Introduction: Under the current scenario, why is optimizing claims management the most apt strategy?

Before the pandemic (before June 2020), Australian life insurers encountered profitability pressures (loss of $1.7Bn in 20201, preceding 12 months to June) due to the high cost of claims handling, administering, and settling arising out of inefficient claims management processes. The invoked lockdown caused by the COVID pandemic had disrupted insurers’ operations, leading to a drop in claims frequency due to a decline in incidents resulting in disability and deaths (natural causes excluding COVID). This decline provided a breather from profitability pressures and generated profits of $1.0Bn in 20211 for Australian Life insurers.

However, in 2022 and beyond, with the economy quickly returning to normal (pre-COVID levels) and the government withdrawing its financial support measures, the claims frequency is likely to rise not only to pre-COVID levels but beyond, particularly for income protection products. This year might see Australian life insurers having to pay an additional $1.5Bn claims2 (above the standard claims estimates) due to increased morbidity tied to COVID.

Amidst such a scenario, the best bet for insurers is to significantly enhance their claims management efficiency, which will potentially have a double positive impact: - Firstly, it will reduce claims expense leading to improved operating margins, and secondly, the improved margins will allow insurers to competitively price their products (lower premiums compared to peers who do not have better margin cushion). Under the current circumstances, Australian life insurers require a relook at claims management by identifying the categories (product lines and processes) that lead to high claims costs and impact seamless customer experience.

Identifying the pain points in the claims landscape: High DII claims costs are a cause of concern for life insurers.

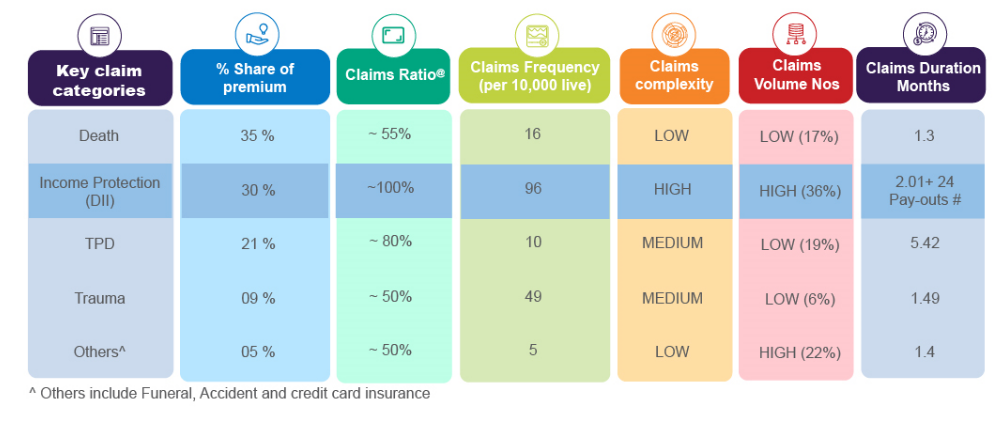

The Disability Income insurance (DII) line of business, as observed in table 15, has considerable business contribution (around 30% of total life premiums) and has relatively higher claims frequency and a significantly high claims payout ratio (~ 100%). This positioning makes DII a critical line of business and a cause of concern for life insurers. Therefore, optimizing (lowering) claims costs for DII lines can have a significant positive impact on overall profitability.

Moreover, the Australian Prudential Regulation Authority (APRA) had issued stringent capital reserve measures3 (in September’20 introduced a capital charge for DII products due to their high-risk characteristics). This measure locked a higher amount of insurers’ capital into regulatory reserves in FY22, thus, impacting insurers’ financial capacity to invest in in-house innovation for transforming and improving claims processing. Additionally, this measure also required life insurers to increase the premium prices (mostly in double digits for DII products).

Fierce price competition shall not allow the life insurers to pass on the price rise to consumers completely, and they will have to absorb a considerable portion of the price hike. The insurers with a better margin cushion (on account of efficient / lower claims costs) will absorb more of the price rise, giving them a competitive edge over the insurers who cannot absorb much due to inefficient/higher claims costs). This market dynamic can put further pressure on Australian life insurers’ capital position and profitability in the coming years.

