Blockchain is the underlying technology that will bring about the next-generation internet: a transition from a web of information exchange to a web of value exchange. Blockchain technology is increasingly considered a disruptor to the status quo across industries, and the wealth management industry is no different. Cryptocurrencies are the first real-world use case of blockchain technology, and their rise over the past decade has sparked increasing debate about how this new asset class might alter the current financial and economic structures of society.

Blockchain is important to the wealth management industry because of two important capabilities. First, they can act as a digital wrapper around any asset; and second, they allow the exchange of those assets on decentralized networks.

There are also two reasons why the decentralized exchange of digital assets is vital for wealth management. Firstly, because these exchanges are distributed, they have strong potential to disintermediate many centralized business processes within the financial services industry. Secondly, cryptocurrencies have ushered in a new asset class and Initial Coin Offerings (ICOs) have allowed investors to invest in this asset class without using the banking system.

This has opened up new paradigms of resource allocation: investors can participate in a global exchange of assets outside conventional structures, where stocks and other financial instruments trade on centralized exchanges under the supervision of centralized authorities and geography-specific regulations.

Technological impact of blockchain

Today, the wealth management industry is running on business models and processes fabricated on decades-old technologies. These legacy systems and processes often result in costly data maintenance and pose severe threats to client-related sensitive data,transactional data and the institution’s reputation with clients and regulators. A leak of such data can lead to hefty monetary fines and the loss of customer trust. Additionally, many legacy systems are not flexible enough to implement new workflows as per market needs.

Blockchain technology’s underlying ingredients including decentralization, consensus, immutability, and faster/cheaper transactions can revamp existing business models to make business transactions more fluid than ever.

Blockchain technology can improve an institution’s service quality for a range of processes such as client onboarding, asset transactions, and portfolio management. Blockchain brings a whole range of use cases built for real-time settlement models, exchange of money and value, KYC processes, automated investing, and rebalancing of portfolios based on smart contracts. Blockchain technology is gaining traction in the industry from both the client side and regulatory bodies as well. Clients are curious about the new asset class built on this technology, and regulators are interested in embracing this technology for broader purposes, ranging from improving interbank financial transactions to regulatory reporting.

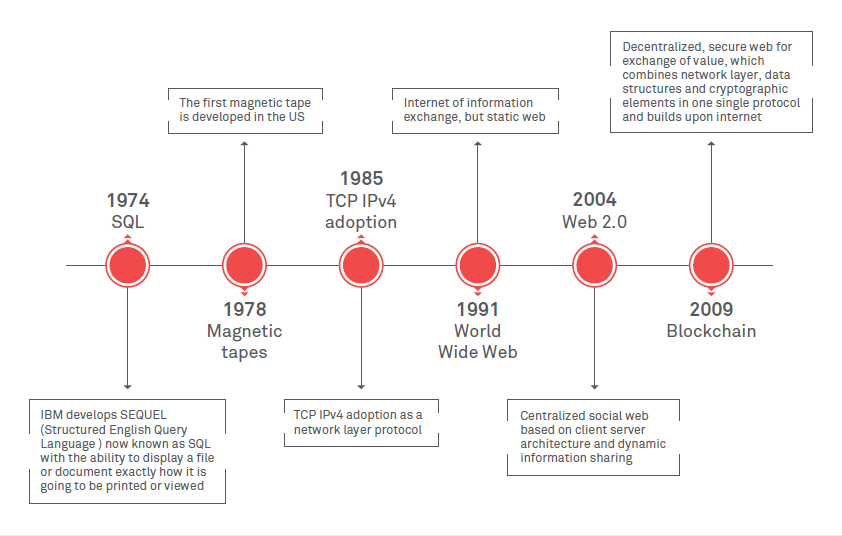

What technological leapfrogs has blockchain made over current technology (i.e., Web 2.0)? The existing Web 2.0 primarily evolved on the Open Systems Interconnection model (OSI). In this model, where the network layer and data layer are separate, organizations started working on data structures (data layer) long before TCP/IP protocols (network layer) evolved, and later kept building on top of the new network protocols. The architecture then eventually grew with dependencies on a client-server model, which required more layers of security to be built on top of it.

