Covid-19 has impacted all industries across the globe, and financial services sector is no exception. The sector is enormously affected due to its correlation with the broader economy and its activities, and link to all other sectors’ activities, oscillating from financing to spending to savings.

With a widespread and diversified clients base across sub-sectors including banking, securities and capital markets, and insurance; the industry is in numerous ways responsible and aligned with overall activities related to individuals, communities, and regions. The crisis has impelled financial services sector to strategies in order to respond proactively on its business resilience and preparedness for the bewildering circumstances.

To navigate through this predicament, numerous actions have been strategized and implemented across the value chain. Impact of some of these actions are instantaneously discernible through market and client fronting functions, whereas rest of the efforts are focused on aligning and managing the support functions, captives and vendors; subsisting through business solvency; strengthening risks and stress monitoring, regulatory adherences; and protecting shareholder’s worth. These actions, crucial to sustainability, are in the industry’s priority list.

How financial institutions are responding to the COVID-19 crisis

Like other industries, financial institutions are facing a broad range of issues related to operations, employees, client servicing, stakeholder’s management, business efficiency, profitability, business resilience, and preparedness and viability for COVID-19 like scenarios. Varieties of actions are being taken by financial institutions globally to navigate through these challenges and to curtail the impact of the crisis while protecting business continuity and solvency. Assortments of these actions are comprehensive and predominantly dependent on the country / community level situations and lockdown policies implemented by authorities, depending on the severity of COVID-19.

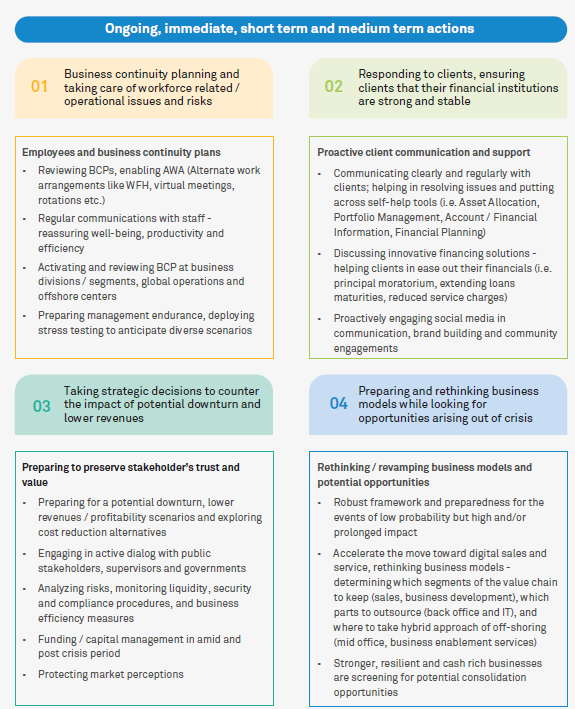

After observing the variabilities of challenges and responses across financial institutions, we have bucketed their actions under four headings (Figure 1).

Figure 1: Short term and medium term action plans categorized in 4 segments

Activating business continuity programs and responding to clients with services and support enablement are immediate priorities and are getting addressed through ongoing and immediate action plans. Protecting business profitability, solvency and restoring efficiency in existing setup are short-term action plans. Exploring opportunities and alternative / more resilient business models are seen as strategic actions and getting explored in the medium term.

Business continuity planning and taking care of workforce, operational issues and risks

Need and actions on activating business continuity planning / programs vary as per the location of operation. Employee’s well-being is reflecting as utmost priority for financial institutions, and unprecedented level of efforts and actions are visible in deploying business continuity programs and alternative work arrangements. Financial institutions are assessing situations on a real time basis and enabling continuity and cross leveraging resources across global / multi location operations, business divisions, offshore delivery centers and captives. Also, they are aligning with business partners and technology vendors on stepping up the supply and support to meet, at least, the necessary and valid expectations of clients. Figure 2 represents financial institutions action across key segments of business operations including employees, global / multi location operations, business divisions / segments and offshore delivery centers.

Figure 2: Business continuity management – invoke and review of business continuity programs

Responding to clients, and support and service enablement

Financial and capital markets across the world are impacted heavily and so are the clients’ financial health, portfolios and savings. Investments are in stress and have moved southwards for a large number of retail and institutional investors. Full or partial closure / halting of non-essential services and business establishments have limited the income flows to a material universe of earners. Financial institutions globally are proactively supporting and servicing clients to their maximum accessible and workable capacity and capabilities, this includes, but not limited to, regular client communication, transactions and trade enablement, providing and educating clients on self-service tools.

The governments across the world have announced a good number of stimulus and recovery measures and financial institutions are playing a vital role in implementing and distributing that to the targeted beneficiaries. Many financial Institutions have stepped up in enabling these measures, along with additional initiatives like waiving of service charges, extending loan maturities, moratorium of principal repayment, enabling portfolio solutions etc. Increased level of client and community engagement activities like spreading awareness about COVID-19, health and well-being tips, etc. have been observed across financial institutions with extensive use of social media and in-house service platform.

Financial institutions are adjusting to the new normal and leveraging digital channels to enable sales campaigns, client services and client support. They are proactively developing capabilities and getting involved with technology partners and other vendors to enable solutions that are valid across business scenarios. Figure 3 explains key financial institutions’ client propositions during COVID -19.

