When it comes to onboarding a customer, ‘one size does not fit all’. The onboarding process of a retail customer is significantly different from that of a corporate or an institutional banking customer, which in turn, is different from that of a commercial customer.

From a business perspective, commercial customer onboarding is highly nuanced and complex. On the one hand, it requires compliance with different regulations and involves lengthy negotiations, stringent documentation, and complex products and services. On the other, it is constrained by the siloed infrastructure of banks. It is, therefore, imperative for banks to streamline onboarding processes to cater to various customer segments and ensure adequate infrastructure support in terms of capacity, costs and operational efficiencies.

In this paper, we delve deep into the onboarding process for commercial banking customers, and offer a framework to streamline the process and enhance efficiencies.

Commercial customer onboarding process

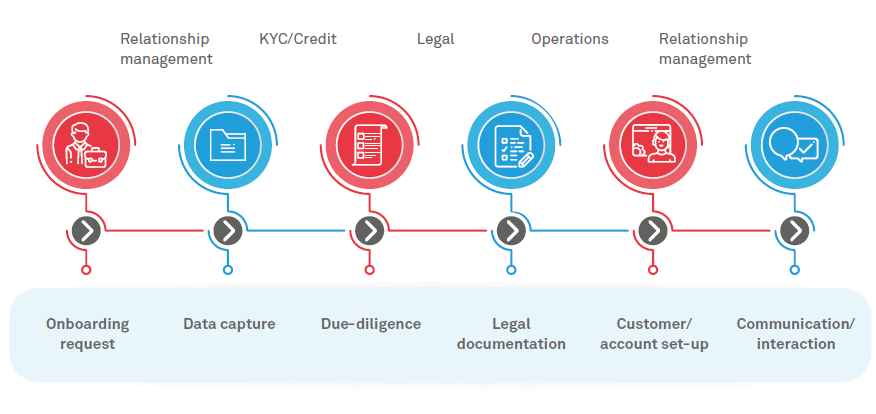

A typical customer onboarding process involves multiple activities. It starts with evaluating the customer’s requirement, followed by due-diligence, completion of legal aspects, account opening1 and making it operational (as shown in Figure 1).

Figure 1: Commercial customer onboarding process

In the context of commercial banking, the onboarding process is not a one-time activity, but rather an ongoing process that needs to be sustained through proactive communications.