Taking an OSI view, blockchain essentially combines the data layer, the transport of information and cryptographic elements in a single concept: Distributed Ledger Technology (DLT). In a Web 2.0 network, centralized authorities maintain data ledgers and dissipate to participants. On a blockchain network, the data is distributed across various nodes and consumed as per rules defined in the protocol. This storage and distribution of data has implications in the way techno-social systems can restructure organizations, government functions and peer-to-peer exchange.

The blockchain is a secure transaction ledger database that is shared by all parties participating in an established, distributed network of computers.

Let us define blockchain again in its simplest form:

The blockchain is a secure transaction ledger database that is shared by all parties participating in an established, distributed network of computers. It records and stores every transaction that occurs in the nodes, substantially eliminating the need for “trusted” intermediaries.

Figure 1: Evolution of web information sharing and web-based technologies

Use cases

Coming back to wealth management systems, implementing blockchain will allow firms to store a golden copy of reference data in a decentralized manner on a permissioned blockchain (i.e., only the approved list of systems have permission to make changes). In a blockchain environment, an organization can run on two different chains, i.e., one interacting with the external bodies like consortia, and another internal to the firm.

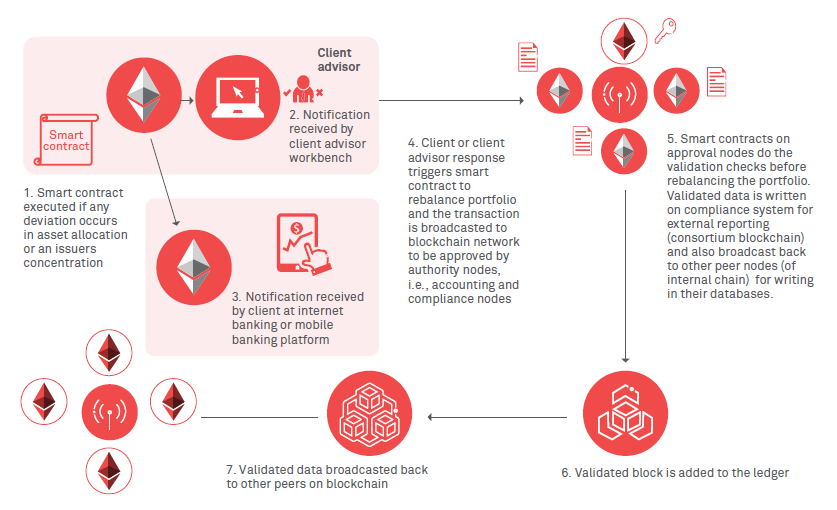

Client book building is a critical aspect of the wealth management business; it enables client advisors to understand client needs, bring in new business opportunities and enhance their relationship with existing clients. Let’s look at an example of using blockchains and smart contracts for portfolio rebalancing in client book development.

Once clients are onboarded, and their portfolios set up, smart contracts on a blockchain network can actively monitor the client book. A smart contract will be triggered if there is any change in asset allocation within a portfolio or the bulk risk for a single asset class increases beyond a threshold value, resulting in sending alerts to clients and their financial advisors in real time.

Figure 2: Portfolio and client book management

The client portfolio will be realigned based on the client or advisor response through available channels. Several other rules can be implemented in smart contracts regarding the client’s investment suitability review as well. The following diagrams detail two other wealth management use cases for blockchain:

