In no time in the history of the mortgage banking industry has digital customer engagement at the point of sale been more important. The growth of digital loan sourcing and lending, the rapid growth of digital mortgage banks in recent years, and emerging entrants such as Amazon all mandate that all mortgage lenders get better at engaging with customers digitally.

Lenders can no longer get by without an integrated digital strategy that improves the customer experience, increases loan pull-through rates, and drives down costs. How lenders combine their loan origination system (LOS), point-of-sale (POS) systems, digital document management, and other technologies to make that happen are critical to continued growth and success.

There are three strategies to focus on to make this digital transformation:

- Adapt to the permanent pre-eminence of customer centricity

- Solve the high labor cost conundrum with capital/labor substitution. Economists call this (capital) investments in technology to automate manual processes.

- Fix the back-office efficiency challenge by integrating with and building workflow between the POS and LOS

Customer centricity needs to keep getting deeper

Mortgage lenders have utilized personal relationships, customer relationship management systems, and multichannel communications to sell, process and service mortgages since the inception of mortgage finance. However, lending systems are still maturing and do not support the quality experience that customers now expect. Customers expect as good an experience in mortgage lending as they experience in the fully digital/mobile/social/retailing world they live in. Leveraging realtor and builder relationships to increase volume in today’s market is critical, but those relationships are also driven by a lender’s digital customer presence and customer engagement that improves and customer satisfaction.

Mortgage customers revealed in Fannie Mae’s 2018 National Housing Survey that:

- Seventy-five percent of homeowners surveyed think it should take one month or less to complete a mortgage.

- Thirty-eight percent of repeat buyers say gathering financial data is the most difficult part and should be easier.

- Two-thirds are interested in a fully digital mortgage process.

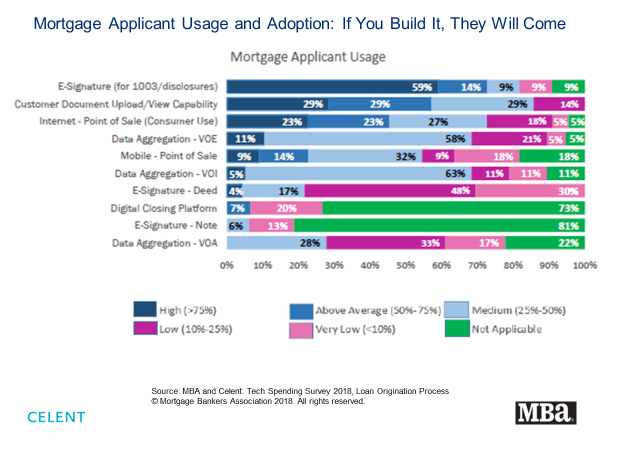

So this is what customers say they want, but if you build it, will they use it? the answer is yes. The 2018 MBA/Celent Technology Spending Survey 2018, Loan Origination Process, reveals that lenders are making the necessary IT investments to make that better. Exhibit 1 below summarizes responses from mortgage lenders about their customer’s adoption of consumer-direct technologies made available to them. This chart shows the percent of lenders that estimated technology adoption by their customers for the lending processes listed below. Estimates were segmented into five levels of technology adoption.

The results show that consumers are willing and able to use mortgage origination technologies. Consumers are also using these technologies at a growing rate as lenders make them available. The largest mortgage loan applicant technology growth of e-sign is in loan application and disclosures, with almost three-fourths having high to medium mortgage applicant adoption. Customer document upload/view usage has also grown. This usage eliminates the customer pain point of having to mail or fax paper documents.

It is important to note that consumer-direct internet usage is much higher than mobile point-of-sale (POS) usage at this point. The large number of data elements makes mobile less practical for some lending processes, but still a good tool for quick communications, status updates, and requests requiring fast response. In addition, consumer use of digital closing platforms and e-signing at closing is “not applicable” for 75% of lenders since they do not yet offer the technology.

Millennials need more than technology

We’ve seen that mortgage applicants want digital technology and will use it when available. But what else do they need? This is a critical question for lenders, because Millennials have been the largest age cohort since 2015, and will continue to be the primary driver of purchase loan growth market for many years to come.

