About this report

This report has been produced by Wipro Ltd (NYSE: WIT), for a leading global bank, in partnership with Celent, a division of Oliver Wyman.

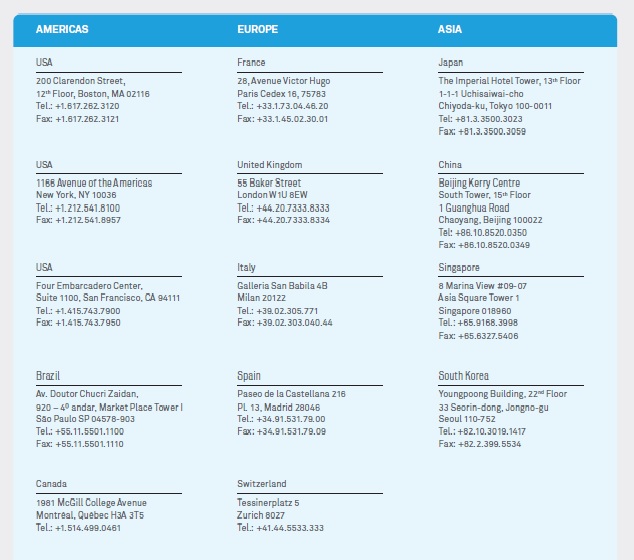

The global bank serves customers in retail, corporate and investment banking, with operations across US, Europe and Asia Pacific.

Celent is a leading financial research and advisory firm. Its thought-provoking content on the intersection of technology and banking/insurance/securities and investments has been guiding its diverse, global clients through the maze of financial technology disruptions for the past 15 years. Celent advises its client base about the disruption and change that financial technology firms, in concert with incumbent firms, can create across the financial verticals in which they operate.

This report is a result of a Strategic Innovation Day with the bank, Wipro and Celent. The goal of the Innovation Day was to leverage digitalization and automation to simplify and consolidate processes in the bank’s global testing team, as it tactically implements the strategic goals.

This report highlights the power of collaboration between key partners and financial institutions as they meet the challenges of today’s capital markets. It looks at specific action items that came out of the Innovation Day and the tools and solutions that Wipro offers for meeting the needs of the bank’s testing team.

The changing macro environment

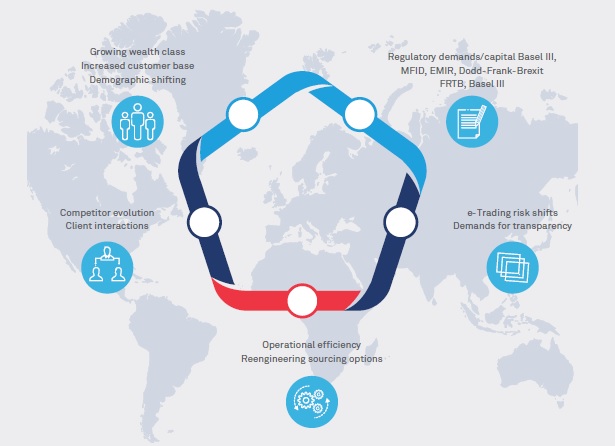

Digital disruption continues to change the landscape of the financial markets. Regulatory and market structure change in the post-crisis world has put extraordinary pressure on the traditional operating models of global banks. Banks have been faced with weak global conditions — increased regulatory burdens that have remapped capital requirements and leverage ratios. This, in turn, has changed the ability of firms to generate revenues in the same fashion as before the crisis. All this is occurring in a macroeconomic environment that is increasingly difficult. The traditional investment bank and client relationship has been turned upside down in the post-crisis world. At the same time, there is tremendous pressure to reduce the cost structure within banks. This path requires critical choices on where to compete, which clients to serve, what business lines to grow and which business lines to divest. It has also brought into view the high levels of complexity that are resident in technology architectures and business lines.

Global banks have reacted in a variety of fashions to the challenges presented by the capital market business environment including new business models to allow them to compete as effectively as possible. A new world is forming in the capital markets; firms are looking at this world through a data-centric lens. In order to compete, firms are simplifying all the aspects of their internal and external touch points. Firms are striving to minimize complexity by moving from analog to digital models.

Firms are reinventing themselves through innovative business models and partnerships in order to operate nimbly in an increasingly automated and digital business. A focus on data processes allows these firms to extract value from their data via cognitive AI tools. They are creating data-driven, replicable processes that are optimized on global scales across their entire infrastructure.These firms are innovating for simplicity through a collaborative approach to their global IT challenges.

