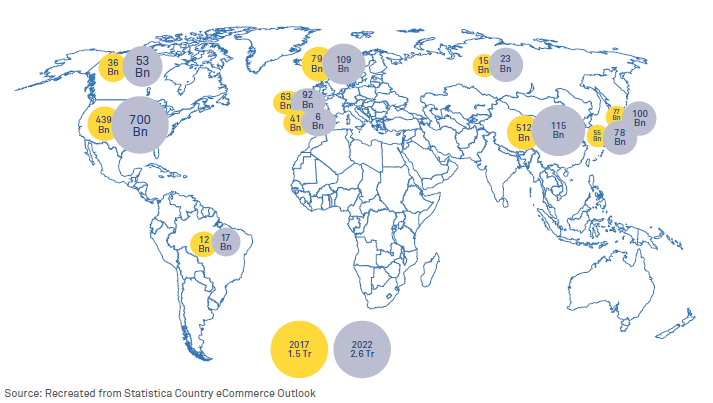

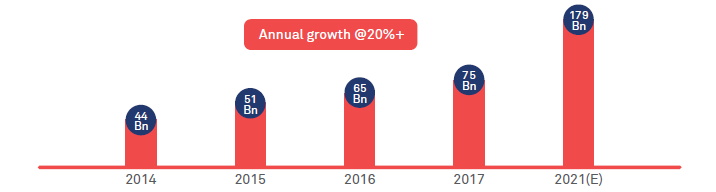

As consumer shopping behavior has shifted, so has the “last mile”, the distance between a product’s point-of-sale and its final destination. Before online shopping, consumers owned the last mile delivery, transporting their purchases to their home. Today, as people shop online for everything from shoes to sofas, and new technologies continue to spur double-digit ecommerce growth, online merchants must innovate their last-mile delivery experiences or lose customers to competitors that offer superior services. Globally, e-commerce is experiencing high growth CAGR ~10% enabled by next generation technologies.1

The last mile moves to center stage

These days, online retailers are playing perpetual catch-up with consumer behavior and desires. Shoppers are demanding both fast and free shipping. With a device in nearly everyone’s back pocket, people have easy access to online stores as never before, and this has exponentially spawned order and fulfillment options. Now, customers expect their orders to meet them where they are, whether it’s their home, office, or vacation destination. All of this make the “last mile” experience not only pivotal in leaving a lasting impression, but also in gathering additional customer data.

Meanwhile, businesses face other challenges related to the disrupted supply chain, with the flow of predictable inventory levels from producers and wholesalers to point-of-sale becoming a thing of the past. All of these seismic shifts should serve to remind businesses that they need to manage both the opportunity and costs of optimizing the last-mile experience in this rapidly changing ecosystem.

Figure 1: eCommerce trends for top 10 countries1

Figure 2: Global B2C e-commerce sales and growth – Pitney Bowes Parcel Shipping Index 2

