Australian Banking and Financial Services Key Trends for 2023

The past year was a turbulent one. Inflation and increased interest rates, high energy costs straining businesses and consumers, climate change and natural disasters impacting asset risk rating and insurers: major events affected individuals and organizations globally. In the banking, financial services, and insurance (BFSI) sector, cybersecurity concerns also spiked, with security breaches hitting unprecedented levels.

To tackle these challenges, BFSI firms adjusted their business strategies:

At the same time, regulatory bodies implemented industry-level reviews and reforms such as APRA CPS 234 on outsourcing, cybersecurity, new capital guidelines; Basel III implementation climate change survey; and AUSTRAC payment readiness survey. These new regulations targeted issues with cybersecurity, climate change, ESG. They also aimed to improve outcomes for customers through new distribution obligations and changes aimed at matters like target market determination and product design.

BFSI firms have had to adapt to remain compliant. Most major BFSI players have already aligned their business strategies with these changes, and in 2023 they will also need to ensure alignment of their organizational capabilities with key objectives such as ensuring business growth and profitability. At the same time, four key themes are likely to continue driving changes throughout the BFSI sector throughout 2023.

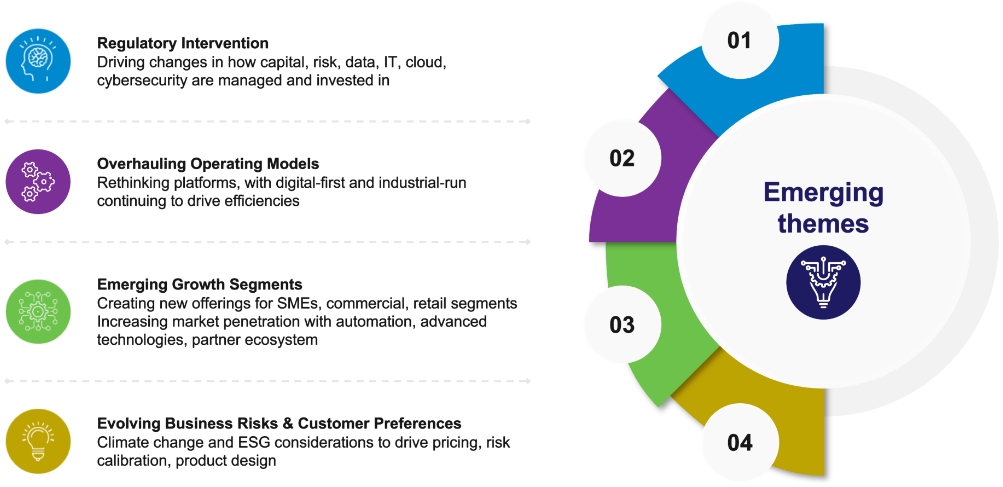

Emerging themes in 2023

The big themes for BFSI in 2023 will be regulatory intervention, emerging growth segments, evolving business risks and customer preferences, and operating model overhaul. These themes will influence organizations’ strategic investments, such as uplifting IT, business operations, and digital capabilities in line with strategic objectives. For example, regulatory interventions will lead to changes in risk frameworks which may require additional investments in data, platforms, automation, and digitalization. Similarly, as new growth segments like small and medium enterprises (SMEs) emerge, digital capabilities and product features will need to be overhauled requiring additional investments.

Key Business Drivers For 2023

While the above themes are common across BFSI segments, their impact will be varied across banking, insurance, and superannuation sectors.

Impact on banking

The banking sector will focus more on enhancing data, governance, and operational risk frameworks (APRA-CPS230, CPS190, CPS 900), and on incorporating BASEL III as the new capital structure. Our experience of working with some of the large banking organizations around the world indicate that Operations Risk Management, Business Continuity Planning and Third Party Service providers management are key aspects to focus on as a part of key risk themes to work on.

Further modernization of operating models will offer digital-first customer experiences with greater efficiencies. Banks will strive to restore growth in home loans through STP and lower processing times.