As of 2016, Millennials had a 32.3% home ownership rate, while Generation X (60.4%) and Baby Boomers (75.0%) had might higher rates. This is expected since Millennials are younger, but how do millennial homeownership rates compare with baby boomers and Gen Xers when those cohorts were also ages 25-34? The home ownership rate for millennial aged 25-34 was an estimated 37.0% in 2016, while Baby Boomers 45.0% and Gen Xers 45.4%. This isn’t just a lender technology and process problem, because some millennials are delaying marriage and have housing affordability issues. Some studies indicate that millennial home ownership rates will eventually catch up with industry averages, but what else should lenders do? Lenders can capture their share of the available market with other loan and banking product offerings, personal financial management leading up to home ownership, and mortgage product design (first-time homebuyer programs, customer engagement and service are critical to capture and growth the Millennial segment.

Winning the back office efficiency war by connecting the POS and LOS

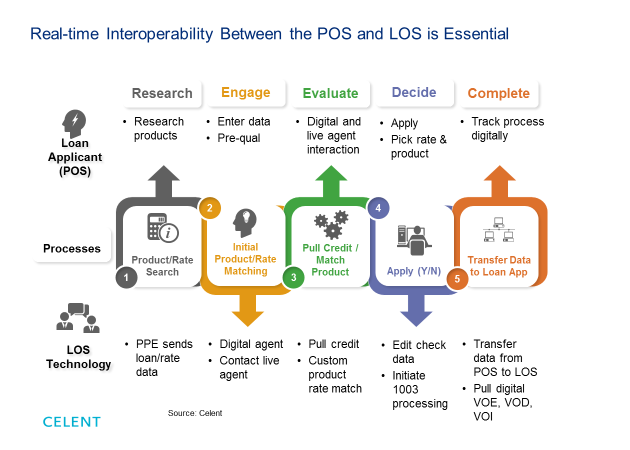

Exhibit 2 shows how lenders can respond from a technology, process automation, and customer journey perspective. The key to delighting and capturing the customer at the point of sale is to integrate POS, LOS, and fulfillment technologies with workflow-driven real-time processing.

Digital customer engagement relies on live loan product and pricing data that the LOS or product/pricing engine (PPE) sends to the POS. Digital channel self-service point-of-sale (POS) technologies need to not only have research, engagement, evaluation and loan application capabilities, they need to integrate and exchange data with the core LOS, decisioning engine, and pricing engine during and after the prospect selects a loan and submits a loan application.

This enables fully digital research, shopping, and custom loan matching processes that result in better product matches and higher loan application rates. Most importantly, it provides the timing and immediacy that the customer wants, at lower cost to the lender.

Fully Integrate Document-Based Processes. We’ve emphasized data-driven technology innovation to build and deliver fully digital mortgage banking to customers, trading partners and employees. However, while data moves synchronously in digital loan origination, lending documents typically move asynchronously via courier, fax, or email attachment. Lenders also need workflow-enabled digital document management to transform and transmit documents digitally to move in sync with data processed by the core point-of-sale, origination and servicing systems.

The key to achieving full digital lending is the integration of document-based processing systems with data-based processing systems so that all content moves synchronously throughout lending processes. This also requires workflow software to create systems-triggered workflows for straight-through processing.

Outlook and closing thoughts

Ongoing underinvestment in mortgage technology has led to ongoing inefficiency in mortgage processing and the high origination-and servicing-cost per loan that plagues the industry. Leading depository financial institutions, digital only mortgage banks, and (in the future) emerging market entrants such as Amazon have permanently raised the bar for improving mortgage customer engagement, cost to originate, and operating efficiency. As interest rates rise and lending volume declines, mortgage lenders need to spend on technology regardless of the business and financial cycle.

About the Author

The article is contributed by Craig Focardi, Certified Mortgage Banker and a senior analyst at Celent

Craig is a Certified Mortgage Banker and a senior analyst at Celent, a global financial services strategy and technology advisory firm for financial institutions, technology providers and VC firms. Craig’s research and advisory coverage areas include digital lending strategy, market sizing and technology product selection across the credit lifecycle. Complementary coverage areas include analytics, digital content management and core banking systems.