Executive Summary

For debit and credit issuing banks managing customer satisfaction and costs is like walking a tight rope.

Today's customers have become more demanding and new technology & products means issuing banks have to spend more to keep customers engaged. Customers are taking to online and e-commerce in droves and this has added complexities into various customer facing processes for issuing banks, especially disputes and chargebacks.

Add to this the fact that disputes growth rate is surpassing the growth in card purchase volume globally largely owing to global economic uncertainty (read spend slowdown). Proliferation of mobile devices is making banking & online purchases more accessible and at the same time increases the propensity of friendly frauds and disputes.

In this paper we explore the purchase trends and concerns issuing banks are facing in managing their disputes and chargeback processes and steps that could ensure the delicate balance is not only preserved but help issuing banks exceed customer expectations by leveraging solutions that could be a win-win for all stakeholders.

Disputes and Chargeback Management: The Growth Paradox

Credit and debit card users are showing declining levels of satisfaction because of the manner in which disputes are handled. Time frames to resolve card disputes are growing longer. There is a lack of engagement with the card user during the process and chargeback teams have to cope with frequent changes in Payment Network Association (PNA) rules for disputes settlement. The picture is even more dismal when combined with the economic uncertainty. Other factors that are contributing to this trend include:

Card transaction disputes and chargebacks have become especially alarming contributors to inefficiencies and are seriously impacting bottom lines. The annual growth rate of disputed volumes is already at a worrying 19%. This is expected to grow even further as consumers take to E-commerce and M-commerce. Consider this, in 2012, global B2C E-commerce grew 21.1% to top $1 trillion and is expected to grow another 18.3% to reach $1.3 trillion by the end of 2013 according to estimates by eMarketer . In the United States for example the E-commerce sales between 2012 – 2017 are expected to grow from $ 225 billion to $ 370 billion, while in Europe the growth is expected to touch $ 250 billion up from $ 146 billion in the same period as per a report from Forrester (Figures 1-4) . The growth in global M-commerce is expected to be larger at 44%, taking the mobile transaction value from $163.1 billion in 2012 to $235.4 billion in 2013 according to estimates by Gartner .

Figure 1:Online sales forecast for the US market

Figure 2: Online sales for European markets

Figure 3: Chargeback forecast for the US market

Figure 4:Chargeback forecast for European market

While the growth in E-commerce and M-commerce is welcome, it is likely to deepen the chargeback crisis. A recent Javelin Strategy & Research report suggested that online identity fraud incidents (Cards used without authorization of the genuine cardholder) increased by over one million in 2012 compared to 2011 . Identity fraud has become one of the top reasons for chargebacks. This increases fraud losses that are a liability to the card issuing bank.

To put this into perspective, the global purchase volume of consumer and commercial cards combined touched approximately $ 7.7 trillion in 2012 of which the US market alone contributed approximately $ 3.8 trillion or 50% of total purchase volume (Figure 5). For the purpose of this study we have included purchase volume originating on Visa, Mastercard, American Express and Discover networks for credit cards and Visa and Mastercard for debit cards . Most network associations levy penalties or even cancel merchant memberships where the propensity of receiving a chargeback is above a designated threshold (abroad benchmark ranges between 1% - 3% of the sales volume) , our experience shows that issuing banks strive for lower charge back rates. At a conservative range of .05 (lower band) to .1% (upper band) of purchase volumes the global chargeback market could be pegged between $4 billion - $ 8 billion and $ 2 billion - $ 4 billion for the US market alone (Figures 6 and 7). With chargeback rates for online transactions generally being higher than regular (Point of Sale or POS) transactions, the chargeback market is only larger than estimated.

This clearly means that while issuing banks may benefit from an increase in purchase volumes, they continue to face increasing risk of disputes & chargeback. This also means issuing banks have to ensure the risk associated with chargeback recovery is mitigated.

Figure 5: Global cards v/s US cards volume in $ T

Figure 6: Chargback Estimate-Global card sales

Figure 7:Chargeback Estimate- US card sales

Chargebacks add to the operating costs of issuing banks. In addition, they are substantial contributors to customer attrition.