In this report, we demonstrate a potential path for the global bank of tomorrow. The solutions described are built upon the three pervasive themes of digitalization, automation, and simplification.

Digitalization, automation, simplification

Digitalization

While digitization is focused on changing an asset from an analogue to digital form, digitalization goes much further — it is about applying customer and data-driven insights to radically transform the business. The digital global bank is built on the premise of leveraging resident data for insight, and prediction across business lines and user types. The data set has morphed to include not only traditional data, but also semistructured and unstructured data. The increase in data presents challenges and rewards. The multifaceted dimensions of data that can be leveraged present a unique opportunity to unleash a digital architecture that puts analytics and predictive intelligence, not just in the hands of data scientists, but all types of business users. This is a cultural shift that allows global solutions across a wide array of businesses and users. Collaborative intelligence will allow rapid transformation into automated solutions.

Digitalization is also about a new way of working. Co-located, multi-disciplinary teams work in collaboration to drive innovation across the lifecycle.

Automation

Banks are automating the heavily redundant processes that still exist within compliance, regulatory and operations into single workflows across their institutions. They are leveraging the wave of machine learning, cognitive computing and AI to continuously free staff to focus on value-added tasks while machines automateroutine and replicable tasks.

Simplification

Banks are innovating for simplicity. Effectively optimizing processes across the value chain of bank businesses is a path to maximum effectiveness. Firms that are burdened by heavy reliance on manual processes, or without the means to automate existing and new processes, are finding themselves at a disadvantage. Process design has an embedded path to automation. The speed of change is amplified in a world where information and capital travels fast. IT, operations and frontline business leaders require market intelligence and information tools to be able to predict the trajectory of their business.

The bank’s strategy

In response to the profound shifts in the industry, the bank has embarked on an ambitious 3-5 year strategy. Focused on making the bank simpler, more efficient, less risky, better capitalized and better run, the strategy involves:

Digitalization, automation, and simplification will play key roles in the strategy

The global testing and QA team is focused on implementing and achieving results to drive the firm’s larger goals. The team is assessing its assets, people and tools. Moving forward with radical change is not easy. Remapping legacy IT and striving for a new architecture is not easy. Some of the challenges are listed below.

Overcoming these challenges is a journey, and Wipro offered and presented its tool set and solutions that can be used to derive benefits in the short term, in terms of efficiency, and in the long term, to move toward its goal of automation and digitalization.

Innovation day

Digitalization and automation within core operations save the industry billions. The process of assessing the tools available to optimize results, the people that are available to achieve change, and assessing the state of a firm’s assets are the path toward quick implementation. The goal is moving the firm forward to create the optimum culture to implement change and thereafter prepare the firm to accept rapid cycles of change.

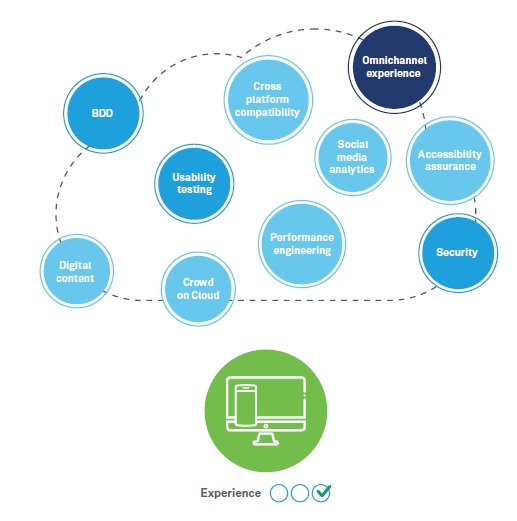

The asks from QA are changing too. In traditional QA, time (whatever time remains after development is done), cost (as low as possible) and quality (got to be perfect out of the door) were the key asks. Today, digital channels are enabling enterprises to reach end consumers faster than ever with innovative products and services with experience at the core. Hence, in digital QA, speed (test as you build or even before), experience (for personalized and omnichannel experience), and iterative development (building a minimum viable product) are what both IT and business leaders are striving for.

Test automation is moving beyond regression to enable parallel development via progressive approaches. Behavior-driven development (BDD) methodology is one such approach where user expectation of behaviour in natural language constructs is the premise for automated testing. Enterprises are increasingly embracing Open Source tools and not-yet-established frameworks, and are open to experimentation more than ever. In tandem, skill requirements are evolving as well.

