The one-stop automation portal hosts more than 150 automations across 35 active processes

Client Background

Client: A leading financial services company

Industry: Institutional Financial Services

Key Products & Services: Brokerage Clearance and Exchange, Loan Syndication

Area of Operations: Global

Challenge

Manual touchpoints and use of Macros were the biggest challenges the bank faced on a routine basis. Manual management of invoice reconciliation led to issues like overpayment, duplicate payment, incorrect allocation, and delayed payment to customers. Also, a large number of Excel Macros were used for reporting, in both, brokerage and loan syndication. While Excel Macros provide short-term efficiency gains, they carry inherent risk of failure, which can result in operational loss due to erroneous reports. The challenge was to find a solution, which could eliminate significant manual effort and End User Computing from investment banking domain operations.

Solution

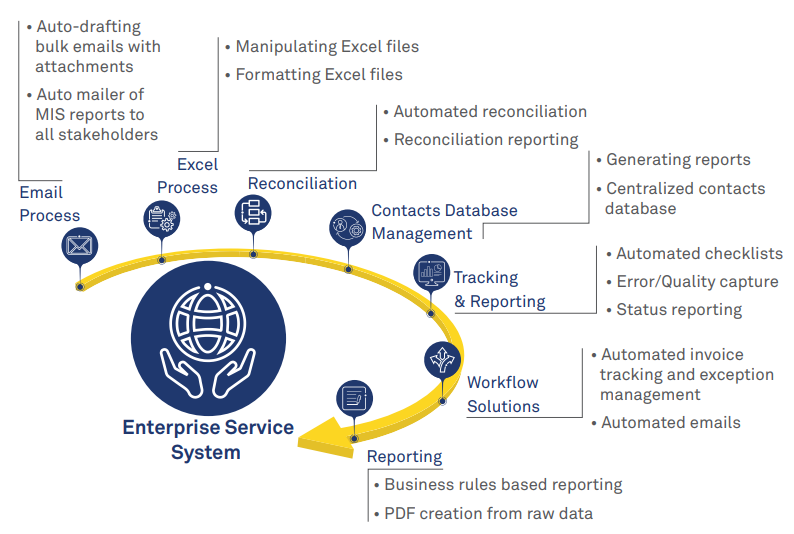

Wipro developed a robust, user-friendly, and flexible application - Enterprise Service System (ESS) - to meet all tactical automation requirements of the bank. During the first release, it enabled conversion of all Macros and migration to the web portal. Auto mailers and database management was enabled through ESS in the second release. Finally, it evolved to serve as a workflow solution wherein invoice management and reconciliation was handled in a secure environment. It provided the benefits of Excel Macros and workflow platform but with significant reduction in operational risks.

The web-based application was developed using .NET and Oracle, which was integrated with the client’s single sign-on for authentication and hosted in their environment for secured access. It was also linked with customer application and database to exhibit real-time dashboard for effective process control and management.

The one-stop automation application was built as an IT supported solution (not user-defined) to ensure better data integrity and reduced operational risk.

Figure 1: Enterprise Service System (ESS) framework.

Business Impact

Wipro helped the bank bring down operational risk by replacing Excel Macros and reducing manual work by upto 70% through auto reconciliation with Wipro’s one-stop automation portal.

Quote

“The platform handles the bank’s huge reconciliation engine to optimize broker-dealer invoice system. Developed under an agile methodology on the Ops floor, it brings down cost and significantly improves the time to delivery. This full-fledged DevOps model is capable of solving End User Computing (forming top 25% of the bank’s identified risks). This application is now evolving to mature into supporting mobility solutions and smart operations with live dashboards. ”

Ramesh Balasubramaniam - General Manager, Institutional Financial Services, Wipro Limited