Artificial Intelligence (AI) and Machine Learning (ML) coupled with digital channels could change the way banks engage with customers in real time—from understanding if the customer interacting with the bank right now is likely to churn, to what is the best proactive advice or offer suited for this customer. AI and ML enable real time insights, proactive advice, and automated actions for creating rich personalized customer experiences. They allow mass customization of campaigns and offers at scale while a bank is engaged with customers and online prospects.

This article explains why and how banks need to move beyond churn prevention, batch insights, and massive acquisition campaigns to the next level…a future full of real time insights, proactive advice, automated actions, and individual campaigns using AI, ML, and digital channels. It shows how banks and FIs will need to scale the “pyramid of trust” to enhance the trust they have earned as safe keepers of money and transaction agents to being respected as proactive advisors. Such business transformation will create a spike in the number of prospects onboarded for banks and minimize investments in customer churn prevention and mass acquisition campaigns.

No wonder banks are one of the leading adopters of AI and ML. They invested over $4 billion in machine learning in 2018 alone and this is expected to exceed CAGR of 40%¹.

Tectonic shifts in expectations of digital customers

Gone are the days of using bank branches as primary channels of acquisition and account opening or answering questions of walk-ins. Also, the days of customer care centers receiving calls from customers seeking answers to questions may be gone in the future. Banks have spent too much time and effort positioning themselves as safe keepers of customers’ money and reactive transaction fulfillers.

A Celent report² on “trust gap” (difference between percentage of adults who trust their banks for the safety of their money and those that trust their bank’s advice) explains how retail banks have largely delivered on safekeeping of money and fulfilling transactions but failed to deliver advice and proactive engagement.

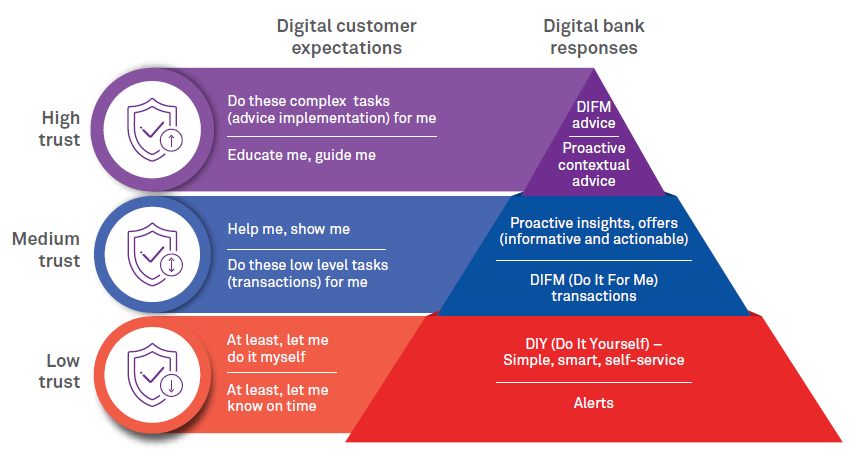

With digital all of that is changing. Figure 1 shows how expectations of digital customers have changed and how banks will need to climb the ‘pyramid of trust’ in engaging with these customers across all banking and financial services products. In the ‘low trust’ zone, at the very least, digital customers expect alerts and notifications and self-service capabilities. For example, competition in the cards industry as well as prevalence of increased fraud have led to prompt informational or fraud alerts from card issuers to cardholder mobiles as well as ability to lock and unlock card usage from mobile apps. However, such capabilities barely impress a digital customer. In the ‘medium trust’ zone, digital customers expect automated transactions, proactive insights, and customized offers. Some large banks are already giving customized offers but proactive insights are still lagging. In the ‘high trust’ zone, digital customers expect proactive contextual advice. Once their confidence levels improve, they could be open to automated implementation of advice such as an investment or savings plan to achieve a specific mutually agreed financial goal.

Both larger banks and digital challengers are in the race to provide an impressive hierarchy of alerts, advice, and automated actions to engage their digital customers. One can see examples in Royal Bank of Canada’s NOMI Insights³, Commonwealth Bank of Australia’s Customer Engagement Engine4 and Huntington Bank’s “Hub” with insights and advice features5.

Figure 1: Pyramid of trust – How banks can earn their customers’ trust “Banks have a vital asset—customer trust. In today’s competitive environment, h

The Celent report² referred to earlier also shows what steps banks must take to close the trust gap with their retail customers and presents case studies from model banks. In the following section, this article takes the use case of campaigns to show a bank can transform itself to climb the pyramid of trust.

“Banks have a vital asset—customer trust. In today’s competitive environment, however, banks must continually earn this trust. Moreover, they must strive to go beyond basic trust and achieve higher levels of trust that allow them to become valued advisers to their customers.”

