Client Background

Client: Leading UK based investment bank

Industry: Financial services

Key Products & Services: Reference data, reconciliation, loans, wealth management and KYC

Area of Operations: Worldwide

Challenge

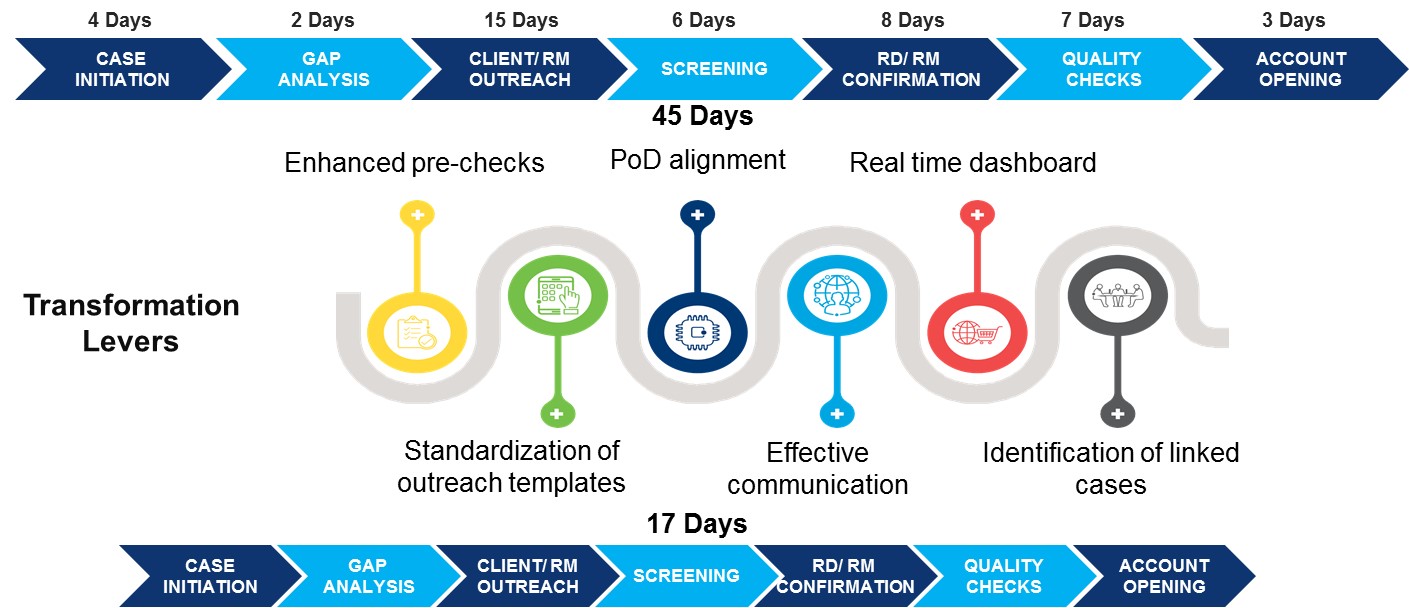

The investment bank was taking about 45 days, against the standard of 20 days, to onboard a client, which is a crucial function in the banking industry as it influences customer experience and relationships.

The reason for the delay in onboarding was the high number of pending (work in progress) cases, which was more than 700. There were multiple handoffs and the cases were stuck in buckets for long periods. Moreover, client requests for information were not being addressed quickly. These issues were leading to customer dissatisfaction and loss of business opportunities, which adversely affected the bank’s reputation and finances.

Solution

Wipro deployed a structured methodology to understand the problem and recommended a solution leveraging transformation levers to help the client reduce the overall work in progress cases and improve onboarding time.

Time to onboard clients reduced from 45 days to 17 days

Business Impact

The chances of financial and reputational loss for the client’s business was drastically reduced and there was improvement in overall work-in-progress cases month on month.

Wipro helps a telecommunication company drive efficiency up through cost optimization

Wipro helps a telecommunications company increase efficiency by reducing errors hrough automation

Wipro helps a telecommunication service provider reduce backlog to a best in class 1%