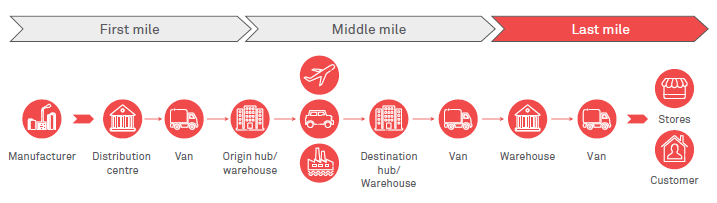

Approaching the last mile challenge

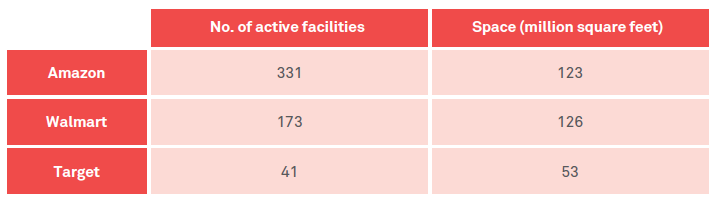

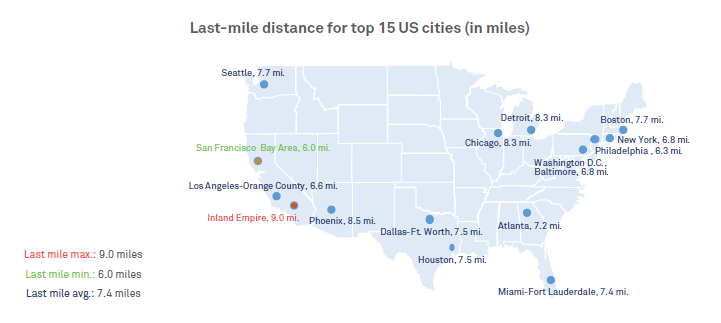

Given the supply chain’s rising complexity and growing customer expectations from the “last point of sale” to the last mile, businesses must organize their processes and systems to meet the small package and small delivery mandate. While the move from large warehouses to smaller storage spaces in close proximity to dense markets will see low utilization with higher costs, businesses can nonetheless reduce these costs by first consolidating the boxes. Since the cost of delivery would depend on the density of its final destination, the consolidation of freight through aggregated deliveries in a small geography will be key to optimizing the cost per delivery.

Figure 3: Component-wise view of the global supply chain footprint

Figure 4: Estimate facilities and floor space in US (Source: Annual reports 2017)

Figure 5: Last mile distance of new facilities (under 200,000 sq. ft.) for top 15 US cities (Source: CBRE Research and U.S. Census Bureau) 5

Evolving and emerging delivery options

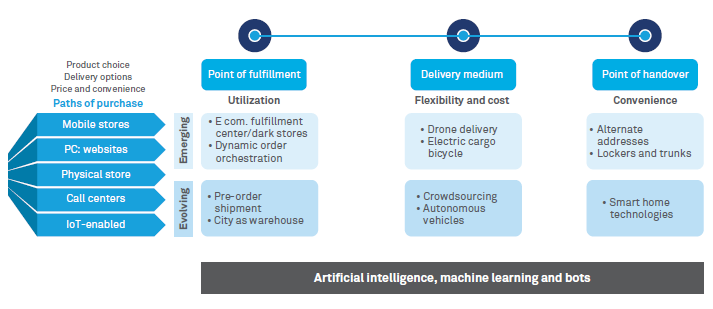

Successfully orchestrating orders to reach the last mile requires a combination of solutions. Currently, these solutions are either emerging (adopted or in process of being scaled), or evolving (in development and under pilots). We can break these solutions down into three areas:

Figure 6: Fulfillment solution path

Point of fulfillment

Delivery medium

Point of handover

The three areas are brought together through dynamic dispatch and routing, i.e., learning from historic data, factoring situation, location, and business. Autonomous and automated fulfillment centers are active 24x7 to meet the order demand.

Because localities vary in their regulations and geographic attributes, so will specific solutions to problems posed by the last mile. Evolving and emerging delivery methods will grow for high density areas, and storage solutions will move closer and closer to the locus of demand. Businesses will make better use of vertical spaces and develop artificial intelligence and bots to ingest data and improve planning efficiency. Ultimately, businesses will expand their partner ecosystems to support their entire supply chain footprint to enable them to keep pace with the ever-shifting expectations of their customers. In short, e-commerce-driven innovations to the supply chain are inevitable.

References

1 https://www.statista.com/outlook/243/100/ecommerce/worldwide

2 http://news.pb.com/article_display.cfm?article_id=5784

3 https://www.businessinsider.com/walmart-store-network-gives-it-huge-advantage-over-amazon-2017-10

4 http://www.latimes.com/business/la-fi-amazon-whole-foods-up-dates-whole-foods-440-stores-gives-amazon-1497656959-htmlstory.html

Cesar Castillo

Senior Manager, Strategy & Transformation

Consulting Practice, Wipro Limited.

Cesar Castillo is a senior manager in Wipro’s Digital Value Chain Consulting practice. Cesar has over 20 years of extensive experience in advising and transforming supply chain and logistics for global organizations. Cesar helps clients to improve supply chain strategy, optimize cash flows and solve multiple complex issues within logistics.

Amit Jain

Senior Consultant, Strategy & Transformation

Consulting Practice, Wipro Limited.

Amit Jain is a senior consultant in Wipro’s Digital Value Chain Consulting practice. Amit has over 9 years of diverse experience in helping business transformations for leading global organizations. Amit helps clients define digital transformation roadmaps and overcome operational challenges in making their supply chains future ready

Get in touch at global.consulting@wipro.com