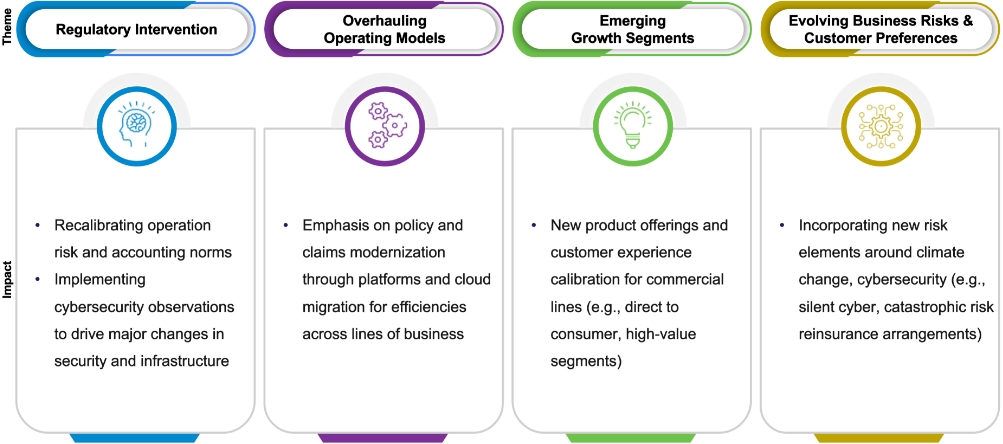

Impact on insurance

The insurance sector will focus on enhancing data, governance, and operational risk-management (CPS230), as well as implementing cybersecurity and IT outsourcing directives (CPS234). While this will require an overhaul of enterprise-level risk systems, it will be efficiently backed by modernization and simplification of policy and claims systems.

Insurers will continue to recalibrate their pricing engines, broker portals, and automation for commercial lines, while paving the way for new-age products like usage-based insurance and rewards for retail lines. Significant investments will be made in building capabilities around new risk classes such as weather and silent cyber, leading to changes in technology for pricing, data, reporting, customer offerings, and risk-charges.

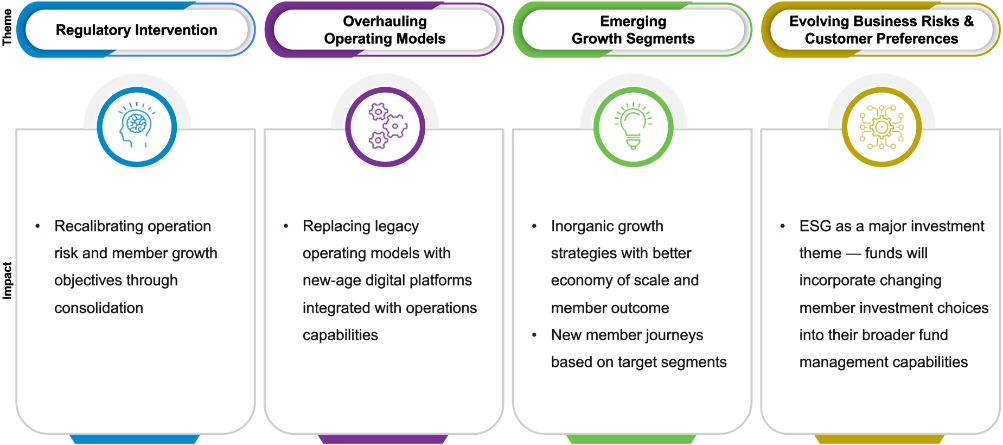

Impact on superannuation

The superannuation and wealth segments will continue consolidation and operational risk enhancements. Most of the super players are already rethinking their operations and platforms, planning replacements to enhance member outcomes and leverage efficiencies across business processes. The trend is expected to continue with investments in new digital capabilities in the short-to-medium term.

To make the most of these themes while minimizing the cost of change, BFSI players need to consider the unique needs of their organizations and the scale of their intended changes. In-house teams may not have the capabilities to lead large-scale transformations, while traditional consulting partners may be too costly. Organizations can enlist the help of systems integrators with large partner ecosystems to identify the most efficient strategy and cost-effective implementations.

You can explore Wipro’s partner ecosystem, and learn more about Wipro’s IT and consulting capabilities at wipro.com.