Today’s insurance companies need to respond quickly to market shifts and environmental changes. Pod-based engineering is a nimble solution.

Between intense market competition, rapid digital development cycles and the chaotic impacts of climate change, insurance carriers need to be nimble, rapidly adjusting their product offerings and messaging to better meet customer needs and maximize their profitability.

Yet insurance has historically been an extraordinarily siloed business. Underwriting, claims, finance and actuarial experts must all align on proposed changes to insurance products. Crossing those organizational boundaries to do something innovative and new can be impossibly time-consuming. To make matters worse, carriers are often working with somewhat outdated claims and policy systems, which further hamper innovation and speed. Data reporting structures are often broken, and feedback loops are long.

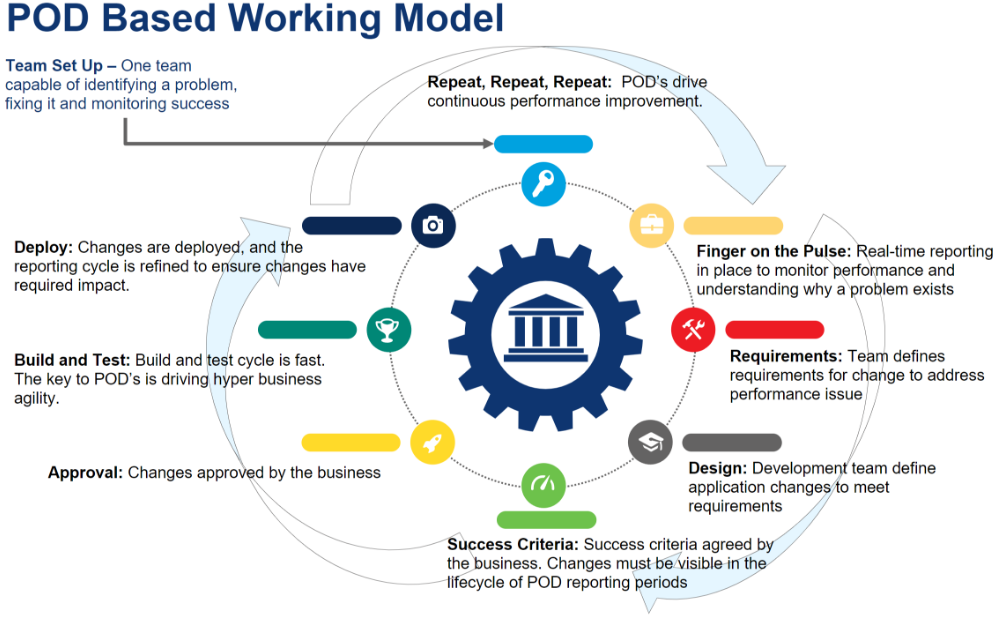

Pod-based engineering, a software development strategy centered on small cross-functional teams, can be a compelling method to overcome both organizational and technical hurdles in the insurance business, and rapidly accelerate the deployment cycle. In fact, it’s fair to say that the most effective way to truly ensure swift deployment in the insurance business is through pods.

Traditional engineering workflows function like assembly lines: One specialist at a time adds their contribution to the product, then passes it onto the next specialist. In the context of insurance, a product launch might require separate sign-offs from marketing, sales, underwriting, claims, actuarial and compliance. While product launches demand such a high degree of control for good reason, product performance can suffer as the same lengthy approval cycles slow down monitoring and enhancements, impacting the ultimate success of the product launch.

With pod-based engineering, small multi-disciplinary teams work together to quickly adjust small pieces of a product. Rather than developing a Version 2.0 sequentially and releasing it all at once, pod-based engineering allows cross-functional teams to tweak small elements of Version 1.0 one at a time, adopting the changes that add value and quickly reversing the changes that underperform until a much-improved Version 2.0 emerges. (Those familiar with scrum, full-stack, agile and shift left engineering will notice some distinct similarities to the pod-based approach.)

Unlike traditional “waterfall” engineering, the agile pod-based approach is tailor-made to quickly change directions and react to new business and market scenarios. Pods can deploy near-continuous A/B testing, gathering insights on performance and adjusting accordingly. Because the IT and data experts in an insurance pod are paired with complimentary experts in actuarial and underwriting domains, insurance pods can boldly experiment with A/B testing while avoiding elevated financial and regulatory risk.