Creating a new culture that focuses on collaborating and optimizing services often requires different models for the holistic testing solution. A means of easing the continued transition to BDD and DevOps will bring leverage to firms using this path to collaborate and automate.

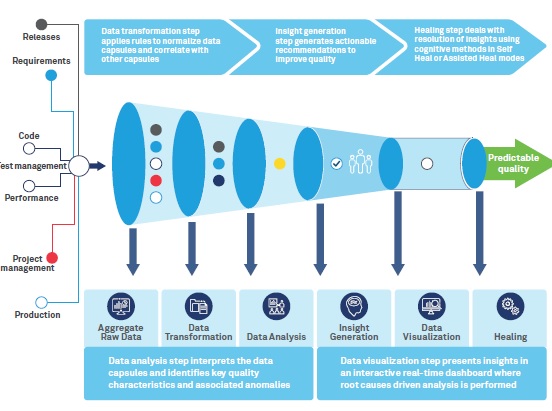

Tools are needed to better map, analyse, and draw meaningful insights and visualize, and create data-based solutions. A key theme is developing more rapid and efficient tools to automate the full spectrum of quality assurance (QA) for application development. Figure 4 illustrates one method to move to leverage innovation in the preparation and ingestion of data for visualization and prediction:

The need to process, analyse and gain intelligence from data is the defining activity of our age. Big Data has created a wealth of data that needs to be processed. The bulk of firms (88%) want to use their Big Data for predictive analytics. Firms that can build the analytical architecture to answer today’s and tomorrow’s questions will be the leaders of their space.

The explosion of data in the capital market has continued as the market has digitized. The multifaceted dimensions of data that can now be leveraged present a unique insight opportunity, but they do so at the cost of complexities in data curation, search distribution, normalization, processing and storage.

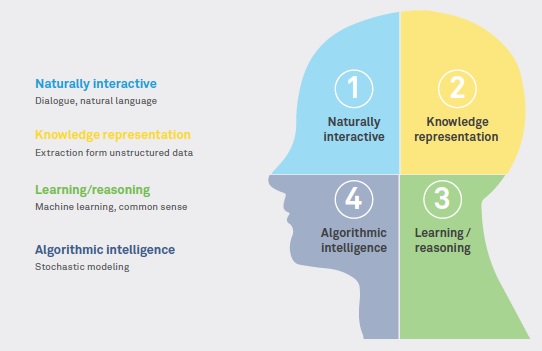

Concurrently, computing power and advanced statistical modeling have made artificial intelligence a nascent reality across the financial world. AI and cognitive solutions are now being employed and will be used to change the methods in which clients and partners interact, represent their knowledge set, leverage algo intelligence, learn and reason. Wipro’s Holmes platform is an example of an AI platform that will bring exponential change to the financial industry.

Wipro has created a next-generation Intelligent Quality Platform that hosts a bouquet of machine learning and AI assets as applicable to QA and testing. It improves predictability in application quality, increases automation, and drives better productivity. Ultimately, it results in IT wellness through predictive quality analytics, reduced cost of quality, and a culture where every part of the organization thinks ‘Quality First’.

AI will be a key component of task and process automation. Holmes is being piloted across the spectrum of operations in the capital markets with an eye toward exponential increases in efficiencies.

As part of the theme of complexity mitigation, tools are required to ease the automation process, rapidly design test cases and create a simpler means of creating regression analysis. Wipro’s next-generation managed services QA delivery framework integrates best-in-class tools, IPs and best practices to address the needs of multi-speed enterprises implementing bimodal IT. By establishing a global partnership with Wipro, the co-creation of innovative solutions for digitalization, automation and simplification will drive the team’s agenda and the bank’s goals in the most rapid fashion. An example is Wipro’s automation framework that serves as the foundation of the bank’s global test automation standard.

Within QA, an entire mapping of the tools available, analytics, dashboards, reporting, and esource allocation needs to be managed centrally and offered in the most effective way possible across the lifecycle. Quality as-a-service (QaaS) is another such tool to drive:

Simplifying the testing lifecycle by integrating the full lifecycle of QA will accelerate go to market, maximize reliability, and drive return on investment.

Action items

Innovation Day wrapped up with a call for action, along the key themes of the day. The joint working groups, with members from the bank and Wipro teams, will focus on strategy and tactics in the move to increased digitalization, automation, and simplification.

