Robo-advisors are digital platforms that provide automated and algorithm-driven financial planning services with little to no human supervision. The concept of robo-advisors started during the financial crisis of 2008, when small investors had cash surplus as they pulled money out of equities and interest rates touched zero. Betterment, the leading robo-advisory firm, seized this opportunity by encouraging investors to invest in algorithm-driven portfolios for getting steady returns. Since then, robo-advisory became the buzzword of the wealth management industry and many traditional players have now launched robo-advisors as part of their solution portfolio. In spite of the increased adoption, robo-advisory is yet to match up to the hype around its origin, and robo-advised assets are a drop in the ocean at $1.4 Trillion in Jan 2020 in comparison to the size of the investible assets at $22 Trillion and overall $9 Trillion cash sitting on the sidelines.

Robo-advisors are designed to understand investor needs, propose the investment and allocation strategy, implement the selected allocations, monitor results, and perform the portfolio rebalancing as per the strategy. Robo-advisors offer easy account setup, robust goal planning, account services, portfolio management, security features, enhanced customer service, and comprehensive education. In addition, services such as tax-loss harvesting and retirement planning, traditionally offered only by large wealth managers, are often packaged into the robo-advisory offering. Robo-advisors provide efficiencies in addressing a wider range of investors including underpenetrated mass affluent and small investor segments of wealth management, and differentiate through intuitive investing experience with fully digital and online processes.

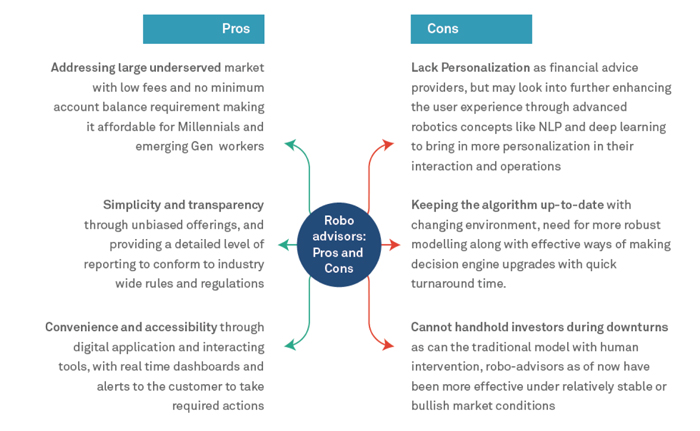

The challenge with robo-advisory lies partly in the design of the platforms, which limit personalization for self-driven investors while access to skilled wealth advisors is often a premium solution. Robo-advice is yet untested in volatile markets and their performance during deep disruption akin to the COVID-19 situation will be closely watched.

Current State of Robo-Advisory

1.1 Robo-advisory business models

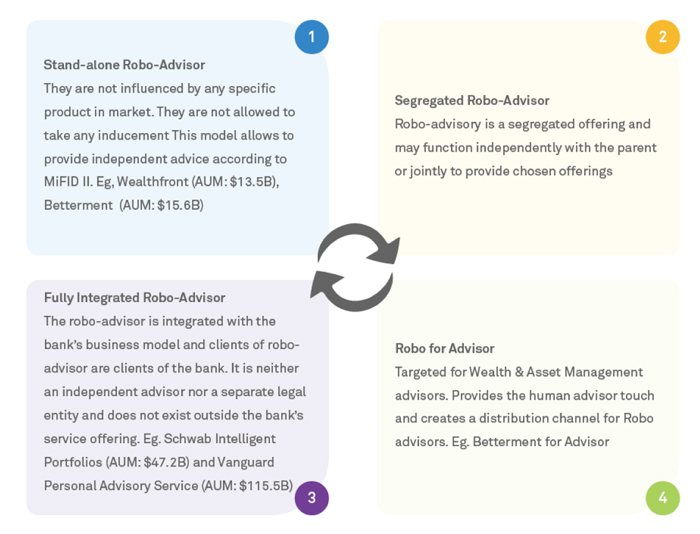

Robo advisory firms broadly operate under four types of business models as shown below. The difference is based on how they interact with the customers and integrate within the banking parent to provide to provide allied services and distribution models.

Robo-advisors are trying to capture various segments through different business models and customized solutions for investors and incumbent asset and wealth management firms that leverage these robo-advisory platforms to build their digital advice capabilities. From being standalone robo advisors, many firms have expanded through integration with other financial institutions, adding more products like Retirement and CDs, and struck partnerships with RIAs (Registered Investment advisors) for providing investment advice.

