disrupting the critical regulatory and financial reporting needs.

With one of our other clients, we leveraged the data hub to bring together multiple sources of customer feedback and case management information and train a Generative AI sentiment analysis solution to assist the agents in proactively identifying best-fit solution pathways. This allows for swift action assignment to the proper parties, ensuring prompt resolution of customer issues.

We are also leveraging the data hubs to train Generative AI solutions to create synthetic test data, providing excellent coverage of the test scenarios while avoiding the risks of using actual customer data.

In the long run, these data hubs may evolve to deliver powerful training data for customer-facing AI solutions, particularly if regulations evolve to provide clarity on acceptable AI usage and if safeguards are built in to protect customer interests.

Insurers will deploy automated yet personalized messaging targeted by matching products to specific customer segments. Later, GenAI can be looped into social media strategy, further refining the approach to B2C customer segmentation. Quick AI-based fraud checks, such as examining uploaded photographs for staged accidents/damages, will enable automated partial claim payments in a matter of minutes with lower risks and increased customer satisfaction.

Incremental Change: The Claims Transformation Imperative

The claims side of the business rarely takes center stage in the insurance sector. Leaders charged with claims transformation often find themselves tasked with ambitious goals yet provided with limited budgets.

Given the realities facing insurance companies, the optimal claims transformation strategy will create an intentional architecture for the modernized claims platform and focus on delivering incremental wins early on. These micro-transformations will build momentum for driving the adoption of the claims transformation program across the enterprise. For many insurers, full-scale cloud reinvention will take a few years. But that shouldn’t entail a pause in progress. By taking an agile approach that welcomes quick wins wherever the claims process is most ripe for transformation, insurers can rapidly improve their claims ecosystem to impress customers, reduce costs, and power forward-thinking innovation.

Versions of this article have also been published in Claims Journal and Insurance Thought Leadership.