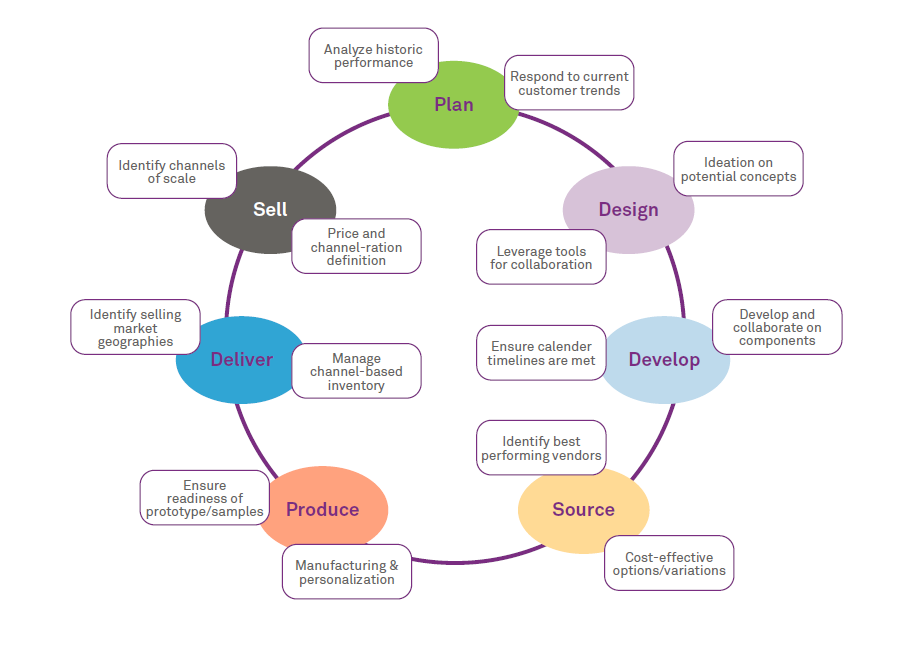

Fashion products fundamentally follow the same product development processes as that of their counterparts in other industries. However, as in any business line, there are underlying nuances that drive the stage-gate process involved from conceptualizing a style and finally delivering to consumers. Below are some of the key drivers for fashion products.

The role of product development & PLM in the fashion supply chain

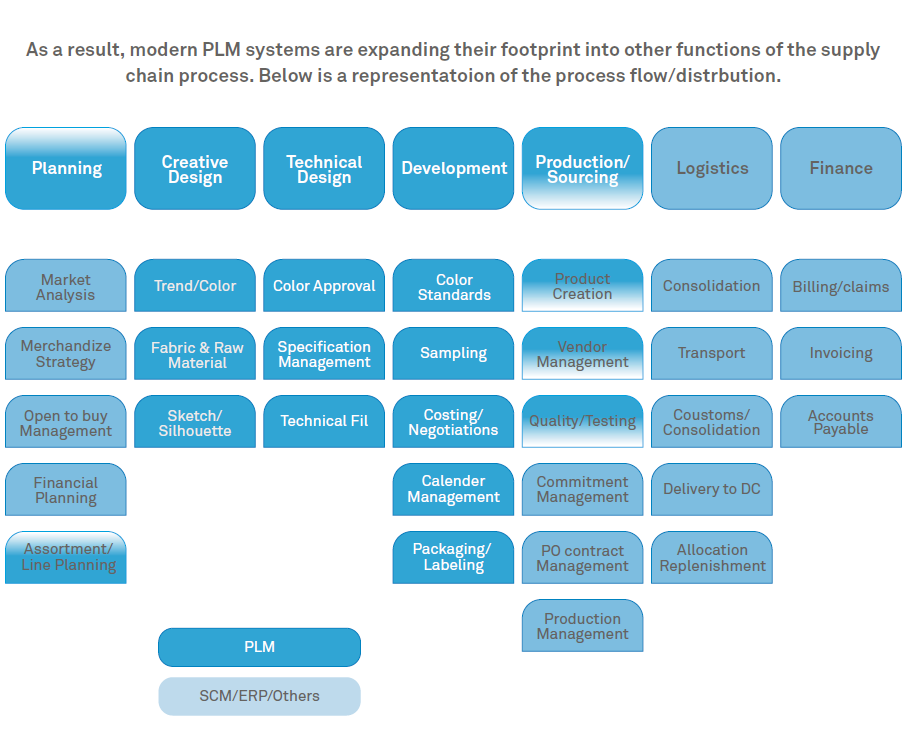

Traditionally, the strength of PLM systems involved managing product design & development. The core functions revolved around

The fashion industry has traditionally lagged behind its discrete manufacturing counterparts from an enterprise technology perspective. One of the key factors being that the industry is very design and development driven–with the rest of the chain typically outsourced between suppliers, factories, distributors, stores, etc. Hence, the need to invest in a state-of-the-art technology stack does not return an adequate ROI–especially to the SMB industry.