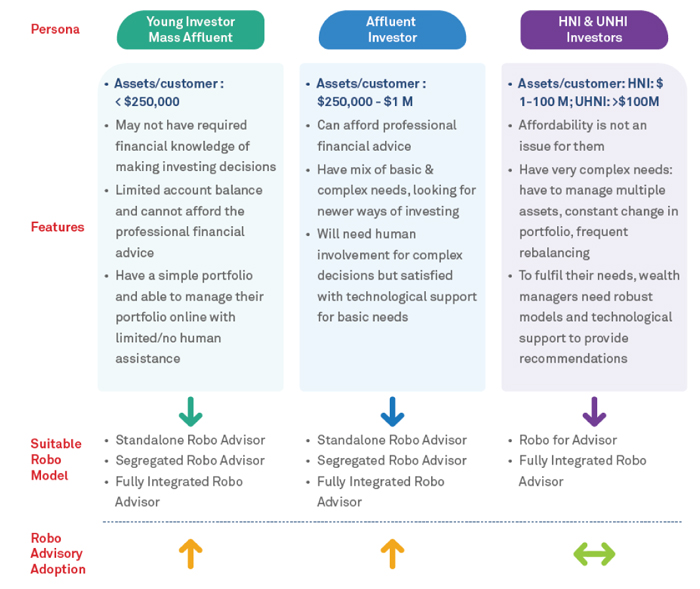

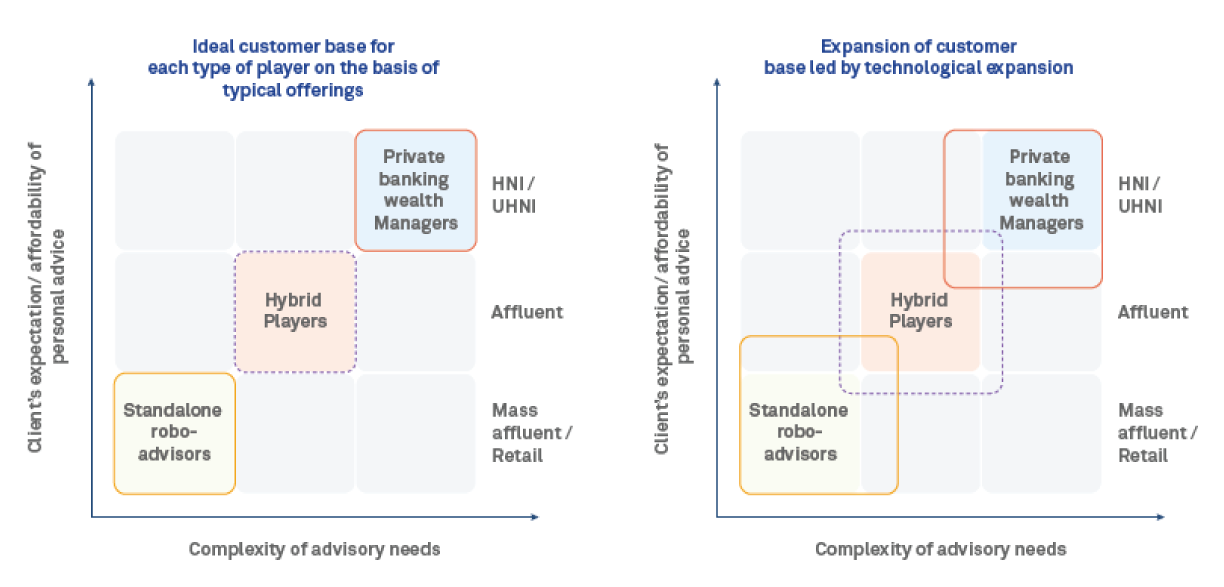

1.2 Persona Mapping

Based on the personal assets of an individual, customers of the wealth management industry are divided into 4 segments: Retail/ Mass affluent (Assets: <$250,000), Affluent (Assets: $250,000 - $1M), HNI (Assets: $1-100M) and UHNI (Assets: >$100M). Per 2018 statistics, 34% of global personal wealth belonged to Retail/mass affluent, 16% belonged to affluent customers, 38% to HNIs and 12% to UHNIs.

The persona mapping for each customer segment based on their needs and suitable robo-advisory model is shown below:

On an average, for a wealth manager, retail and affluent segments hold 17% of the AUM but generate 27% of the revenues. They have a higher revenue per unit asset as compared to the HNI/UHNI but at the same time, revenue per customer is much less. Hence, this segment is neglected with no dedicated business unit or helpdesk serving it. As the robo-advisory model becomes more sophisticated, it will be able to serve the needs of this retail and affluent segment, and can increase revenue per customer with better control over operational costs. Hence, the scope of adoption of robo-advisors for retail and affluent segments is expected to be much higher as compared to HNI and UHNI.

