For many years, 3D Printing has been described by media and technologists alike, in glowing terms like “game changing,” “revolutionary,” “transformational,” and “disruptive.” The industry, which began to experience exponential growth in the last decade, is populated with technology companies of all sizes seeking to leverage expertise (both longstanding and newly developed intellectual property) that add to a rapidly evolving body of knowledge and capability, and manufacturing organizations of all sizes seeking to gain an advantage in production cost, time, and/or quality. Yet, despite the industry’s approximately tenfold growth over the last six years, the stock prices of many of the most notable publicly traded 3D Printing technology companies (3D Systems (DDD), Stratasys (SSYS), The ExOne Company (XONE), Voxeljet (VJET), SLM Solutions (AM3D.DE)) have dramatically underperformed the broader market, having share prices much less than or, at best, approximately equal to what they were 10 years ago.

Why would 3D Printing technology companies, the lynchpin of the additive manufacturing revolution that has witnessed exponential growth over the same time period, underperform so significantly? Interestingly, why have two notable exceptions, Materialise (MTLS) and Protolabs (PRLB), overperformed the broader market in the same time period?

The answers to these questions are of course multifaceted, but are indicative of the direction the 3D Printing market is headed and who the winners and losers will be in the future.

The Theory of Disruptive Innovation

A common refrain from executives, from every industry, is that they are absolutely certain that additive manufacturing will be an important piece of their company’s future. However, they are just as uncertain of exactly how additive manufacturing will be that important piece. The net result of this certainty/uncertainty dichotomy is often a shotgun approach to investment, R&D priorities, and product development as related to additive manufacturing. This unfocused approach is at best a very expensive way to identify viable business opportunities, and at worst a critical error that allows a properly focused competitor the opportunity to overtake them. Failure in additive manufacturing strategy usually occurs simply because the company failed to properly understand the true disruptions presented by additive manufacturing, so their positioning is then improperly placed.

Disruptive Innovation is a process by which a product or service initially takes root in simple applications at the bottom of a market—typically by being less expensive and more accessible—and then moves upmarket, eventually displacing established competitors. Coined in the early 1990s by Harvard Business School professor Clayton Christensen, the term has become virtually ubiquitous from Wall Street to Silicon Valley. Consequently, it’s also one of the most misunderstood and misapplied terms in the business lexicon. Disruptive Innovations are not breakthrough technologies that make good products better; rather they are innovations that make products and services more accessible and affordable, thereby making them available to a larger population.

3D Printing fits the definition of Disruptive Innovation. Beginning as “rapid prototyping” in the 1980s and 1990s, the technology quickly displaced traditional prototyping artistry despite the crudeness of the 3D printed parts of the era. Over time, as the 3D printing technology improved, more applications of the technology emerged. In the early part of this century, the first end use 3D-printed applications began to emerge, and over the last decade, the use of the technology has grown exponentially.

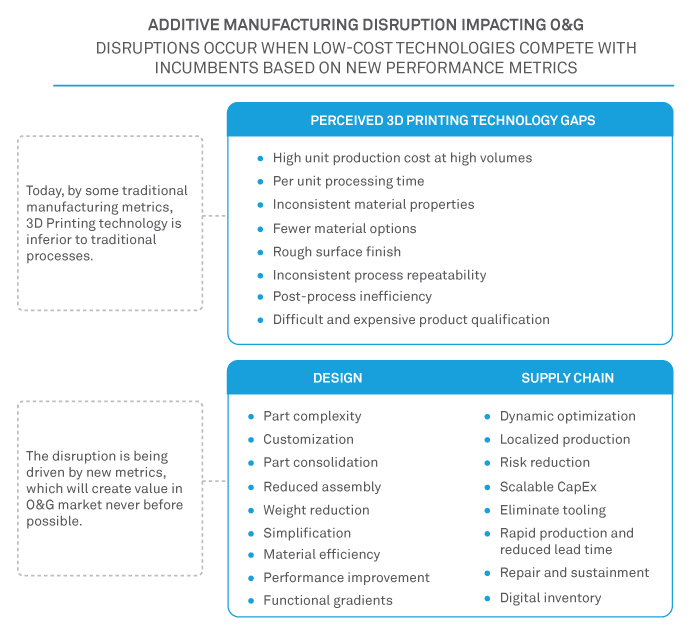

In order to properly position any organization in the 3D printing marketplace, we must first understand the disruption that additive manufacturing presents to the component manufacturing industry. In fact, today there are two disruptions presented by additive manufacturing – design freedom (“I can make things that I couldn’t make before”) and supply chain optimization (“I can make things in a time, place, and/or quantity that I couldn’t make before”). It is through these disruptions that AM technology, which is currently known to be inferior to its traditional manufacturing counterparts according to many traditional metrics, that AM succeeds using new metrics, as depicted below.

