Many refer to actuaries as original data scientists. They work extensively with data to provide meaningful insights to the entire insurance ecosystem at large. The confluence of actuaries and data science aims to bring transformation by developing innovative products, lowering distribution costs, introducing better risk management practices, and ensuring dynamic reporting concerning local and international regulations.

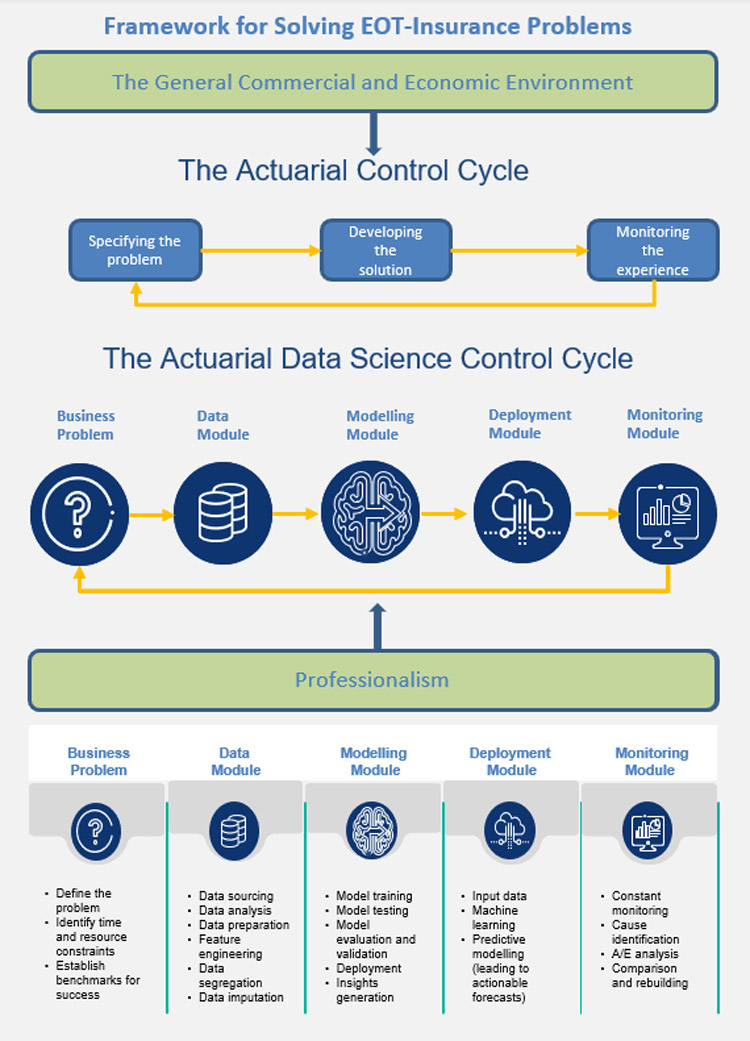

Traditionally, actuaries used the Actuarial Control Cycle framework to identify problems, develop solutions, and monitor them, end to end. However, this confluence has led to the evolution of the “Actuarial Data Science Control Cycle.”

Figure 1: Framework at a glance

Challenges that come with this confluence

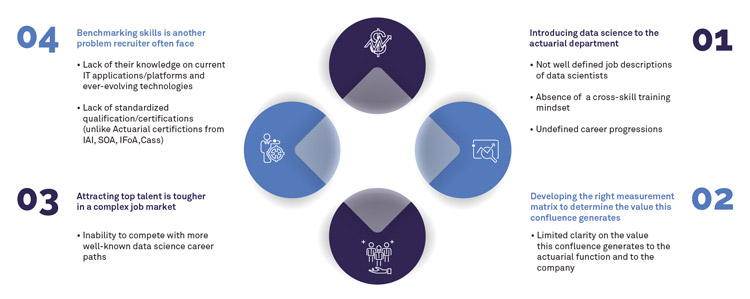

Some of the challenges faced by an insurance carrier are elaborated in Figure 2.

Figure 2: Challenges faced by insurance carriers

How to leverage the confluence

Developing an operating model that integrates the two domains is the key to leveraging the best of both worlds.

The areas where the early confluence can be witnessed are distributions, pricing of insurance products, risk management techniques and mitigation, claims, in force creation, and liability valuations.

Benefits to realize with this confluence

Reserving process will become more streamlined, and the frequency of reports will increase. It can quickly provide a quicker analysis of changes and their impact on capital management and profitability matrices.

Enhancing value for insurers

Insurers are increasingly looking to use data science techniques in the actuarial domain. Today, actuaries can access more data to work with and more information about people and society than ever before. The use of non-traditional data sources like social media, wearable devices, POS scanners, drones, etc., will play a dominant role in setting real-time assumptions, thereby increasing the granularity and frequency of reporting. The robust techniques will provide a suitable data architecture for seamless and on-the-call reporting.

Wipro is committed to providing high-quality business solutions and consultancy services, coupled with proven cutting-edge, data science expertise to bring transformational change that can solve the challenges that this confluence poses. Our narrative focuses on strengthening your delivery excellence, designing value creation models, and lowering your Capex significantly.

For details, connect with our experts here.

Reference:

IFOA Data Science Committee, John Ng

Modular Framework of Machine Learning (2020)

Industry :

Anirudh Bhattacharjee

Practice Leader- Actuarial Services, Digital Operations, and Platform- Insurance, Wipro

Anirudh leads the Actuarial services practice for the insurance vertical in DOP. He has more than 17 years of experience in Actuarial Valuation, Risk Management, Modelling and Reporting including, regulatory and shareholders spanning across geographies like US, UK, and Asia. In his free time, he likes to analyze handwriting styles.