Group 1

Group 2

Anchors have been identified from both the bank and Wipro with an objective to work jointly and adopt the relevant tools and solutions across the bank to enhance the capabilities of the testing organization to meet its strategy.

Conclusion

Trends in digitalization will accelerate, and the challenge for established financial firms will be to find the correct means of collaborating with new business models and innovative technologies. Partnerships are growing and are key to creating value for internal and external clients in the challenging environment in which we all compete. Firms will continue to move to more digital, simpler and more automated models. Testing will move forward to leverage behavioural, business and technology changes to implement the bank’s strategic goals. The joint working groups between Wipro and the bank are immediately forming and working to implement testing strategy across the bank.

Leveraging Celent’s expertise

If you found this report valuable, you might consider engaging with Celent for custom analysis and research. Our collective experience and the knowledge we gained while working on this report can help you streamline the creation, refinement or execution of your strategies.

Support for financial institutions

Typical projects we support related to IT strategy include:

Vendor short listing and selection: We perform discovery specific to you and your business to better understand your unique needs. We then create and administer a custom RFI to selected vendors to assist you in making rapid and accurate vendor choices.

Business practice evaluations: We spend time evaluating your business processes. Based on our knowledge of the market, we identify potential process or technology constraints and provide clear insights that will help you implement industry best practices.

IT and business strategy creation: We collect perspectives from your executive team, your front line business and IT staff, and your customers. We then analyze your current position, institutional capabilities, and technology against your goals. If necessary, we help you reformulate your technology and business plans to address short-term and long-term needs.

Support for vendors

We provide services that help you refine your product and service offerings. Examples include:

Product and service strategy evaluation: We help you assess your market position in terms of functionality, technology, and services. Our strategy workshops will help you target the right customers and map your offerings to their needs.

Market messaging and collateral review: Based on our extensive experience with your potential clients, we assess your marketing and sales materials – including your website and any collateral.

Copyright Notice

Prepared by

Celent, a division of Oliver Wyman, Inc.

Copyright©2016 Celent, a division of Oliver Wyman, Inc. All rights reserved. This report may not be reproduced, copied or redistributed, in whole or in part, in any form or by any means, without the written permission of Celent, a division of Oliver Wyman (“Celent”) and Celent accepts no liability whatsoever for the actions of third parties in this respect. Celent and any third party content providers whose content is included in this report are the sole copyright owners of the content in this report. Any third party content in this report has been included by Celent with the permission of the relevant content owner. Any use of this report by any third party is strictly prohibited without a license expressly granted by Celent. Any use of third party content included in this report is strictly prohibited without the express permission of the relevant content owner. This report is not intended for general circulation, nor is it to be used, reproduced, copied, quoted or distributed by third parties for any purpose other than those that may be set forth herein without the prior written permission of Celent. Neither all nor any part of the contents of this report, or any opinions expressed herein, shall be disseminated to the public through advertising media, public relations, news media, sales media, mail, direct transmittal, or any other public means of communications, without the prior written consent of Celent. Any violation of Celent’s rights in this report will be enforced to the fullest extent of the law, including the pursuit of monetary damages and injunctive relief in the event of any breach of the foregoing restrictions.

This report is not a substitute for tailored professional advice on how a specific financial institution should execute its strategy. This report is not investment advice and should not be relied on for such advice or as a substitute for consultation with professional accountants, tax, legal or financial advisers. Celent has made every effort to use reliable, up-to-date and comprehensive information and analysis, but all information is provided without warranty of any kind, express or implied. Information furnished by others, upon which all or portions of this report are based, is believed to be reliable but has not been verified, and no warranty is given as to the accuracy of such information. Public information and industry and statistical data, are from sources we deem to be reliable; however, we make no representation as to the accuracy or completeness of such information and have accepted the information without further verification.

Celent disclaims any responsibility to update the information or conclusions in this report. Celent accepts no liability for any loss arising from any action taken or refrained from as a result of information contained in this report or any reports or sources of information referred to herein, or for any consequential, special or similar damages even if advised of the possibility of such damages.

There are no third party beneficiaries with respect to this report, and we accept no liability to any third party. The opinions expressed herein are valid only for the purpose stated herein and as of the date of this report.

No responsibility is taken for changes in market conditions or laws or regulations and no obligation is assumed to revize this report to reflect changes, events or conditions, which occur subsequent to the date hereof.

For more information, please contact info@celent.com or bbailey@celent.com