Therefore, prioritizing the optimization of DII claims costs shall be the most apt strategy to improve overall profitability and competitive edge under the current circumstance.

The challenges: Why are the current claims processing systems inefficient and error-prone?

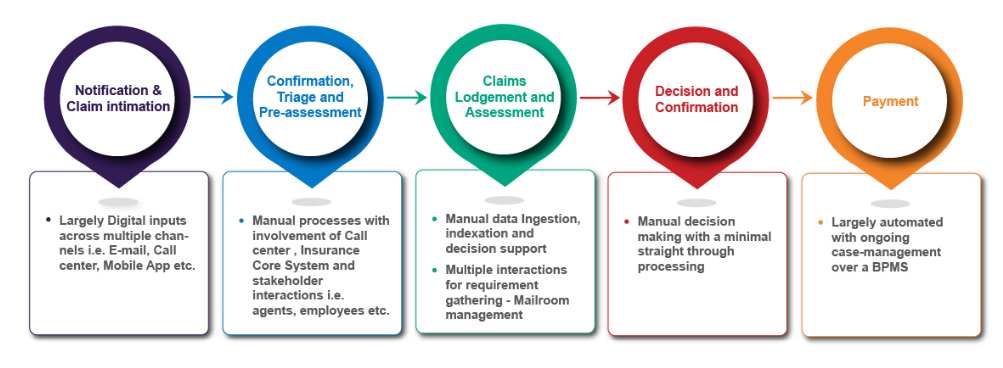

Currently adopted by most insurers, the claims management process (as depicted in Figure 1) involves a high degree of manual effort and increasing costs, resulting in delays and potential errors.

Further, inefficiency in claims management arises out of the following factors:

The complex and long-tail characteristic of the DII claims further exacerbate the claims costs.

The big opportunity: Optimizing the claims management costs

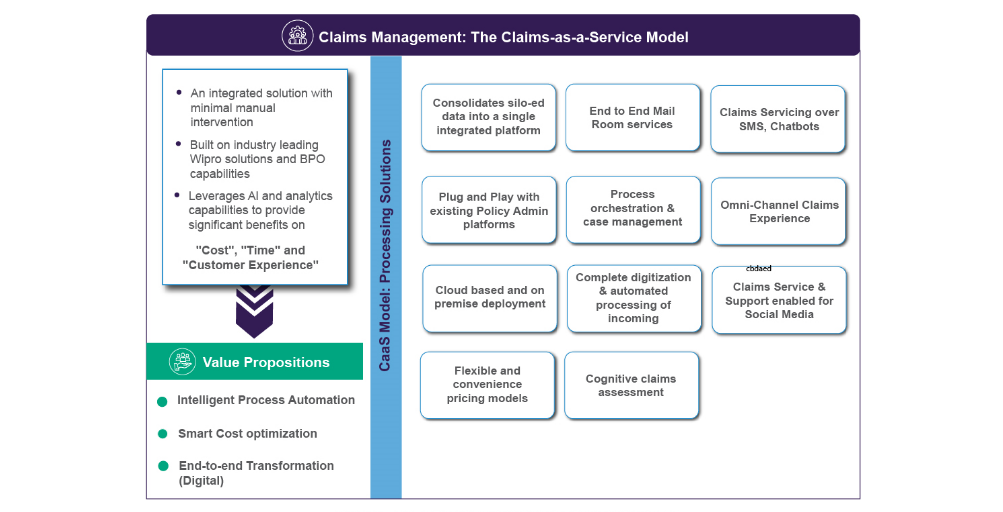

With their legacy systems and existing limited resources (talent as well as infrastructure), life insurers will have to bear a considerable amount of fixed costs to develop a new market-leading claims management system in-house. Instead, the life insurers can convert the fixed costs into considerably lower variable costs by deploying the ready-to-use plug-and-play claims management system in the form of the CaaS model (time-based subscription / solution-based / end-to-end).

This strategy of optimizing claims costs by deploying the CaaS model shall enable life insurers to reduce claims expenses and achieve overall profitability.

The Solution: Claims management transformation by leveraging the CaaS

The Claims-as-a-Service model embeds the operating solutions in the claims cycle, and one can build them as an integrated solution requiring minimal manual interventions. Using AI and analytics as foundational capabilities, this model will address difficulties in the current claim process and render the benefits of agility, cost-efficiencies, and improved customer experience.