Pod-based engineering gives insurance companies easy wins in four areas in particular:

Bringing New Insurance Products to Market

Pod-based engineering flips the traditional approach to insurance product introduction on its head. Previously, market testing would occur after market research, analytics and actuarial had their say. The danger of such approach is that much diligent work can go toward a product that is destined to make little impact on the market. Pods, instead, incorporate a customer-focused design layer that runs parallel to the requirements, development and QA phases. The design layer validates the market while the product is still very much under construction, allowing for a more agile transition from design to build. With pods, new product introductions become both less risky and less time consuming.

Fraud Management

The period immediately prior to popular sporting events like the Olympics and the World Cup is characterized by a significant temporary spike in insurance claims for TV sets. Compared to the normal course of business, the percentage of fraudulent claims is likely to be higher—people simply want to replace a perfectly functional TV with a new one. Fraud management at scale is all about filters, and a legacy filter may underperform amid a new pattern. With pod-based development, a pod can deploy new filter rules for a two-week period, then refine and adjust the rules in real time, optimizing fraud detection and minimizing false positives when faced with a time-bound anomaly.

Customer Journey Optimization

While most insurance companies have adopted online sales, shiny front-end systems often conceal a slow, cumbersome back-end process. As a result, the customer journeys become static, rarely monitored or adjusted, resulting in poor pre-sales communications, low quote-to-bind ratios and high customer acquisition costs. Pods can dramatically accelerate the pace at which customer journeys are updated. An underwriter, marketer, salesperson, actuary, and testing and development specialist can work together in three-day cycles, identifying weaknesses in the customer journey, implementing solutions and monitoring the results. Instead of changing monthly, customer journeys might be updated hundreds of times a year. The wealth of datapoints will drive more intelligent customer segmentation, further improving the efficiency and effectiveness of the customer acquisition process.

Reporting as a Service

While carriers might hold a significant amount of data deep in their systems, that data will not be very useful if leaders and key stakeholders receive it in the form of quarterly reports. Pods can also function as ad-hoc data teams, delivering “reporting as a service” capabilities to the larger organization. A team consisting of functional SMEs, business analysts, and data and visualization developers might be spun up to investigate a failing marketing campaign, marshaling real-time data and drawing on a cross-functional knowledge base to understand whether the problem is the messaging, the market conditions or the underlying product.

Because of the interdisciplinary nature of the pod teams, they can also safely experiment with real-time rate adjustments. To win the market, insurance companies need to rapidly respond to market conditions with dynamic pricing. With the right people tracking and adjusting rates, it is completely plausible to expect that pods will deploy rate changes for individual insurance products as frequently as twice per day, and monitor the results in a 24-hour cycle.

One of the most attractive aspects of deploying pods is that pod-based engineering is never an all-or-nothing proposition. An insurance company might initially deploy a single pod as a one-off hacking team to solve a particular problem. As the organization becomes more comfortable with pods, they can be deployed across the insurance value chain and identify pod-based engineering solutions that can transform numerous other areas of the business that have been neglected or are underperforming. While digital transformation in the insurance industry is often fraught with challenges, pod-based engineering represents a uniquely low-risk, high-impact approach to insurance industry transformation.

Rituparna (Ritu) Ghosh

Vice President & Head of DevSecOps and Agile

Wipro FullStride Cloud Services

An experienced and dedicated “agilist,” Ritu drives new ways of working that catalyze digital transformation. She enables teams to respond to paradigm shifts by calibrating their existing systems, processes and tools to adapt to a changing world. Prior to her current role, Ritu headed the continuous improvement initiatives in Wipro, including Lean, Six Sigma and Agile transformation initiatives. She is a certified Black Belt in DMAIC and trained in Lean, CMM®, CMMI®, ITIL® and Agile.

Peter Melville

Consulting Partner – Lead Domain Consultant, iDEAS Domain and Consulting

Peter is a domain expert with more than 30 years in the insurance industry. He has led business transformation for a variety of clients across the insurance industry, from managing business engagement across the transformation journey to building end-to-end business blueprints that identify pain points and opportunities for change.

Contributors

Luke Sykora – Content Writer, iDEAS

John Hollinger – General Manager, Insurance