Technologies

However, with advances in technologies as well as the need for better systems consolidation, PLM systems are now expanding their footprint. Current vendors provide the capability to introduce components are early as planning and later in the sourcing process as well. Additionally, to complement these capabilities, solutions leverage next-generation design integration and collaboration tools to integrate with external system.

Platforms

Factors controlling the fashion supply chain

Accelerate speed to market– There is a perpetual need to reduce all potential process (planning, design, development, sourcing, production and distribution) timelines to hit in-store dates. The foundation of an effective product development process involves optimizing these functional areas.

Effective collaboration– Ensuring the right level of communication improves process efficiency and product reliability. Collaboration is critical to both the internal cross-functional teams (planning/design/development) as well as external partners (sourcing/production/distribution) involved in building the products.

Single source of truth– The fundamentals of product development require visibility to the current product and related information during the particular time-slice. Moving away from sharing physical documents and managing data with systems ensures teams are always working with the relevant information.

Cost reduction– A streamlined process reduces the number of cycles/iterations, thereby minimizing potential issues. Additionally, identifying geographically positioned vendors to optimize delivery costs or recommend cost-effective variations to reduce product costs.

Alignment to seasonal timelines– A tight integration not just between internal functions, but other SCM, ERP, etc. systems is critical to ensure alignment to the seasonal calendar. Brand owners have to constantly track their lines and have the ability to proactively/reactively address issues.

Compliance management– Corporate social responsibility is now widely accepted as a core element of fashion design. In addition to the corporate mandates, brands now need to cater to environment-conscious consumers, for whom compliance is a major shopping factor.

Classification of fashion brands – in response to the supply chain demand

Based on market-focus, consumer demand and their internal operating model, fashion brands can be broken down into 3 distinct types. Each targeting a specific consumer base by following an effectivity delivery cycle.

Traditional fashion– Versace, burberry, yves saint laurent, etc. Each line within a traditional fashion house revolves around a designer. During ideation, they travel around the world, looking for inspirations for their seasonal collection. These new trends could include styles, materials and colors concepts–traditionally based on previous successful lines. Each designer typically works with a specific factory to release the product to market. Prices are typically high with long development cycles.

Private label– St. John’s Bay (JCP), alfani (macy’s), prologue (target), etc. retailers may choose to leverage their larger manufacturing network to produce private label products, eventually sold as their own brand. Typically, these brands have no dedicated designer, as most of the design is outsourced. The concept was to provide consumers, especially those loyal to the retailer, with an assortment of cost-effective alternatives through the season. However, some private labels now position themselves are competitors in the “premium brand” market.

Fast fashion– zara, H&M, uniqlo, etc. Fast fashion brands have a strong consumer focus providing imitations of the latest trends and styles introduced on the runway at fashion week. With a model that involves manufacturing most products in their own factories or those near their design offices, brands can drastically cut down the end-to-end production time and costs. Additionally, these compressed durations allow for a more continuous delivery model by additional seasonal releases.

Conclusion

Depending on their classification, each fashion brand adopts its own flavor of supply chain processes–with varied deviations from the standard plan, build & deliver process. Whether a designer within a brand, vendor or partner, it is critical to understand these dependencies and underlying nuances. This background is especially significant in M&A, consolidation and transformation programs, where alignment across these processes is a critical success factor. In the case of multi-brand organizations-which could potentially have a mix of these fashion classifications-the ideal process would be to align to a standard enterprise process, and then layer the ability to support brand-specific variations. Experts believe that, in the near future, the boundaries separating these fashion flavors will gradually shift–in response to global social and economic changes. These changes will force brands to re-evaluate their core focus areas and in turn consolidate their supply chain by adopting flavors that currently lie outside their existing boundary. This future path reaffirms the need to establish a strong foundation with an extendable layer-driven by an optimized business process and supported by the necessary technology stack.

Manoj Balakrishnan

He is a consulting partner with Wipro’s Global Consulting Group. He has 25+ years of consulting experience in the fashion industry focusing on product creation. Wipro’s Global Consulting Group comprises strategy, industry & technology experts who have been involved in similar engagements and studies in various industries. Please reach out to the author or to your local Wipro office, if you are interested in this topic.