Chargebacks hurt Profitability

Chargebacks add to the operating costs of issuing banks. In addition, they are substantial contributors to customer attrition. Among other reasons operational costs of a chargeback may stem from:

Hiring and training: Training and learning curves for chargebacks are longer given the complexities around types of disputes, reason codes, systems involved and therefore add to the cost of operations.

Human error: Many issuing banks maintain legacy systems which rely on human interpretation in assigning reason codes to a dispute. This may result in application of incorrect reason codes, thereby resulting in a loss to the issuing bank.06

Association penalties: Incorrect reason codes or incomplete chargebacks owing to human errors could in turn lead to PNA (such as MasterCard or Visa) penalties. These add to costs and increase the time to resolve a dispute. Complexities around legacy systems: Many issuing banks continue to manage their disputes & chargeback process through legacy systems which were enhanced over time with stop gap arrangements like macros, external tools, IT applications, etc. A leading bank in the APAC region for example uses up to 35 different systems, applications, macros and tools to manage their end to end disputes workflow process. Managing such a complex infrastructure of systems adds to operational costs and may lead to delays in chargeback processing.

Figure 8: The Disputes and Chargeback Management P

Dispute write offs: Financial losses related to dispute write offs and chargebacks are high. A sample study of a leading global issuing bank showed close to $11 million spent in annual dispute write offs. This did not include the cost of managing the dispute. Financial institutions need to manage not only their operating costs such as labor, technology, overheads, etc., but also bundled costs of managing a dispute which could be $50/dispute or even higher (excluding arbitration) .

Arbitration: Every case filed for arbitration by the issuing bank with PNA members to resolve a chargeback that is challenged by the acquiring bank can cost between $250 and $750. If the issuing bank failsto win the arbitration, they are required to pay the entire cost of the arbitration.

It is estimated that the total cost of managing disputes and chargebacks can be up to 15% of operating costs. Added to this are the costs involved when an issuing banks credits a customer by deciding not to investigate. There are two key reasons for not initiating an investigation –

A) The issuing bank may be keen to maintain customer satisfaction (also called good faith write off ’s) or

B) The disputed amount may be below a pre-determined threshold and could be too small to investigate.

In either case profitability is negatively impacted.

The Impact on Productivity, Costs & Customer Satisfaction

We have already discussed identity fraud as being a growing reason for disputes and chargebacks. Chargeback can be triggered by unauthorized purchases, cyber-shoplifting, errors in billing amounts, goods not being delivered, the quality / model / type of goods delivered not matching the merchant’s promise in the case of online, mobile catalogue or kiosk purchases.

