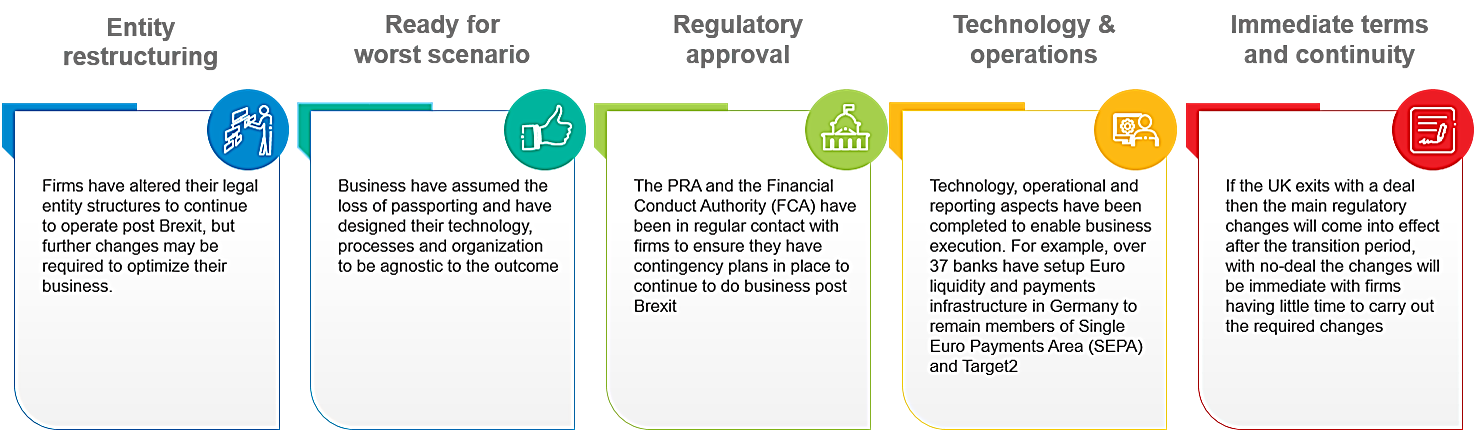

With the latest uncertainty in Brexit and October fast approaching, banks need to take stock of their preparation. Firms have carried out significant work to ensure that they are able to continue to operate post Brexit regardless of the outcome. However, once the nature of Brexit is known, there will be further work required to comply with the new regulatory and legal framework as well as changes to processes, data and technology systems.

Passporting ceases on exit or at the end of a transition period if a deal is agreed

Post-Brexit, the FCA Handbook will get updated to reflect the transposition of EU directives and regulation into UK law and will form the basis for regulation of UK financial services firms

The work done so far

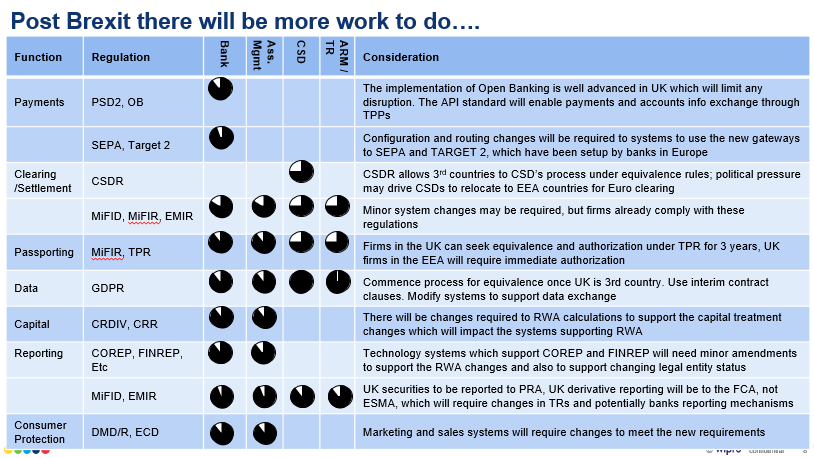

So, what further changes do firms need to do post Brexit?

E-commerce business from the EU to UK customers will be impaired if the Temporary Permissions Regime (TPR) does not gain approval with changes made to online sales data systems and technology required to terminate this activity and closure of any outstanding business. In the interim, should a deal not be struck, online sales from the EU to the UK will cease immediately and the changes will need to be accelerated.

Figure 1 – This representation shows the estimated completion of preparation to support the regulatory changes required for Brexit

To conclude

While financial institutions have made significant investments to continue to operate post Brexit regardless of the type of deal, there is still work that will be required post Brexit to comply fully with the new requirements. What these will be will become clearer over the coming months once the new government negotiates the future Brexit deal.

Richard Thornton

Head of Risk and Compliance Practice - Banking, Financial Services and Insurance, Wipro

Richard has over 39 years’ experience in Financial Services spanning Retail Banking, Wholesale & Investment Banking, and Asset Management. He has worked in Risk and Compliance for over 25 years and has delivered large-scale change programs covering Basel III, MiFID, EMIR, Financial Crime and Dodd Frank.