We recommend you to start from part 1 or part 2 (for a firm understanding of this article).

Based on what you have read so far in parts 1 and 2, we believe we have convinced you about the importance of proactive fraud prevention. All it takes is a single fraud event to deal significant losses in terms of lost contracts, lawsuits, and damage to your brand.

To prevent damage to your company, you must not compromise on proactive fraud prevention strategies. This is why successful brands invest capital and do everything they can to avoid fraud and protect the sacred trust and safety assurance they give to their customers.

The tools, tips and techniques outlined in this series will help your business proactively avoid fraud. However, if your company has a complex business model or is scaling up, then evaluating the vast volume of transactions for potential fraud becomes a very cumbersome task that small or medium-sized teams will not be able to perform. Therefore, significant investments are required to make your fraud management efficient from a technical perspective as well as HR perspective. You need to evolve from a fraud management team to a fraud management SYSTEM.

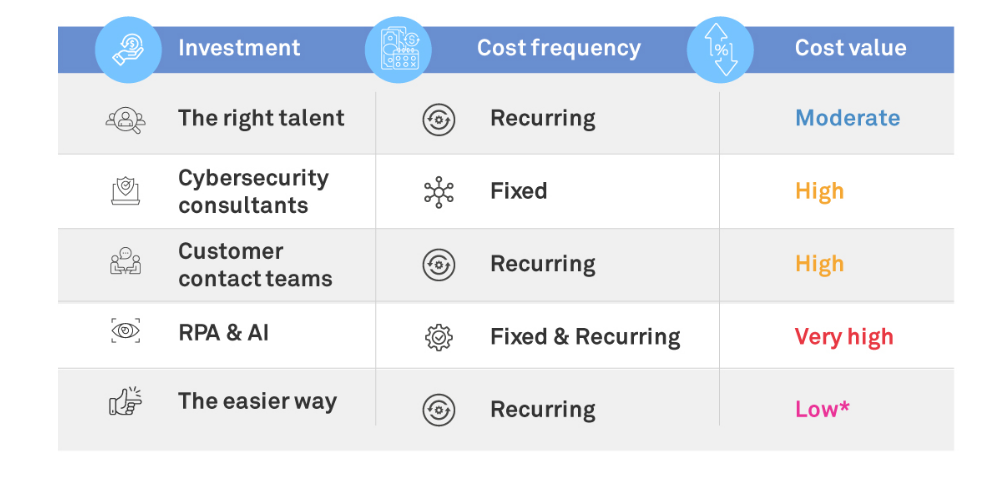

A robust fraud management system requires the following investments-

*compared to the other investments in this table

The right talent

While you can employ any type of person to be a part of your fraud management team, ideally you need people with –

The investment you need to make here is recurrent and dependent on the volume of transactions that you deal with regularly and the level of training requirements.

Cybersecurity consultants

Companies across industries have different business models and financial situations. Therefore, the fraud management program in your company must be customized to your internal environment.

You need to hire a proficient cybersecurity consultant who will conduct an outside-in analysis and offer you a detailed fraud management plan that caters to your company’s characteristics and financial situation. A consultant with a background in fraud management would be even better. This plan would comprise of the technical and HR investments that you will need to make with their respective costs.

Ideally it would be better to hire skilled and experienced consultants with a proven track record. Most consultants in this domain charge a fixed fee for a certain number of meetings and the top consultants are expensive. Thus, this will be a large one-time investment that you will need to make.

Multi-channel customer contact teams

As mentioned in the previous article, you need to carefully investigate each transaction/user you mark as suspicious. One of the key tasks of this activity is to directly contact the concerned users. Large volumes of transactions mean you need to contact a large number of users. Traditionally e-mails can be used to perform this task; however, it will be very efficient to use chats, voice helplines and video calls for efficient execution. Thus, you will need to invest in an efficient customer contact team whose primary responsibility will be to contact all the users that have been tagged as suspicious in the fastest possible time.

The employees in this team need to have –

The investment you need to make here is dependent on the volume of calls that need to be performed on an hourly basis and the level of training requirements. You might also need to make investments in special software that supports your customer contact team by recording their transactions with users and offering hints or assistance during challenging moments in conversations.

Robotic process automation and artificial intelligence

Despite their efficiency, relying upon human beings for manually checking your transactions for fraudulent activity might help you up to an extent. However, beyond a certain volume, it will become challenging for your fraud management team to perform at their best. Thus, you will need to invest in robotic process automation systems, which are convenient computer programs that will analyze several thousands of transactions in a few minutes and offer insights that will help your team make the right decisions. Just like how you cannot have hardware without software, robotic process automation needs to be complemented with strong artificial intelligence programs.

A good artificial intelligence program must help your fraud management program in the following ways –

Both these emerging technologies are in high demand, and require significant fixed investments. In addition, you will need to employ and maintain the right talent to be able to maintain these systems, which is also a high recurring cost.

Outsourcing - the easier and efficient way

Investments in a robust fraud management system with a top talent team to support it are high, in addition to being long term and subject to risk.

If your company is comfortable with making these large investments, this article will be a good starting point for you. If not, you can connect with us and we will be able to help prevent fraud in your business transactions.

Here are 4 reasons why Wipro will be able to help you -

So why not entrust your payment fraud prevention and management program to Wipro so that you can focus on your core activities and make your customers happy?

We recommend you to start from part 1 or part 2 (for a firm understanding of this article).

For more details and queries, please fill the contact form here.

D. Davis Pinto

Davis is a senior manager (payment risk operations) in the digital operations and platforms (DOP) service line of Wipro. He has over 17 years of experience in the field of payment risk management and currently manages a team with over 1,000 employees that prevents payment fraud on a daily basis. He is an improvement-oriented person with a vast amount of experience in the trust and safety industry and works very hard to meet and exceed the demands of our customers.

B. Leepika

Leepika is a senior group leader (payment risk operations) in the digital operations and platforms (DOP) service line of Wipro. She has over 7 years of experience in evaluating transactions for potential fraud, and currently heads a team of more than 150 employees in DOP’s payment fraud management division. She believes in putting herself in the customer’s shoes and keeping up to date with the latest payment fraud trends.

Richards TV

Richards is a marketing executive and a content writer in the consumer business vertical of Wipro-DOP. He is an engineer-turned marketing professional with an avid interest in all things marketing, trust & safety, and the latest technology trends.