All of the value propositions of 3DP that have been identified over the years fit into one or both of these disruptive buckets. These disruptions make clear why product OEMs and organizations with design authority are so keen to grow the AM service industry – because those with design authority are the direct beneficiaries of the additive manufacturing disruptions and therefore stand to gain the most from the growth of these technologies. Those without design authority, in order to have a role that is not eventually commoditized, must find a unique value proposition and stake their claim of that territory as soon as possible, or otherwise face a future of commoditization.

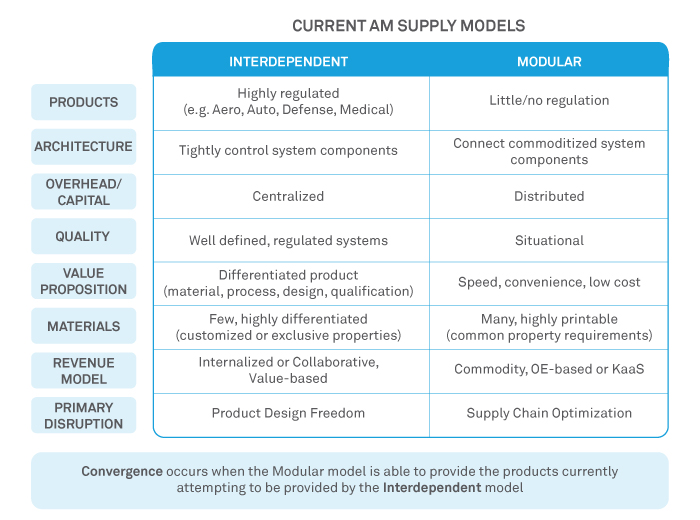

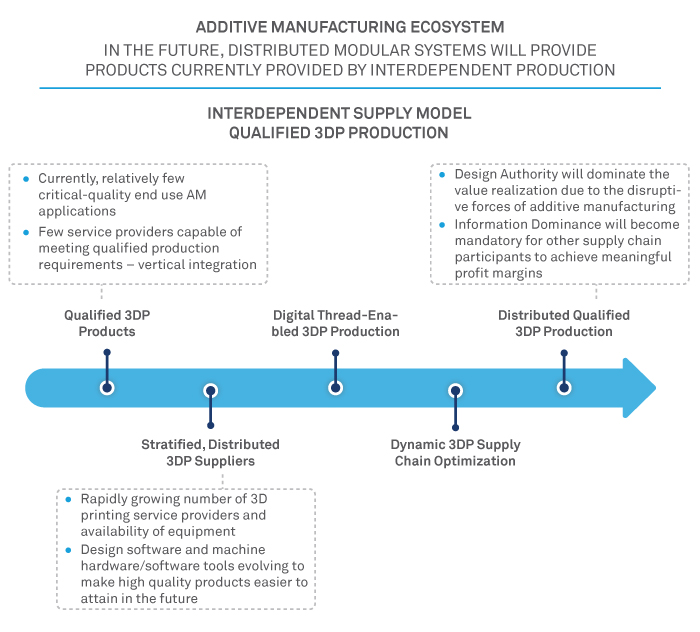

The current manifestation of these disruptions in the AM industry is the existence of two supply models: an interdependent model aimed at producing highly differentiated products, and a modular model aimed at providing the lowest cost, highest speed, and greatest convenience to the end customer.

For any organization trying to determine where their future business opportunities lie in this additive manufacturing future, it is critical that they first understand where they fit within these converging marketplaces. Organizations that have struggled to adopt and/or monetize 3D printing capability typically fail to understand their strategic fit, and misplace scarce resources as a result. Often, a shotgun investment approach is employed due to this lack of understanding, which at best dilutes and delays the impact of a potential success story, and at worst leads to outright failure when the investment fails to achieve an acceptable return on investment.

To date, most companies have entered the 3D printing space without a clear understanding of the 3D printing disruption, and therefore their place within it. Wipro can help companies looking to embark upon or refine their 3D printing journey. By helping these companies understand their place in the disruption, Wipro can help these clients save many months or years, and save or properly allocate millions of dollars of R&D capital.