Figure 3: Client communication, service, support and brand building amid COVID-19

Preparing to preserve stakeholder’s value through measures on risk, funding, liquidity, efficiency, profitability and perceptions

Ongoing economic stress, bearish capital market along with unprecedented level of volatilities, falling interest rates, increased risk aversion and spreads, and rise in delinquencies have started building pressures on revenue-generating abilities and going forward, solvency of financial institutions.

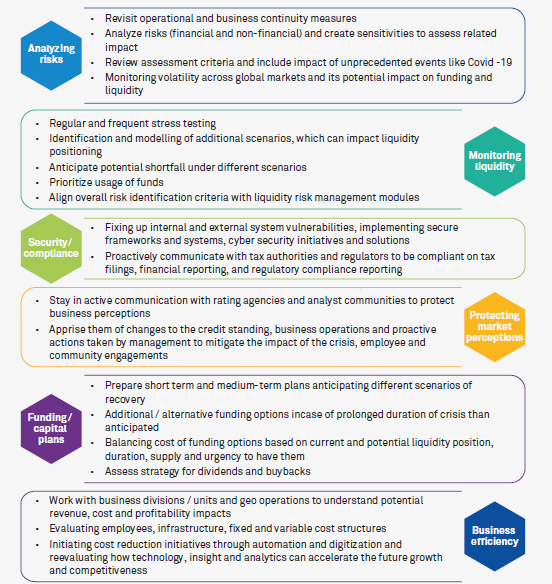

Measuring of risks, liquidity monitoring, adherences to security, compliance and regulations, managing and protecting revenue, costs efficiency, profitability and solvency, chalking out short term and medium term capital and funding plans, and protecting market perceptions to preserve stakeholder value are some of the key actions plans of the financial institutions (See Figure 4).

Figure 4: Key actions across risks, liquidity, security / compliance, efficiency and profitability, funding, and market perceptions

Preparing and rethinking business models while looking for opportunities arising out of the crisis

COVID-19 has forced financial institutions to explore new ways of working. Building business resilience, driven by digital agility and technology adoption; developing robust framework and preparedness for events like COVID-19; and preparing / hunting for new opportunities arising out of specific needs and sector wide consolidations themes are the resultant key considerations (See Figure 5).

Robust framework and preparedness for the events

Robust framework and preparedness for the events

Consolidation opportunities

Figure 5: Building resilience and exploring opportunities

Multiple scenarios are getting modelled and forecasted for concerns and damages arising out of the COVID-19 crisis including recession, socio-economic tension, V/W shaped recoveries or even economic fallout. Under all possible scenarios, the business that remains committed and proactive to stakeholders tends to recover faster.

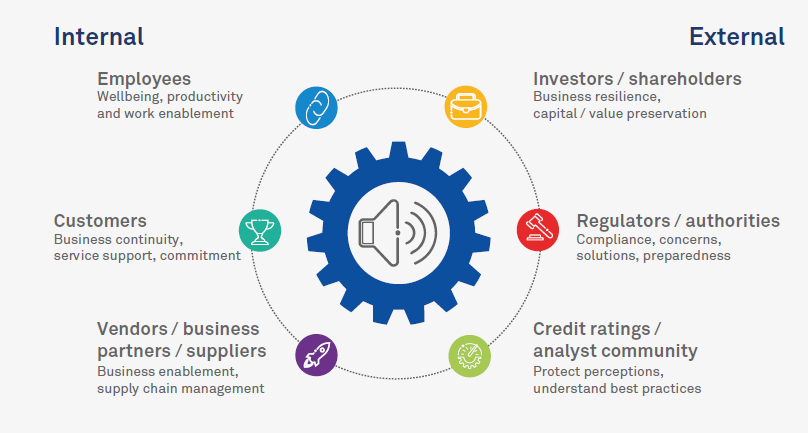

Staying connected

Amid the widely prevailing uncertainties and assumptions across the stakeholders, the top responsibility for an organization is to connect and communicate. Financial institutions have managed this well and majority of them have been proactive in maintaining transparency, keeping communication and announcements ongoing by using all accessible channels including customary corporate memos to contemporary social media.

Figure 6 lists out the key communication related requirements financial institutions address with some related topics relevant from the COVID-19 perspective.

Figure 6: Maintaining regular communication / announcements of key decisions, solutions and adherences to internal and external stakeholders

Towards a resilient future

The nature of COVID-19 is similar across countries but depth of severity is making it different across the board. Accordingly, authorities are deciding the action plans and most of them have proactively implemented the prevention, cure and closing measures while working around stimulus to minimize the impact on individuals, communities, markets and in total, on economy. Financial institutions have responded well so far and are increasingly innovating and working towards solutions, which can / will help them to adjust to this new normal; while building a business model which is resilient and future-proof.

Pradeep Agarwal

Pradeep Agarwal leads the Securities & Capital Markets (SCM) and Swiss Universal Banking (SUB) verticals in the Wipro Insights team. Pradeep has over 12 years of experience in Financial Services sector. Pradeep is skilled at performing sector research, forming go to market strategies, capital advisory, M&A origination and execution. You can reach him at pradeep.agarwal2@wipro.com.