The metaverse is poised to bring bold opportunities for banks and deliver valuable new services to customers.

Bloomberg Intelligence estimates that the metaverse represents a nearly $800 billion market. An emerging technology ecosystem that creates collective virtual shared spaces defined by social networks, digital assets and AR/VR technology, the metaverse may still be loosely defined, but its potential impact is undeniable.

Banks are recognizing the significance of this emerging metaverse market. They have already begun creating virtual metaverse banking experiences in metaverse worlds like Decentraland, The Sandbox and Earth 2. British and American banks that have opened metaverse branches and lounges, curated metaverse experiences or purchased metaverse real estate in the past several years include HSBC, Chase, JP Morgan, NatWest and Quontic. But the trend is deeply global, including players like Siam Commercial Bank (Thailand), Hana Bank and Kookmin Bank (Korea), Caixa Bank (Spain), Warba Bank (Kuwait) and Union Bank (India). South Africa’s Nedbank, one of the largest financial services groups in all of Africa, recently created a village in Africarare, the first Africa-focused metaverse. Though still quite nascent, these experiments in metaverse marketing and customer engagement represent an opportunity for banks to generate data-driven insights about customer interactions in the metaverse and build on top of these initial experiences.

Recent trademark applications from American Express, NYSE and others make it clear that financial institutions are laying the groundwork to provide functional financial services through the metaverse.

What might this future of metaverse banking look like? As metaverse adoption continues to accelerate, banking services in the metaverse are likely to become seamless extensions of a bank’s in-person and digital banking services—a metaverse version of a teller or an online banking portal. Looking even farther down the road, it is possible that younger generations will simply expect all of their digital services—including banking—to take place in the metaverse. In this scenario, clients will don VR headsets and access their bank accounts through virtual branches located in metaverse worlds. One can imagine metaverse meetings about mortgage refinancing, intuitive three-dimensional budget and portfolio modeling in VR, virtual real estate-backed lending, and numerous so-far-unimagined social network tie-ins.

To position themselves to take full advantage of the metaverse, banks should be focusing on four key themes:

1. Bridging real and virtual worlds: Unlocking true utility and functionality in the metaverse will first require embedding basic real-world banking services in metaverse worlds. In its simplest form, this will involve creating more seamless ways of converting money into digital assets without leaving a metaverse experience. Services that do not require movement of assets – like advising – can also help bridge real and virtual worlds even before the larger asset-related infrastructure locks into place. Generation-based segmentation, meanwhile, will allow banks to target these new metaverse services and experiences at Gen Z clients—the clients most likely to enthusiastically adopt and even expect metaverse banking. As a first step in this direction, banks can build applications that operate on metaverse-related hardware like VR headsets rather than inside metaverse worlds themselves. While not customer-facing, even VR employee training programs can help banks build metaverse capabilities.

2. Supporting new metaverse markets: Most metaverse consumers are already transacting via in-world digital assets. After banks improve the connections between real world assets and the growing metaverse economy, the next step will be to facilitate exchanges and build products based on metaverse assets themselves, including in-world currencies, NFTs and virtual real estate. MasterCard’s recent NFT- and metaverse-related trademark filings indicate a move in exactly this direction. Meanwhile, in January of 2022, TerraZero completed the world’s first metaverse mortgage transaction. As open banking accelerates, some open banking platforms may begin offering white labeled metaverse banking services out of the box, delivering pre-built functionalities through APIs. And metaverse platforms themselves may increasingly work with the banking industry as they strive to build vibrant in-world economies.

3. Bringing real-world assets into the metaverse: As metaverse adoption scales, banks can also leverage customer recognition and trust to develop metaverse marketplaces for non-metaverse assets (for example, buying and selling real-world property in the metaverse). Such a hybrid marketplace might include a digital overlay of owned real estate – a sort of metaverse digital twin – while blockchain would legitimize transactions and eliminate the need for a laborious property verification and validation process. Beyond real estate, metaverse avatars will create markets for in-experience wearables that are connected to real-world products like clothing—resulting in an opportunity for banks to facilitate a “buy now, pay later” ecosystem that collects payment when the real-world version of the product arrives to a consumer.

Tokenization offers another path for real-world transactions in the metaverse. The use of non-fungible tokens as collateral would enable banks to issue instant loans, while the tokenization of high value physical assets could give token holders access to instant liquidity. In these hybrid markets, banks might play the role of the actual owner of the metaverse marketplace, or they might support the marketplace much like a utility, offering more traditional banking services to market participants.