Onboarding challenges

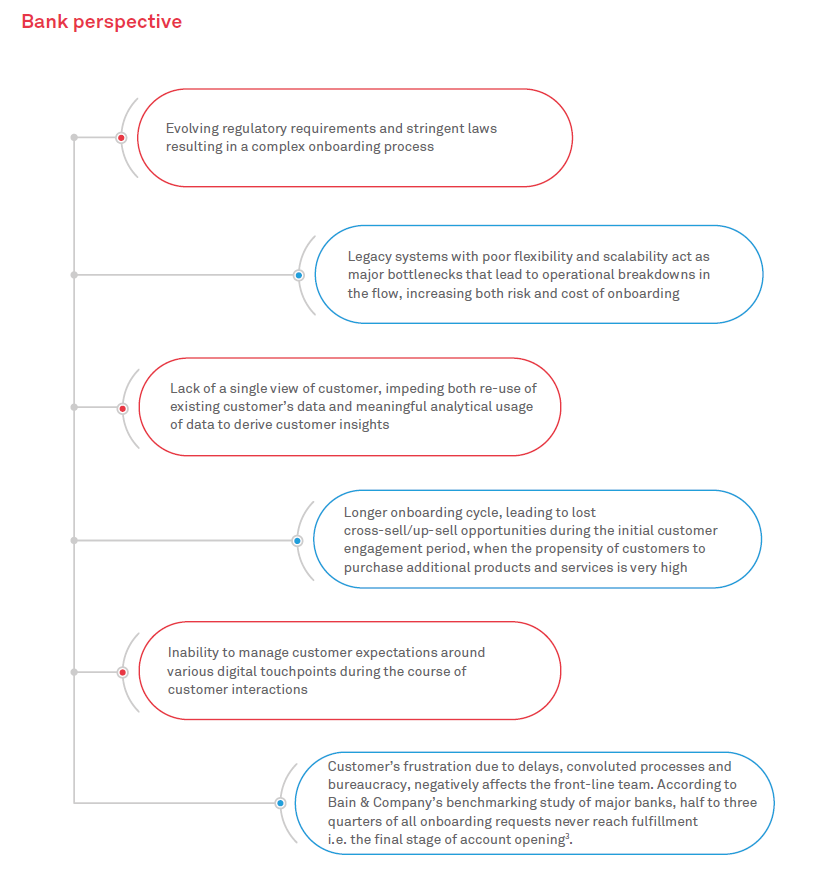

According to Bain & Company, major banks have incurred over $200 billion in fines between 2009 and mid-2016 due to Anti-Money Laundering breaches2, which in turn, have resulted in severe implications for their brands. As a counter measure, banks have started to add stringent controls around their Know-Your-Customer (KYC) and onboarding process, leading to a sharp rise in the onboarding cost. These measures negatively affect the customer acquisition process, resulting in unwanted delays and lengthy time-to-cash cycles. This hampers a commercial customer’s day-to-day operations and results in a considerable loss of revenue for the bank.

Here are some of the typical challenges faced by banks and their commercial customers due to the inefficiencies in the onboarding process.

A solution framework to streamline onboarding

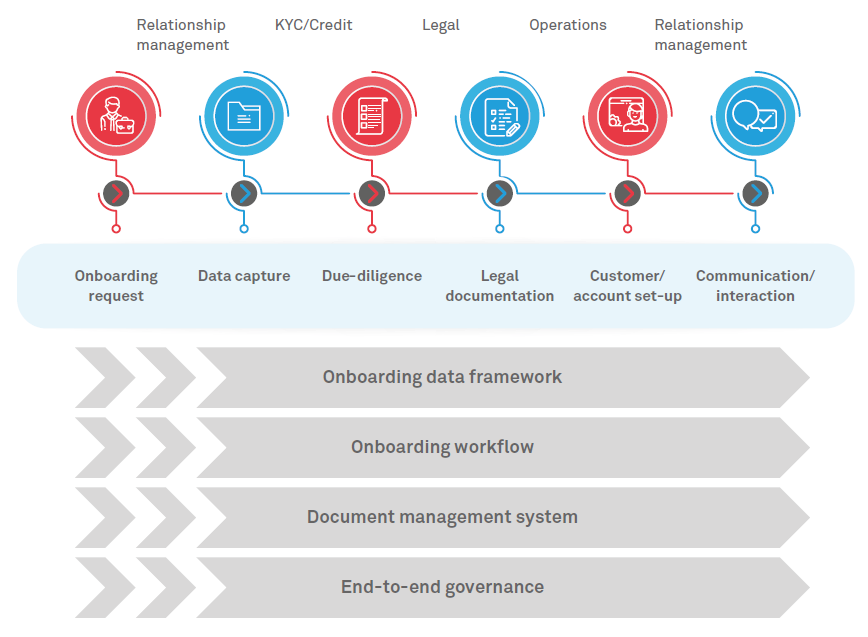

To overcome the challenges associated with commercial customer onboarding, banks need to enhance and enrich their processes, and implement control mechanisms in a streamlined manner as shown in Figure 2.

Figure 2: Commercial customer onboarding process along with controls

Onboarding data framework

Banks should have a single repository of customer data as the ‘golden source’ for all interactions with the customer. The single source should integrate with all applications in order to feed the customer’s data automatically into all applications. An automated process helps reduce data duplication, ensure data integrity, and resolve data inconsistency issues - in both, front-office and back-office systems. Another important aspect is the need for clear definition of the required data points - from a validation, due-diligence, identification, operations, regulation, and compliance standpoint. Banks should rationalize commercial customer’ specific documents to a coherent list of essential data points. Ensuring foolproof metadata management for all customer attributes and segmenting customer’s risk profile along with general, transactional and business information is critical. This not only ensures a structured customer onboarding process but also helps serve them better across the entire customer lifecycle.

Onboarding workflow

In order to provide a seamless experience to customers, it is imperative to deploy a well-defined and robust workflow. The workflow should align to the onboarding requirements, rather than provide a standard generic view, which may lead to confusion and inefficiencies for the onboarding team. Multinational banks serving commercial customers with global operations should standardize processes across locations. Ideally, a core global model supplemented by local variations can help deliver a unified experience to customers, leading to increased productivity of the onboarding team and reduced compliance risk. A robust workflow also demands rationalization of the onboarding application landscape. While there could be multiple channels for interacting with customers, it is best to avoid overlapping of functionalities across multiple onboarding applications. In addition, the objectives of deploying an application must be clearly articulated and aligned with the application portfolio strategy of the bank.

