The emergence of novel coronavirus (COVID-19) and its impact on the global markets is unprecedented in modern history. The COVID-19 pandemic has put a majority of the world’s population under lockdown since the start of 2020, leading to a widespread halt in economic activities. Experts expect the pandemic to derail economic growth across the world due to reduced economic output and rising unemployment, and consequently leading to a deterioration in credit quality.

Financial institutions are focused on maintaining continuity of their services and the transmission of government support and financial aid to troubled sectors. However, the financial services sector is already witnessing a significant impact on profitability, with large US banks announcing huge reserves for potential losses from the deterioration in asset quality.

In this blog post, we’ll examine what these market realities mean for financial institutions.

The impact is multiplying as the pandemic progresses, forcing banks to proactively reset their business priorities to mitigate potential threats around liquidity and profitability—all while managing their discretionary spending and investments. Customers are increasingly demanding better and more intuitive self-service tools while employees’ productivity is impacted by the remote work required to maintain business continuity.

Financial institutions are exploring several alternatives to meet the objective of serving their customers. They are assessing the commonality in requests to make efficient use of available options—including digital channels, call centers, or branch networks—to eliminate points of friction. The focus is also to understand if self-service digital capabilities can roll out to seamlessly serve client requests in this challenging period. With a renewed focus on the customer experience, this might be an opportune time to examine the customer’s clickstream on digital properties and assess if they can achieve desired results.

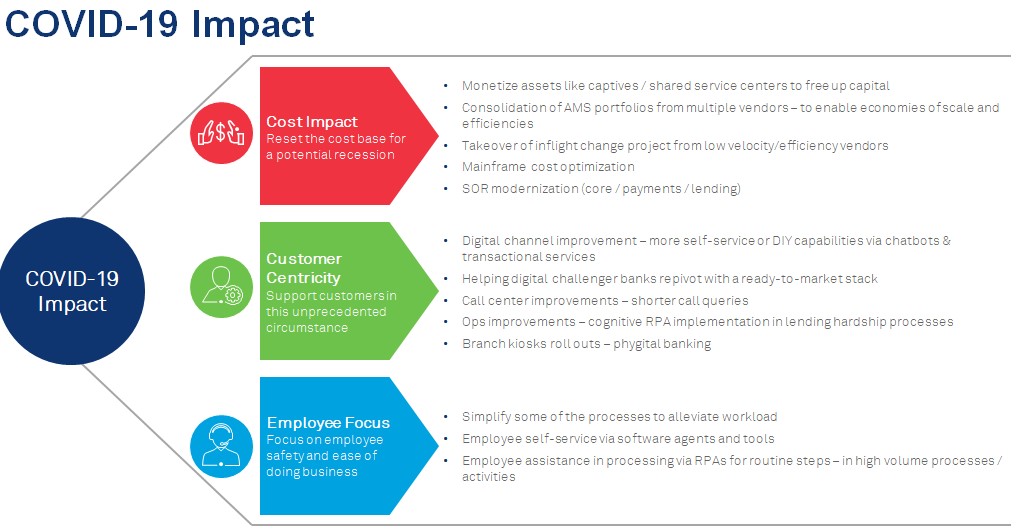

In addition to maintaining business continuity and assessing different solutions for tackling regular customer queries, as well as resulting from the pandemic, banks need to work on key themes to proactively limit the business impact in the coming period. The below diagram highlights the key technology imperatives, which can help banks to curtail the potential impact:

Sushankar Daspal

Digital Leader – Banking Americas

Sushankar is the digital leader for Banking North America. Sushankar has been part of multiple digital transformation programs for customers spanning US, UK, Switzerland, Japan, and Australia. Sushankar is a multi-time presenter in Finnovate and OpenBankProject global fintech hackathon.

Contact us

Wipro’s Banking, Financial, and Insurance Salesforce practice provides real-time transactions with results, data security, and improves the customer experience.

Payments system transformation can enhance bank and customer relationships, as well as create new revenue streams.

Cash Management and Payments systems in Emerging Markets : Opportunities and Challenges