Chapter 1 – The Banking Business Model is Undergoing Innovation Disruption

The incumbent/legacy banking model is set for an overhaul. The catalysts for change include constantly changing customer preferences, a highly competitive landscape and the emergence of contemporary technologies.

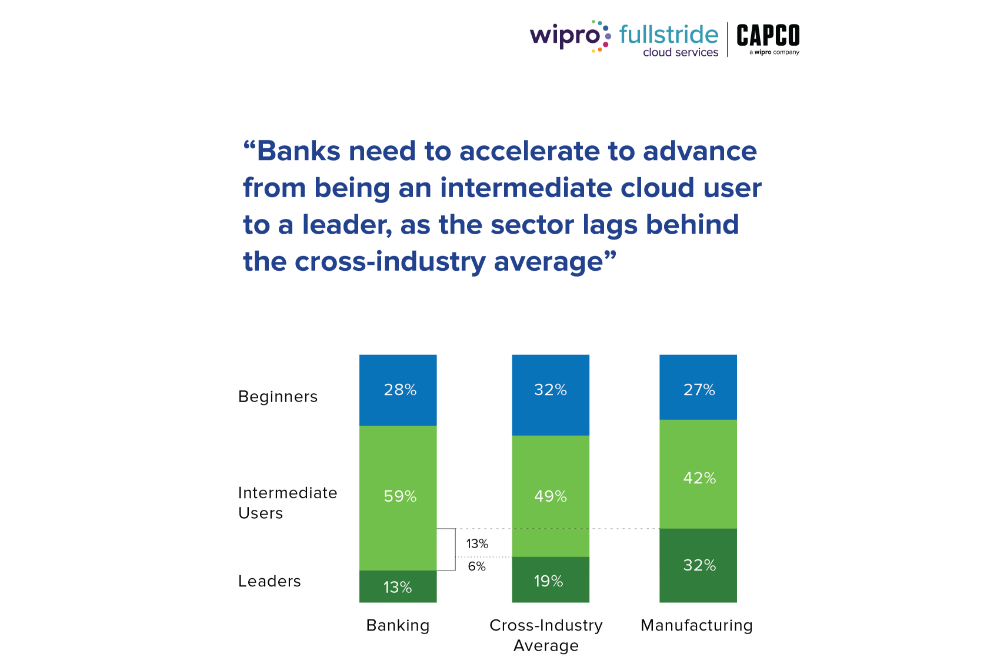

To illustrate this point, while cloud adoption in banking has surged, the sector is still behind other industries and there is significant potential for banks to accelerate their cloud transformation journeys. Currently only 13% of banks are considered cloud leaders, against the cross-industry average of 19% and 32% (highest) in the manufacturing sector.

With disruption taking center-stage, the potential for cloud to help banks solve imminent challenges to stay competitive, is underscored in this report.

Trends and challenges that are altering the banking landscape today

82% of US banking customers access their accounts through digital channels with smartphones being the most preferred medium.

Since 2016, the industry has witnessed a proliferation of neobanks – there are 256 live neobanks currently operating globally.

Technologies such as AI/ML, Cloud, RPA, Blockchain (and others) have acted as important catalysts in driving momentous changes in traditional banking models.

Wipro and Capco global banking research report series, Chapter 1 – Reaching for the Cloud: A Proposition for Leaders, for more details on how banks can accelerate cloud adoption and to discover three distinct approaches to cloud transformation that banks can follow to become disruptors.

Download your personal copy here

Wipro’s Banking, Financial, and Insurance Salesforce practice provides real-time transactions with results, data security, and improves the customer experience.

Payments system transformation can enhance bank and customer relationships, as well as create new revenue streams.

Cash Management and Payments systems in Emerging Markets : Opportunities and Challenges