1.3 Regulations governing Robo-Advisor

Regulators around the world have suggested that the registration requirements for investment selection, investment recommendations, and asset allocation are technology-neutral. This means that the registration, know your customer (KYC), and information requirements of traditional wealth managers will apply to digital / robo-advisors. Therefore, robo-advisors must register with the Securities and Exchange Commission of a given country to conduct business and are subject to similar securities laws and regulations as traditional broker-dealers.

So far, there is no specific regulatory framework related to robo-advisory except to the Joint Committee Discussion Paper on Automation in financial advice of ESMA, EBA, and EIOPA. However, there are different regulations that are not directly related to robo-advisory that can be entirely or partially applicable. Some of the regulations from leading markets for robo-advisory are covered below.

Robo-advisors should continue evolving their approach to keep up with the myriad rules and regulations that they are facing, to take advantage of the untapped opportunity in wealth, asset management and retirement markets.

1.4 Challenges faced by Robo-Advisors

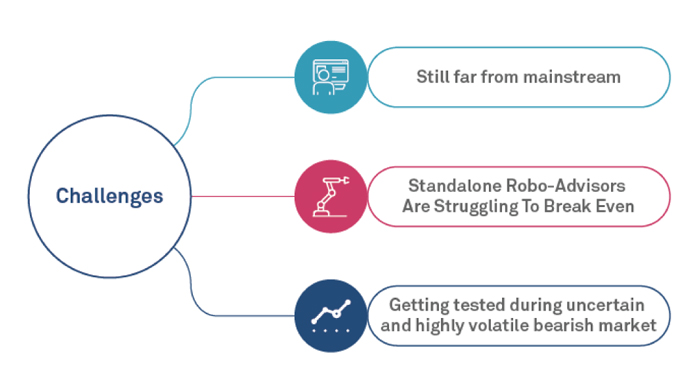

A. The robo-advisory is still far from mainstream

In 2016, robo-advisor assets under management was forecasted to reach $2.2 trillion worldwide by 2020 and $4.1 trillion by 2022. But currently, as of 2020, AUM for robo-advisory is around $1.4 trillion with only a select few standalone robo-advisors like Betterment and Wealthfront gaining scale. Unlike Uber in personal transportation and Robinhood, closer home in online brokerage, robo-advice has not lived up to the visionary outlook to make advice accessible to all and revolutionize personal investing.

Even as passive investing is becoming popular (there is over $6.3 trillion invested in global ETF/ETPs at the end of December 31, 2019 up from around $3.0 trillion at the end of 2015), AUM for robo-advisors has not followed the same growth pattern, though most robo-generated portfolios leverage ETFs.

Robo-advisors will need advanced technologies to improve their algorithms, drive more personalization in their offerings for millennials/ Gen Z investors. They need to involve human advisory at higher portfolio thresholds and expand distribution through Robo-for-advisor solutions. In addition, Robo-advisors can cross-sell and upsell other products like retirement and CDs, and differentiate based on the customer’s risk appetite and investment preferences.

B. Standalone Robo-Advisors Are Struggling To Break Even

Per experts, robo-advisors should manage between $11.3 billion and $21.5 billion to break even. In Europe, the breakeven AUM falls to $3.5 billion to $5.3 billion, based on a higher fee level of 0.45%. The main reasons robo-advisors struggle to break even are the low service fees, low average portfolio size, and high marketing costs required to acquire customers. For some customers, the revenue can be as low as $100 per year, whereas customer acquisition costs (CAC) for most robo-advisors are from $300 to $1,000 per client.

As income and responsibilities increase, financial planning gets complex and requires constant intervention that can be provided by a human financial advisor only. The early adopters of robo-advisors tend to move to traditional advisory with an increase in their wealth. There is a need for standalone robo-advisors to tie up with incumbents and specialized fintechs to fulfill the needs of this migratory segment as they move to the higher end of the mass affluent or enter the affluent segment.

C. Getting tested during uncertain and highly volatile bearish market (e.g. COVID-19)

COVID-19 has wreaked havoc on investor portfolios. Robo-portfolios are no exception, given their dependence on ETFs, which have seen a sharp price correction. Ensuing market conditions will test investment and business models of robo-advisors as this segment will be facing its first economic downturn.

The market reaction is different for different firms. For Wealthfront, new investment account signups were “through the roof ” during the market volatility while Betterment saw more “dip buying”, but overall, Betterment saw more inflows than outflows, and most inbound calls were about tax-loss harvesting and how to do more of it. Charles Schwab’s Intelligent Portfolios captured more of the market’s year-to-date downside than upside, mainly attributed to Schwab’s higher-than-average exposure to international equities, small exposure to high-yield and international fixed income, and high cash allocation.