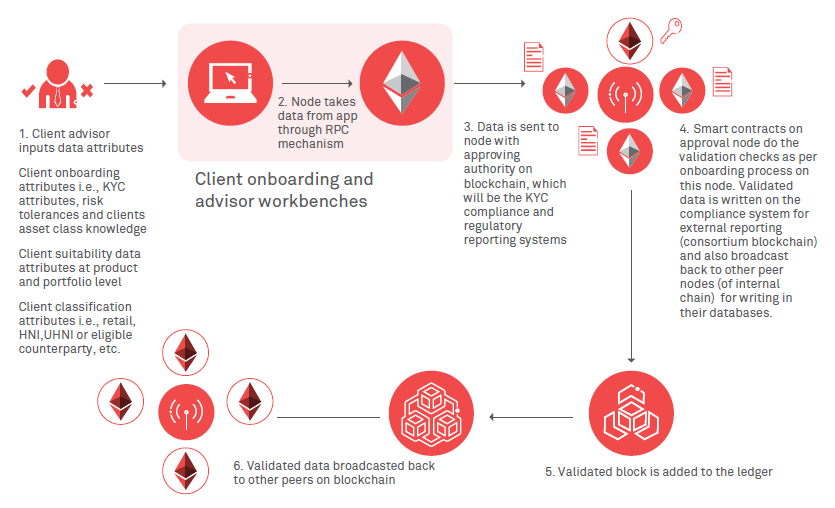

KYC and client onboarding

Figure 3: Client onboarding

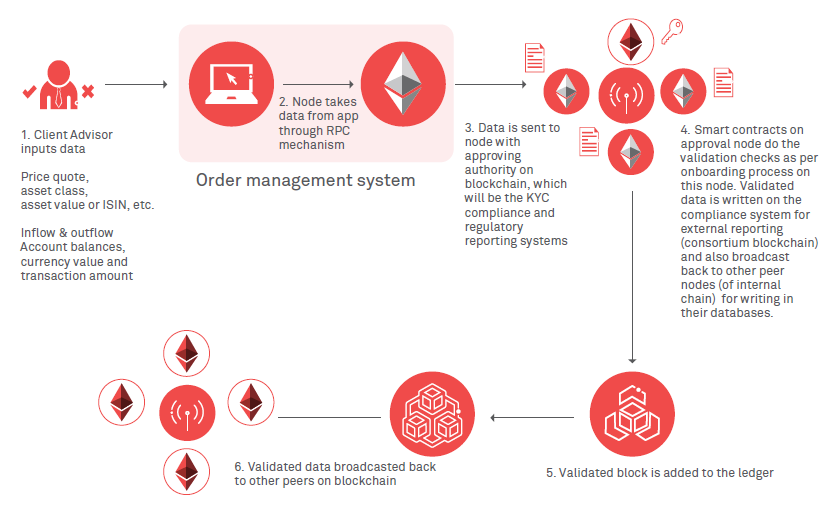

Figure 4: Trade booking and settlement

Challenges in the near-term and how to respond

On the technical front, blockchain is still facing scalability challenges due to its nascent experimental state, and only a few organizations and conglomerates are testing blockchain-based implementations in incubated environments. Also, companies are not sure as of now if they should go all-in on blockchain technology, or run their legacy infrastructure in parallel until blockchain becomes mature enough to minimize operational risks. The majority of banks in developed economies are comfortable using the current technology in their everyday operations.

On the regulatory front, only a few development initiatives have been taken on by central banks and governments to lay down the foundational protocol and infrastructure for implementing blockchain. However, this should not hamper growth. Institutions should explore more use cases for low-risk internal applications—like loyalty points for credit cards or internal file transfers—to test the initial blockchain infrastructure and then ramp up to more critical applications. This way, they can identify the possible benefits and opportunities according to their strategic and long-term vision. Also, banks can partner with growing Open Source community platforms like Hyperledger and R3, where they can pool their resources to achieve the desired results in a more focused way.

Another way is through inorganic growth—over $1 billion USD has been invested in blockchain startups since the inception of technology in 2009. Fintech players’ platforms are close to being production-ready, which have the possibility of integrating with existing business lines without going through painful and costly implementations.

Finally, and most importantly, due to the decentralized nature of blockchain, all the participants in the chain—including internal and external stakeholders—should agree to implement the solution. So the only way to address these challenges is to take initiative to lead the change, which means innovating in collaborative environments at the same exponential pace as nimble startups. Experimentation with disruptive blockchain solutions should not be ignored by any wealth management firm.

Glossary

Akshay Arora - Consultant, Financial Services, Consulting Practice, Wipro Limited

Manish Ramrakhani - Consultant, Financial Services Consulting Practice, Wipro Limited

Manish Ramrakhani and Akshay Arora are consultants in Wipro’s Consulting practice, where they serve clients in the global financial services industry. They are currently exploring the use of blockchain in fintech and wealth management, and the disruptive trends shaping the financial services industry.

Get in touch: global.consulting@wipro.com