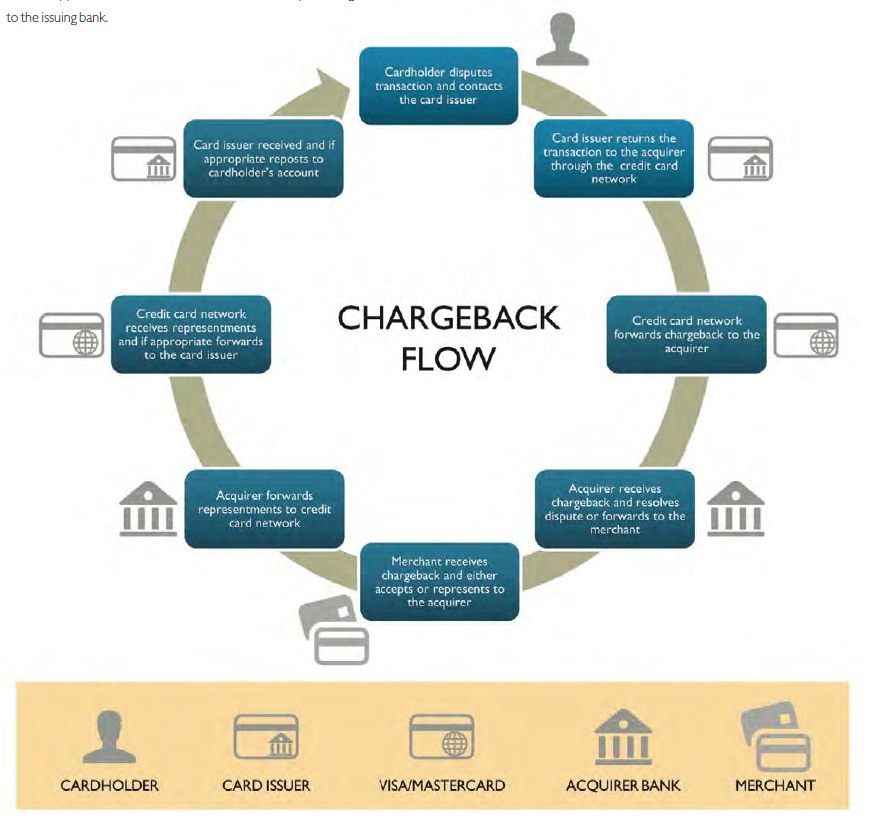

When a transaction is disputed by the card holder, it sets into motion a complex, manual, time consuming, expensive and resource-intensive sequence of events to identify the exact reason – called the “Reason Code” - for a chargeback (Figure 8).

The growing volume of chargebacks, the complexity in documentation requirements, frequent changes in PNA guidelines and meeting Regulation Z (Truth in Lending Act, see highlights on page 8) statutes means that agents assigned to investigate claims rarely have the time or requisite tools to accurately identify the correct reason code.

Errors and the time taken in manual reason code identification are compounded by several factors:

The growing volume of chargebacks, the complexity in documentation requirements, frequent changes in PNA guidelines and meeting Regulation Z statutes means that agents assigned to investigate claims rarely have the time or requisite tools to accurately identify the correct reason code.

Highlights of Regulation Z (Truth in Lending Act)

In a bid to address these issues affecting recovery and customer retention, issuers routinely follow quality checks by auditing between 10 to 15 % of all disputes and chargeback resolutions. This of course, does not provide a guarantee that the other 85% to 90% of resolutions are accurate or do not violate regulations.

This raises several questions:

Strategic Levers to Strengthen Disputes & Chargeback Management

Issuing banks can take certain steps to alleviate issues in their disputes and chargeback process. While outsourcing such a process will bring immediate labor arbitrage benefits, we opine that for a long term solution issuing banks should re-look at the legacy systems currently in place and the possibility of replacing these with either a home grown system or partnering with vendors who offer an adaptive, secure and reliable chargeback management platform involving minimal human intervention. Vendors with the ability to do both (provide the platform and service) can offer a long term remedy that adds immense value in not just lowering costs but also improving customer satisfaction.

Issuing banks will be benefitted by ensuring they look at platforms that provide four key functionalities as specified below.

1) Identification of the correct reason code

Most often than not agents handling the disputes process rely on manual assessment of dispute reason codes and require extensive training (then retraining) which adds to operational costs and is prone to subjective interpretation of a dispute which may lead to human error in the identification of the right reason code. Therefore automating the identification of the chargeback reason code (by examining transaction details) using the right domain expertise can help address this issue. An agent can be then made familiar with the time-scales and documentation involved with the identified reason code, without having to refer to the voluminous Scheme Regulation Manual (SRM) that provides the documentation list. This will eventually reduce manual intervention, improve turnaround time and enhance the accuracy of resolutions.

It is vital that issuing banks urgently examine quick to deploy scalable solutions that use reliable technology without increasing the cost of managing the growing number of disputes.