Robo-advisory firms, by design, have advantages in the crisis due to a focus on goal-based investing, which helps align the investment risk reward based on the risk appetite and time horizon of the investors. However, there are several aspects where robo-advice can improve in being responsive during such large market disruptions.

Perspective: Future Scope of Robo-Advisory

2.1 Hybrid Robo-Advisors

Hybrid models combining the best of both worlds (digital and traditional) are seen as the future of investing with digital solutions for investment experience, digital-led advisor connects, and robo-models for goal-based investments with added options of human advisor interactions. Some of the advantages of the hybrid model are as follows:

2.2 Role of technology across various touchpoints in enhancement of robo-advisory

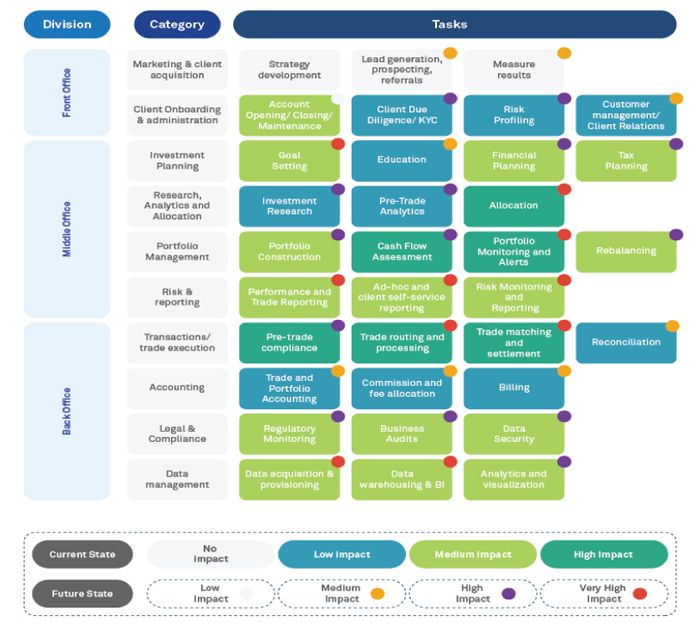

The below figure shows the various touchpoints of robo-advisory across the wealth management value chain with future potential for technological improvement.With the advancement of technology in areas such as advanced analytics, artificial intelligence

(machine learning) and natural language processing, the effectiveness of robo-advisory is set to increase. This will enable robo-advisors to have higher impact across the value chain further strengthening the value proposition.

Marketing and Client Acquisition:

The cost of acquisition for mass affluent customers is a big challenge for robo-advisory firms. New-age marketing tools such as content marketing can be used to create marketing material in different formats like videos, case studies, articles, and podcasts. By leveraging social media analytics to understand customer preferences, the suitable format can be used to reach out to the customer. Website and clickstream analytics will be helpful to drive more conversions and ensure the effectiveness of each marketing program. Further, programmatic marketing solutions can be used to optimize the marketing spend and drive cost-effective acquisitions.

Client onboarding and administration:

Investment Planning:

Research, Analytics, and Allocation:

Portfolio Management:

Risk & Reporting:

Accounting:

RPA is used to run queries, perform calculations and data validation checks to support different components of the tax assessment and filing process. Fund expense processes can also leverage RPA technology to run validation checks, process payments based on pre-defined criteria and budget forecasts. The adoption of new technologies in accounting is low but can increase in the future to augment the human workforce.

Transactions/Trade Execution:

Pre-trade Compliance: Robo-advisor algorithms can automatically factor in the trade compliance needs, by integrating with a compliance engine that continuously tracks the regulatory changes and compliance requirements at every level • Trade operation: Complex AI systems are used to make extremely fast trading decisions. Millions of transactions are to be done per day by

robo-advisors incorporating high-frequency trading (HFT) algorithms. The adoption of machine learning and deep learning algorithms for calibrating trading decisions in real time will increase in the coming years if robo-advisors are able to scale up their customer base.

Legal & Compliance:

Data management:

The huge amounts of qualitative and quantitative data extracted from different sources in the middle office, trading and accounting, and back office operations is saved in the data warehouses. The different aspects of data management can be used for building algorithms to effectively run constituent processes in the wealth management value chain. With the help of ETL tools, insight generation and effectiveness of robo-advisors can be improved significantly. Data visualization tools can be helpful in creating engaging dashboards and trade reports for the customers and financial advisors, enabling effective, s trategic decision-making.

