If you have been responsible for automation projects in your organization in any capacity, you know that many projects fail. Why? There are many surveys and studies, but we think that Bill Gates, the Founder of Microsoft, has summed it up quite well:

“The first rule of any technology used in a business is that automation applied to an efficient operation will magnify the efficiency. The second is that automation applied to an inefficient operation will magnify the inefficiency.”

In our experience, we have seen insurance clients apply automation to their business operations. An automation project has three distinct stages:

Three Stage of automating a business process

While automation projects are not exactly rocket science; however, they do share an interesting similarity. A successful mission has three stages—launch in which the rocket takes off, acceleration in which the rocket escapes the earth’s gravity, and deployment in which the payload, say a spacecraft, is delivered into outer space.

Similarly, an automation project has three stages. Each stage has its objectives and critical success factors, as shown in the table.

# |

Stage |

Objective |

Critical Success Factors |

|---|---|---|---|

1 |

Launch |

Opportunity assessment and prioritization. |

|

2 |

Acceleration |

Delivery of automation projects. |

|

3 |

Deployment |

Adoption and industrialization of automation. |

|

Why use design thinking to identify automation opportunities?

As we move from the launch to acceleration phase, the most important tollgate is go/no-go for the proposed automation project based on a business case that stakeholders believe in. However, a business case is not just a matter of crunching numbers. It is about the business and IT stakeholders sharing a common vision of who will benefit from the automation, why they will benefit from it, what needs to be built to provide the same, and how it should be tested and deployed. To do this effectively, we should adopt a useful, systematic approach, and that’s where design thinking helps. In this article, we won’t get into details of the design thinking approach, but will limit ourselves to outlining three key benefits:

1. A structured method for analysis based on real world inputs:

a. Who? — The user, her persona, and her needs.

b. Why? — Pains, gains, and insights.

2. Synthesis of ideas from multiple stakeholders

a. What? — Pain relievers and creators across processes.

b. How? — Prototype to test hypothesis and iterate.

3. Continuous improvement through an iterative process.

How to apply design thinking across the insurance value chain?

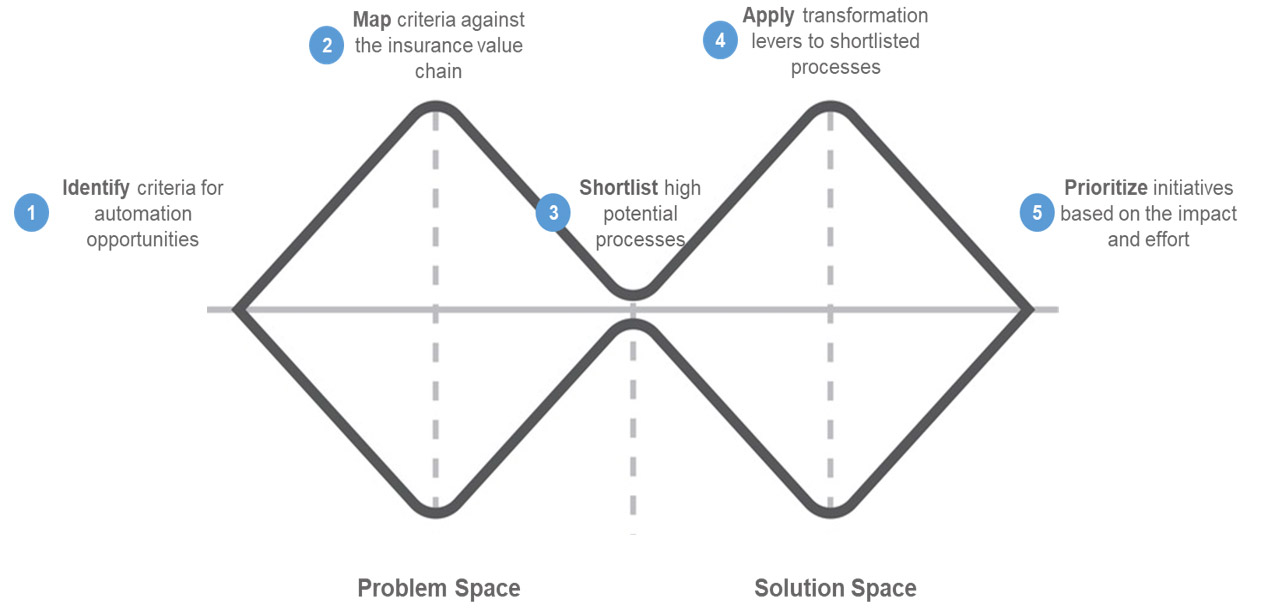

Now that we have considered advantages of using the design thinking approach, let’s see how we can apply it to identify automation opportunities across the insurance value chain. The approach consists of five stages as shown in the figure (below).

4. Apply transformation levers to shortlisted processes: We usually apply four types of transformation levers:

a. Simplification – We consider lean and six sigma, shared services setup, and digitalization. An example of this would be centralizing the rating function.

b. Automation – We consider workflow solutions, smart script, utilities, and RPA. An example of this would be bots managing digitized data.

c. Intelligence – We consider data visualization, predictive and prescriptive analytics, and cognitive RPA. An example of this would be ensuring AI-based underwriting leakage reduction.

d. Experience – We consider CX, mobile first strategy, and channel optimization. Providing a 360-degree customer view would be an apt example for this.

5. Prioritize initiatives based on the overall impact and effort. Usually, considering two dimensions of the transformation effort vs. transformation impact can help us identify quick wins and strategic priorities.

Applying the design thinking approach in the launch phase of an automation project will help in managing different stakeholders with ease. You will be ready to accelerate to the next phase of implementation.

Soumya Ranjan Dash

Insurance, Digital Operations and Platforms, Wipro Limited

Soumya leads the Insurance business unit of Wipro Digital Operations and Platforms. With a team of business consultants, process and automation experts, and operations, he is handling our clients across the Americas, Europe, Asia, and Africa. His strength lies in navigating Life & Pensions and Property & Casualty insurers during business process transformation, business change management, and digital operations using digital platforms. Soumya keys in 17 years of experience in management consulting, digital transformation, innovation, and operations within the global insurance and financial services sector.

V R Krishnan

Insurance, Digital Operations and Platforms, Wipro Limited

Krishnan heads the Insurance practice of Wipro Digital Operations and Platforms. He has over 30 years of experience in leading global operations and sponsoring transformation initiatives for clients, including enhancing the digital footprint for Healthcare Payers, Providers, and Life and P&C Insurance companies. He is often roped in to help with new client operations setup and advisory services across the Americas, Europe, Asia, and Africa.