2) Improve communication with customer

Once the agent generates the list documents required based on the SRM the customer needs to be adequately informed (in line with Regulation Z). Unfortunately, most of today’s customer communication modules as part of the disputes and chargeback management systems seem inept to meet this need. Customer communication letters are pre-set, designed only to let agents tick a check list of required documents. This does not always adequately communicate what the customer needs to be told. Such communication leaves the customer confused and unable to respond accurately in time. Additionally this adds to the turnaround time and leads to customer dis-satisfaction. Ideally, the Disputes & Chargebacks Management solutions should have an integrated Document Management System (DMS). Such a system coupled with a guided workflow would indicate which documents are required from the customer for a particular reason code and should direct the agent in managing the dispute in a timely manner while keeping the customer communication current. This helps increase customer communications accuracy. The DMS should also be flexible allowing for customization of letters, e-mail, secured messaging, etc., and should have the ability to highlight only the missing information which the customer needs to provide. Once the information is received the system should auto tag and inform the agent about completeness of the documentation to expedite the dispute resolution process. This will go a long way in streamlining the customer communication process and in turn increasing customer loyalty and satisfaction.

3) Ensure regulatory and PNA requirements are met

Issuing banks operate in an ever changing regulatory environment. This also applies to regulations that cover retail customer management, payment processing, disputes management, etc. We have already highlighted the importance of Regulation Z in this article and find that in the current scenario many issuing banks that continue to operate on legacy systems spread across several tools and applications where quick adaptability to changes in regulations may be time consuming, costly and complex. Hence a solution which could for example dynamically codify all regulatory and PNA requirements and make them available in real-time for an agent so that the case management work flow allows business as usual will help reduce potential legal/ regulatory lapses thereby reducing legal costs and financial penalties.

4) Use intelligent analytics to reduce operational costs

Each dispute leaves a trail of data and most financial institutions struggle to mine this data effectively. We believe that with automation and analytics issuing banks can reduce the likelihood of human error and improve process efficiencies. Intelligent systems with inbuilt tools like predictive analytics can help understand the origin of disputes and interpret loss patterns to guide issuing banks to make intelligent rules in their card authorization processes which in turn reduces incidents thereby bringing down operating costs as well as reduces potential disputes / write offs.

The Path to Success for Disputes and Chargeback Leaders

To summarize, the manual process to manage chargebacks is prone to errors and can take between 45 - 120 days to resolve. For a disputes and chargeback leader, the key to success is to ensure that disputes are closed quickly and accurately. This implies automating the process, using guided documentation processes and workflows, eliminating agent errors, introducing a high degree of intelligence and analytics into the chargeback management framework.

This strategy has several salient features. The time, cost and resources involved in training an agent in chargeback processes is greatly reduced. Lowered agent attrition is therefore not the number one priority of the leader. By deploying automation, intelligent analytics, etc., new recruits can be quickly made operational. Importantly, additional capacity due to the projected increase in disputes volumes could be better augmented and predictive analytics deployed to counter any emanating trends or financial threats.

With the growth in E-commerce and M-commerce there is going to be an increase in the number of cards not available physically. In addition, economic conditions are expected to contribute to an increase in fraudulent transactions. As a result, the number of disputes will continue to grow. It is therefore vital that issuing banks urgently examine quick to deploy scalable solutions that use reliable technology without increasing the cost of managing the growing number of disputes.

Sources

Sumit Sood heads the solutions practice for Retail Banking for Wipro BPO globally. Based in India, Sumit brings domain expertise in retail banking along with New Business Innovation, Strategy Consulting experience in FMCG, Advisory and Manufacturing Industries with overall experience spanning 13+ years. Through his career Sumit has worked with some of the most renowned Banking and FMCG brands. His interests include all things digital, emerging trends in retail banking like mobility, new business strategy, solutions selling & marketing and entrepreneurship.

Joseph Pinipe is based in India and is part of the Global Solutions Group in Retail Banking of Wipro BPO. He brings 9 years of domain expertise in cards including disputes and chargebacks. His areas of expertise also includes Chargeback Management (Issuing & Acquiring), Fraud Control Management, Customer Service, Process Re-engineering, working experience on various banking legacy systems, Process Consulting and Strategic Assessment, Quality Management and Business Continuity Plan Management. He has provided data analysis support to leading global financial institutions and IT firms. His interests include reading and learning new technologies.