2.3 Way Forward

By embracing technological advancements, wealth management firms in the human to robo-advisory continuum will be looking to expand their services by providing enhanced customer experience, personalization, and better advisory outcomes.

Traditional wealth managers and standalone robo-advisors can expand market share by taking the hybrid approach while existing hybrid players can expand at both ends of the spectrum:

With improved robo-advisory algorithms and better personalization, robo-advisors can evolve to address the needs of the affluent segment. Smoother customer onboarding, improved reporting, and premium offerings incorporating human advisory connects and chatbots can drive higher adoption.

Hybrid players

Existing hybrid advisory players can leverage technology for digitization of various middle office and back-end operations and leverage financial advisor networks to address client needs. Financial advisors can be judiciously used based on the segment they are dealing with. More advanced robo-advice models for direct stock investments, community/ peer-based investment models, and alternative investment options like real estate and commodity investments can be added to increase the value delivery at the higher end of the market

Traditional players need to digitize and modernize extensively to offer Robo / Digital advice driven models. Integration with existing Fintechs can be used to accelerate the go to market. New Digital advisory offerings will need to be incubated through innovation centers and partnerships with large technology firms to ensure that client and user experience delivered are best-in-class and in line with industry-leading digital offerings. The advantage for the incumbents will be a potential captive market for digital advice with the ability to attract underpenetrated affluent and mass affluent segments. As millennials and Gen Z customers build assets, the opportunity will be to help them with a larger suite of financial needs including retirement, mortgages, and dedicated wealth advisory. Standalone players will need to be agile to maximize revenue opportunities by building up distribution and scaling up their technology platforms.

Conclusion

More than a decade since their inception, robo-advisors are at an inflection point. Despite the buzz and early success, mainstream adoption has been elusive. They are now facing the first major test for their goal-based, algorithm-driven investment model; the COVID-19 crisis has brought in an unprecedented level of uncertainty for investors across all categories. The ultimate impact on investor wealth and how well robo-advisors can wade through this crisis remains to be seen.

Incumbents have adopted robo-advisory models to launch their own offerings quickly gaining scale by leveraging their existing customer base. The future may well be all digital but traditional advice will continue to hold sway at the top end of the market. Traditional wealth managers and independent advisors will increasingly use robo-for-advice models to serve the high end of the market. The standalone robo-advisors are at a juncture where they have to decide if they want to expand by innovating on product offerings and building market partnerships or get sold out to larger firms to help bridge the gaps in the market.

References

• “BCG-Reigniting-Radical-Growth-June-2019”

• “BCG Global Digital Wealth Management Report 2019-2020”

• “AITE-US-Digital-Investment-Management-Market-Monitor-Q2-2020-Report”

https://www.statista.com/outlook/337/100/robo-advisors/worldwide

Source:

ETFGI for ETF industry data

Pradeep Agarwal

Wipro Insights Team, Securities and Capital Markets

Pradeep is the Wipro Insights lead for the Securities and Capital Markets practice at Wipro. He has over 12 years of experience in the Financial Services sector having worked with EY, HSBC Investment Banking and Guggenheim Transparent Value. Pradeep is skilled at performing sector research, forming go-to-market strategies, capital advisory, M&A origination and execution. You can reach him at pradeep.agarwal2@wipro.com

Shubham Kapoor

Solution Design Consultant, Securities and Capital Markets

Shubham works on developing relevant solutions/response designs for technology proposals in the Capital Markets industry. He is also tasked with carrying out research activities for ongoing deals and devising strategy plans for the vertical. He has completed his management degree from IIM Udaipur with a specialization in the area of strategy and finance, and is well versed in matters related to the Capital Markets industry. He can be reached at shubham.kapoor@wipro.com

Sakshi Agarwal

Solution Design Consultant, Securities and Capital Markets

Sakshi works as a consultant for developing IT solutions/response designs for customer proposals in the Capital Markets industry. She is also responsible for bid management and devising strategy for lead generation. Sakshi holds a management degree from IIM Udaipur with a specialization in the area of finance and strategy and has proven expertise in the Capital Markets industry. She is CFA level 1 certified by CFA Institute. She can be reached at sakshi.agarwal9@wipro.com

Swarnabha Seth

Solution Design Lead, Securities and Capital Markets

Swarnabha is a solution design lead in the Security and Capital markets division at Wipro. He has more than 14 years of experience across solution development, consulting, and sales strategy. He also has a deep technology understanding of the digital space and has been instrumental in shaping large deals for banking, insurance and financial services domains. You can reach him at swarnabha.seth@wipro.com