Integrating the onboarding workflow to a business rules engine will facilitate uninterrupted processing. It must be equipped to control user access and ensure compliance to data privacy, data secrecy, as well as all data and role-related entitlements. The workflow should also be able to minimize the need for manual reconciliation and data break checks through automated exception management, and ensure straight-through processing of all customer related data to the downstream applications

Document management system

An effective commercial customer onboarding process relies on multiple documents: a combination of standard documents as well as those based on products and services, geography and corresponding local regulations. As a best practice, banks should maintain all documents in a central repository and integrate it with the onboarding workflow to make the documents readily available.

A robust Document Management System ensures the following:

End-to-end governance

A fundamental requirement for effective onboarding is a governance structure that spans the organization to provide leadership and management oversight. Deploying dedicated teams across various onboarding activities such as KYC, credit check and legal, with well-defined roles, responsibilities and segregation of duties, Service Level Agreement (SLAs) and escalation pathways, is highly recommended. Dedicated teams help increase productivity and reduce operating costs, thereby raising the bar on professionalism and reducing chances of fraud. The governing body must define Key Performance Indicators (KPIs) for the onboarding team with a strong focus on ‘customer experience’. At their core, banks will need to adopt process simplification initiatives to re-engineer their processes and improve technology infrastructure. While multinational banks may have several global centers of excellence, it is important to follow the same processes across the board, making it easy to ensure strong governance, uniformly roll out process changes and reduce compliance risk. Leveraging an offshoring model can result in cost advantages, including wage arbitrage, provided a well-defined operating model underpins it.

Redefining customer experience

While the foundational elements discussed above are critical, it is equally important for banks to constantly redefine customer experience in today’s digital age. Unfortunately, banks often neglect the commercial customer segment as their needs differ from those of the retail or corporate world. Banks need to develop a strategy that aims at creating commercial customer personas and leverages the following tools and techniques:

Deploy a self-service portal – 71% of small and medium businesses consider a bank’s onboarding process and self-service tools while selecting a new bank4. Providing an intuitive self-service portal to customers, empowers and enables them to key in basic data, upload documents, submit and track applications, and even receive alerts. An advanced optical character recognition feature pre-populates data from the documents and eliminates manual data entry largely. Banks should extend these functions to smart devices such as smartphones and tablets. The idea is to leverage opti-channel banking to drive a robust customer engagement strategy in today’s evolving digital world.

Tap into advanced analytics – Leveraging advanced analytics to derive insights related to commercial customers is essential. Machine learning can help analyze and interpret customer behavior, patterns, and preferences, enabling competitive advantage. It is also important to categorize commercial customers based on their business domain, turnover, risk appetite and strategic focus, to create personalized experiences.

Leverage emerging technologies – Emerging technologies that are being tested and piloted for customer onboarding have the potential to shorten the time to fulfillment, reduce redundant data entry and collection, and offer high levels of accuracy in risk and compliance scoring. Such emerging technologies that can transform onboarding processes include Open APIs that facilitate integration with both internal and third-party systems. Digital ledger technology can help validate digital identities, while machine learning is key to rapidly processing unstructured data for due-diligence processes.

Use design thinking – Human-centered design thinking principles that put the customer front and center are indispensable for customer journey mapping and identifying the specific ‘commercial customer’ persona. This, in turn, helps in redesigning customer interactions and transforms their pain points into a differentiated experience.

Next-gen onboarding

The proposed solution approach will help banks realize their objectives around commercial customer onboarding, leading to multi-dimensional benefits. Streamlined processes will drastically cut down redundancies across front, middle and back-office functions and help increase productivity. Shared services for processes such as credit checks and KYC authentication will accelerate revenue recognition by decreasing onboarding time. Simplified and automated processes will also reduce base cost.

A single repository of customer data will better equip compliance teams to identify high-risk customers based on suspicious activities - both external and internal - across any line of business. Such a repository will also increase data integrity and provide an audit trail of all customer interactions and transactions, ensuring robust compliance.

A better understanding of the customer’s preferences and behavior will provide enriching insights that are critical for superior customer relationship management. Great customer experiences will also lead to cross-selling and up-selling opportunities within the first few months of onboarding, further leading to increased loyalty and satisfaction levels.

At a time when Fintechs are completely transforming customer experience and disrupting traditional business models, success depends on the value that banks attribute to their customer relationships. The focus should shift to smart, agile, flexible and customer-centric processes, as the customer’s onboarding journey is pivotal to making or breaking the relationship with the bank.

References

Sumit Mallik

Principal Consultant, Banking Domain – Corporate Banking Practice, Wipro Ltd

Sumit has 13+ years of experience in business analysis, consulting, process analysis and re-engineering, project management, and solution management in the banking domain. He has worked in engagements spanning core-banking, digital channels, and credit risk domain. He is responsible for corporate customer onboarding, and account and relationship management initiatives at Wipro.