Open APIs shaping payments landscape and creating a massive connected API Economy

An Application Programming Interface or API refers to a set of communication methods between various components of a software application or between different software applications themselves. They play a significant role in transforming interactions between the various systems within an organization, between players within the financial industry as well as between financial institutions and other industries like telecom, travel, etc.

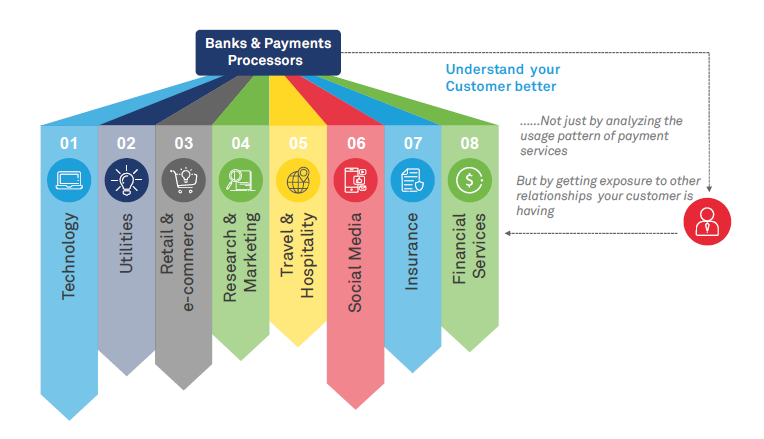

Traditionally, the payments industry has exercised tight control over end-to-end delivery not only of products and services but also the user experience. The proliferation of the internet, smartphones, and tablets coupled with regulatory pressures to open up the markets to third party payment providers and Fintech companies to participate in the payments space has threatened the traditional banking approach, forcing the banks to be nimble to take part in a dynamic FinTech ecosystem. The key enabler for such engagement has been “Open APIs.”

Open API strategy is central to such a transformation enabling banks to play a more active role instead of being a fringe entity in the digital revolution.

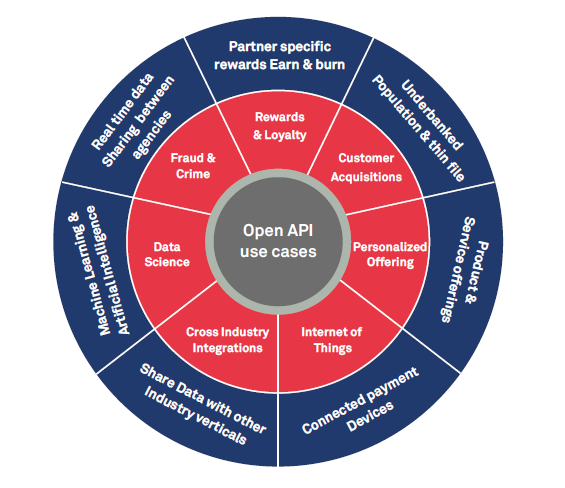

Some of the use cases which have been instrumental for next-gen payment firms in disrupting the payment world through the adoption of open APIs that are relevant to traditional banks are depicted in the figure below.

Challenges for banks & payment providers

Most banks are at some point in their API journey. API journey at banks slows down mostly on lack of clear understanding between the major business stakeholders and some technical challenges.

Banks are struggling to identify the right business functions and use cases that could leverage Open APIs. Most banking professionals are paranoid about security and very word “Open” brings immediate fear among bankers of APIs being unsecured and hackable even though most of their fears are unfounded for. They are skeptical of sharing of information and data with partners to provide better customer experience. This cultural mismatch in a consumer-producer API economy results in lack of commitment and support from various stakeholders.

Majority of core banking systems are built on decades-old legacy infrastructure which has worked fantastically well in the past, but their integration with next-gen technologies takes an enormous amount of resource bandwidth. Any efforts to bring about a legacy modernization is coupled with strategic & technological challenges which could pose a grave risk to the bank’s operation and brand reputation.

Majority of core banking systems are built on decades-old legacy infrastructure which has worked fantastically well in the past, but their integration with next-gen technologies takes an enormous amount of resource bandwidth. Any efforts to bring about a legacy modernization is coupled with strategic & technological challenges which could pose a grave risk to the bank’s operation and brand reputation.

Data-driven approach & framework for open APIs adoption

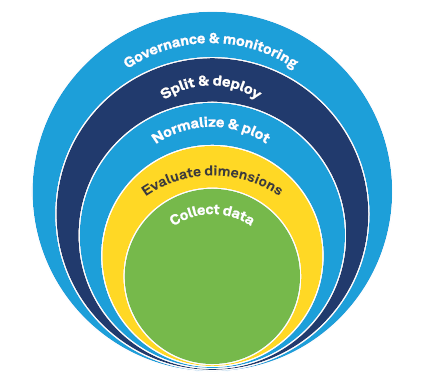

Our view is that banks and payment service providers should take a “balanced” adoption approach towards open APIs. Neither should it be a knee-jerk reaction of blindly experimenting with all kinds non-relevant use cases nor should it be a “wait and watch” option. We suggest a systematic data-driven framework to evaluate and deploy the use cases having three basic pillars – Deployment framework, API governance, and value realization & monitoring post-deployment.

Deployment framework

Collect Data - Start identifying all business use cases which are possible candidates for open APIs.

Ordinal data points can be assigned for business value across three areas

Evaluate Dimensions - Evaluations can be done on two dimensions – Business Value and Technical Challenges

Similarly, ordinal data points can also be assigned for technical challenges across

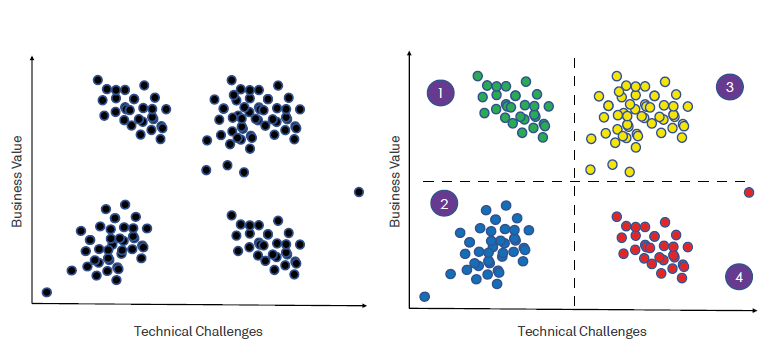

Normalize & Plot - The data need to be normalized for all dimensions so that they could easily be plotted for analysis. Normalized data can then be plotted in a two-dimensional plot.

Split & Deploy - Once we have the plotted data we can start dissecting the area into 4 logical partitions which will effectively be various deployment phases for open APIs

API Governance

Value realization and monitoring

It is essential that business continuously monitor the deployed APIs for the value they generate.It is appropriate to decommission APIs that don’t create value since the cost and risks of maintaining such APIs outweigh the benefits.

Awhan Mohanty – Managing Consultant, Payment Practice

Kaivalya Deshpande – Senior Consultant, Payment Practice

Rakhi Prasad – Senior Consultant, Payment Practice