4. Solving security and regulatory hurdles: While it is tempting to envision all sorts of wild possibilities for metaverse banking, there will be little progress without a robust framework for security and identity management and for addressing various regulatory concerns. Banks need to bridge metaverse avatars with verifiable digital identity credentials, emphasize know-your-customer compliance, and work to prevent activities like money laundering in the metaverse. A secure identity framework would also strengthen the collections process for the banks that lend against virtual assets. As trusted consumer brands, banks are well-positioned to become the architects of interoperable metaverse identity frameworks.

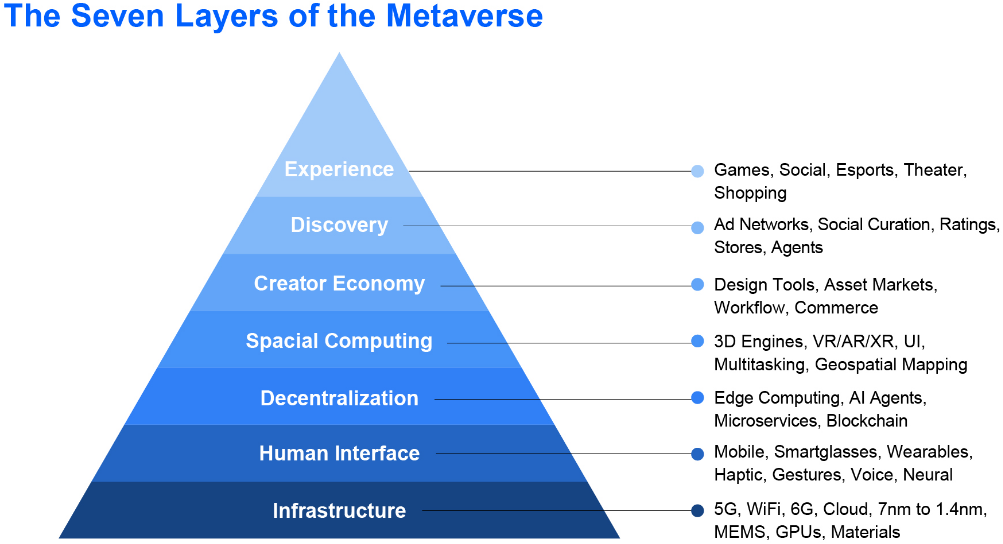

Increasingly, banks will need to work with key metaverse players to refine the deep infrastructure layer of the metaverse (see Figure 1). As the metaverse marketplace matures, engagement with regulators will be critical, to enable bold experimentation while also protecting consumers. Amid the growing regulatory scrutiny of cryptocurrency markets, in particular, banks need to be prepared to robustly prove the soundness of innovative approaches to digital financial services in the metaverse.

Getting from Conception to Reality

There are some very real roadblocks to metaverse adoption in banking. Endpoint computing requirements mean that VR hardware remains expensive, and a fully interoperable metaverse across platforms and companies has yet to emerge. But it would be a mistake for banks to ignore the metaverse. Technology trends that are over-hyped in the short run are often underestimated in the long run.

Whether the future of metaverse banking emphasizes virtual branches, ubiquitous digital asset and virtual real estate transactions, or something not yet anticipated, the metaverse is here to stay and can only grow and expand. Rather than ignoring the metaverse, banks should build their metaverse-relevant capabilities while focusing on the metaverse applications that show the most compelling use cases.

Looking at their lines of business, banks should prioritize those LOBs that show the most metaverse potential from a cost/benefit perspective. As they build their metaverse strategies and competencies, banks should be prepared to:

Though much early metaverse activity has been focused on gaming, the recent integration of Microsoft business apps into the Meta Quest device ecosystem indicates that the metaverse future involves true business functionality as much as play. If the metaverse ends up being as transformative as technology innovations like personal computers and mobile devices, the financial institutions that ignore the trend will miss out on a truly monumental growth opportunity in the coming decades.

To understand the full potential of emergent Metaverse platform - its applications, challenges, risks, and opportunities - Wipro surveyed 550 business and technology executives across the US, UK, and Germany. Read the newly launched full report here: The Industrial Metaverse: A Revolutionary Game Changer for Business.

Ashish Shreni

US Practice Head – Banking Domain and Consulting, US

Ashish leads the Banking Domain and Consulting Practice for the US at Wipro. He is responsible for CXO advisory, CXO relationships, data and analytics, digital strategy, process and technology transformation, risk management, and partnership and alliance strategies, as well as industry representation and industry relationship management.

Contributors

Mayank Panwar – Principal Consultant, Banking

Luke Sykora – Content Writer, iDEAS