- Alenka Grealish, Senior Analyst, Celent

Digital approach to insights and campaigns

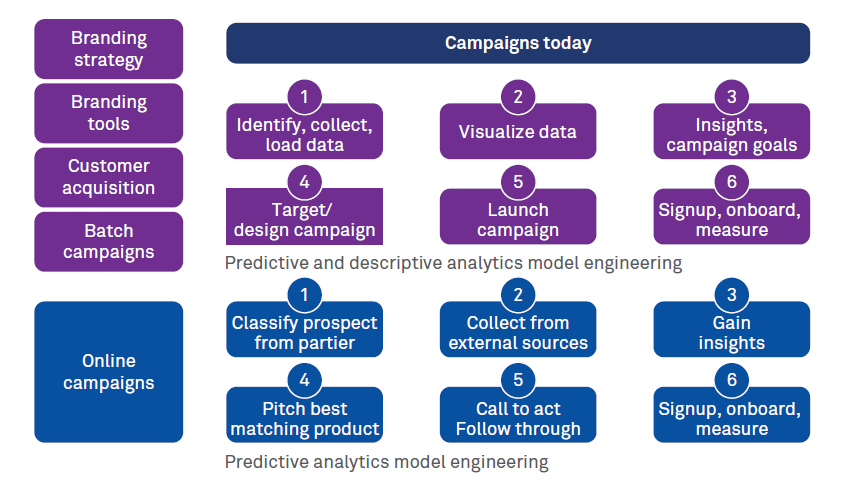

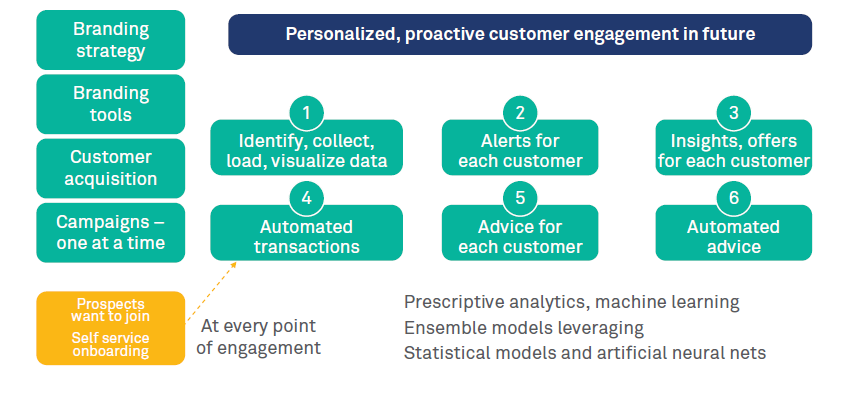

Figure 2 shows how banks conduct acquisition campaigns today and how they can make them more personalized, engaging, and proactive using AI, ML and digital channels.

Figure 2: Campaigns—Today vs future

Today’s campaign process (Figure 2) is focused on generating insights for the bank’s marketing department and then planning campaigns around these insights. Most of the insights are generated using statistical regression models for descriptive and predictive analytics. There is hardly any use of artificial neural networks (ANNs). Risk of non-acceptance and feedback cycle time are quite high. Marketers have to wait for at least several weeks, if not months, to get feedback on the effectiveness of campaigns.

In future, data will be processed as event flows and streams to be able to generate real time alerts with low latency (Figure 2). Auto-encoders using ANNs can generate alerts from streaming data. Banks stuck in the low trust zone will be busy providing alerts and self-service capabilities, albeit smart and useful. Progressive banks will attempt to climb the pyramid of trust using capabilities such as “Do-It-For-Me (DIFM) transactions” (automated mundane tasks). They will leverage ML to generate proactive insights and offers by analyzing data at rest and in motion. As they build more trust with their customers, they will offer proactive contextual advice. As they consolidate their trusted customer relationships, they could finally end up offering “DIFM advice” automated actions to realize mutually agreed financial goals. AI-ML-powered customer engagement will compel prospects to switch banks and reduce the need for banks to conduct mass campaigns.

Most ML products offer tools for visualizing data and modeling using statistical as well as ANN-based models. Automated feature engineering (ability to predict which of the input variables have a high degree of correlation to output automatically) capabilities are also critical as they reduce the need for manual intervention from expensive and specialist data science resources. ML models are trained and tested offline using batch data. However, once the F1 scores (measure that balances between precision and recall) and accuracy reach acceptable levels, ML models in production can generate insights, advice, and automatic actions customer by customer in real time while the bank is engaged with the customer. Optimizing metrics such as F1 and accuracy is to help minimize business costs and impact (e.g. avoid classifying a customer likely to churn as someone loyal).

Other factors that are critical in ML adoption are the ability to reduce over fitting of input data and the ability to explain predictions. Based on outlier patterns and errors in insights, offers, and advice generated, the models can be retrained manually. Several of the fintech vendors provide such capabilities today. In future, unsupervised learning could produce “self-learning ML models”.

Benefits of ML led digital insights

Looking ahead

Banks have earned valuable customer trust as safe keepers of money and reliable fulfillers of financial transactions, but they have yet to push their trust bar higher. The majority are still fixated on customer churn and mass acquisition campaigns. It is time they redirect their energies and budgets towards engaging, personalized, contextual, and proactive insights and advice powered by AI and ML technologies. As they scale the pyramid of trust, they will automatically experience a marked surge in prospects wanting to sign up!

References

¹IDC forecast – Worldwide spending on Cognitive and Artificial Intelligence systems https://bit.ly/2N7w4Pf

²Raising the CX bar – How to Close the Trust Gap in Retail Banking, Celent, Dec 2018 https://bit.ly/2V1VBOK

³Meet NOMI https://bit.ly/2B6zGew

4CommBank using data to drive “Next Best Conversation” strategy https://bit.ly/2XVcUm0

5Introducing The Hub https://bit.ly/2UAvEW6 6Personetics https://personetics.com

Acknowledgments

Hari Subramanian

Consulting Partner, Banking and Payments,Wipro Limited.

Hari is a management consultant with 25+ years of global experience in financial services and telecommunications. He has 10+ years of experience in Fintech (emerging payments, mobile & digital banking, wallets, digital rewards, blockchain, AI/ ML, cognitive and robotic automation). He is an invited mentor for one of the leading accelerators at San Francisco.

Get in touch: global.consulting@wipro.com