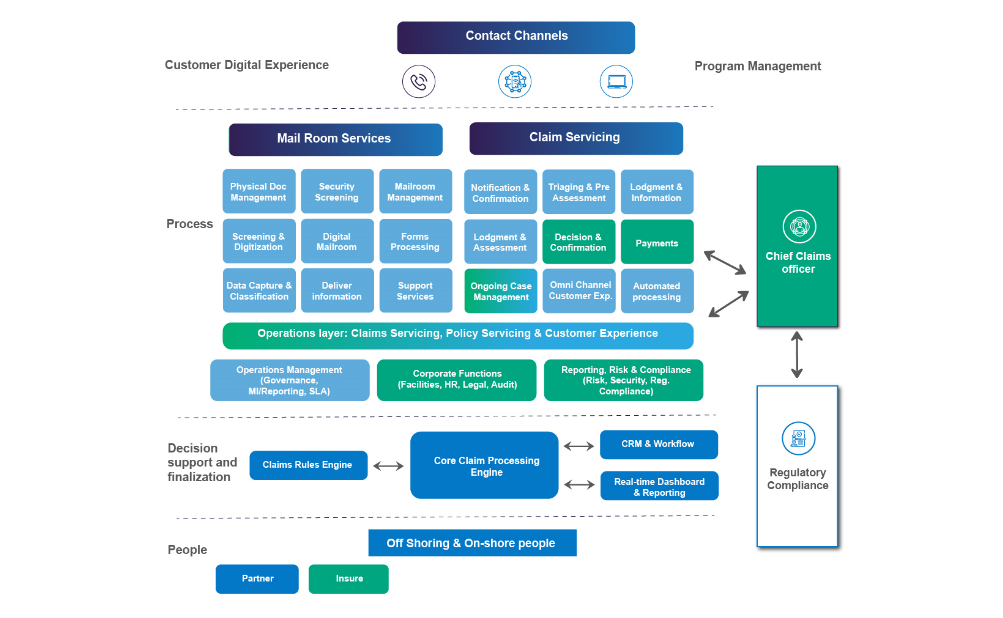

CaaS model brings together multiple solution blocks with omnichannel customer interaction capabilities and digitally-enabled processes. It will result in a highly scalable and modular solution by integrating operations, corporate functions, core (Legacy) systems, CRM, and claims processing engine to meet insurance regulatory reporting and program management requirements, as depicted in figure 2.

Figure 2 – Key components and capabilities of the CaaS Model

The CaaS model imparts enhanced capabilities to life insurers across the claims management value chain.

Some of the key advantages imparted by the CaaS model includes:

Conclusion:

As far as the claims-as-a-service model is concerned, the deployment of such a model depends on the insurer’s current automation and digital maturity. This model’s modularity reduces the claims management expense, making it convenient for insurers to pick and choose among the various claims automation components that align with their overall strategic objectives.

The current economic and market circumstances will likely increase the claims frequency and the claims management expense. Therefore, it is the most opportune time for the insurer to review their claims practices, priorities, and operating models to gain a sustainable competitive advantage for efficient and agile claims management.

Sources:

Amol Pramod Ubale

Leads digital insurance initiatives for Wipro’s BFSI ANZ region

He has 18 years of experience building digital insurance channels for group benefits, employee benefits, pensions, and retail. Amol currently focuses on building digital business solutions for banking, wealth, superannuation clients.

Sumit Bhalla

Heads Life and Pensions practice for Wipro’s globally

He has 23+ years of experience in building large scale digital insurance capabilities for fortune 500 insurers and health plans across the globe for Life & Pensions and Healthcare life cycle. Sumit is currently heading the Life and Pensions practice and working towards strengthening digital operations and solutions.

Supported by:

Pradeep Agarwal - Senior Manager, Wipro Insights

Ashwani Saini - Manager, Wipro Insights

End Notes:

@: The claims paid ratio is the dollar amount of claims paid out in the reporting period as a percentage of the annual premiums receivable in the same period. Numbers are weighted average proportionate to the premium across Group and Advisor channels

# : DII has recurring monthly payments. Total payments are approximated using an assumed 24-month payout period for the reported claims ratio.