Leveraging AI & Machine Learning in Designing Anti Money Laundering (AML) Framework; Perspectives from Indian Banking Industry

Abstract

Globally and in India, managing financial crime has been a major challenge. Regulators across the world have introduced several guidelines and taken measures to detect, prevent and tackle money laundering activities. The Indian banking industry has experienced considerable challenges in adhering to and complying with the financial crime guidelines on account of the new patterns the guidelines are evolving on a continuous basis for carrying out money laundering activities that remain undetected by the traditional rule-based system. Also, there have been instances of non-compliance, identified by the regulator (RBI); resulting in massive monetary fines and reputational damage. This paper covers current practices adopted by Indian banks to prevent financial crime and fraud risk management. It provides a holistic view of the prescribed measures (by RBI) to avert money laundering and financial fraud. The focus of this paper is to provide an overview of the risk-based AML principles and how artificial intelligence (AI) and machine learning (ML) could be leveraged for monitoring transactions and complying with the guidelines in an effective and efficient manner.

1.0 Introduction

Know-Your-Customer (KYC) and anti-money laundering (AML) are in the limelight globally since some large banks were hit with hefty penalties in 2012. Regulators in the United States and Europe have imposed $342B in fines on banks since 2009 for misconduct, including violation of AML rules, and that is likely to top $450B by 2023. Despite several analytical platforms, tools and applications being available for AML transaction monitoring, there has been an increasing incident of penalties levied on the banks in India and abroad for non-compliance with the AML guidelines1.

In 2016, the Reserve Bank of India (RBI) had imposed INR 270M in fines on 13 Indian banks for violating KYC norms and 8 other banks were advised to put appropriate measures in place, and had reviewed from time to time to ensure strict compliance of KYC requirements2. As of August 2019, RBI has imposed INR 265M in fines on banks for non-compliance with its directions relating to opening/ operating of accounts and end-use monitoring of funds. This has triggered a flurry of initiatives across the banking sector to boost compliance both in India and abroad.

Most of the financial institutions (FIs) rely on a system of rules and procedures targeted for acquiring knowledge about their customer and their activities. However, money launderers have come out with alternatives to cover their activities, that a traditional rule-based system might not be capable enough to detect. It results in non-detection/ non-reporting of the suspicious transactions; leading to non-compliance with the AML/KYC regulations. This may result in both financial and reputation loss. Therefore, it is of utmost importance for banks to establish a reliable set of controls, allowing them to identify monetary activities and transactions even when the money launderers are using the best of their ability to circumvent the rules. One of the promising ways is to use an AI & ML driven AML transaction monitoring system.

2.0 Traditional process – Anti-money Laundering (AML) transaction monitoring

The traditional process performs routine scans for transactions based on pre-defined rules and flags that meet the criteria of those rules for the purpose of further investigation. These rules generally fall in the following categories of scenarios:

Alerts generated out of these rules are then investigated by a bank’s operations team, which is set up for conducting a detailed review/ investigation. Based on the outcome of the investigation, they are either closed considering false positives or reported as suspicious transactions.

2.1 Drawbacks of the traditional AML transaction monitoring

Despite the efforts taken by the banks, the level of undetected suspicious transaction remains high. Thus, to overcome various shortcomings, banks are evolving from the traditional approach towards advanced approaches involving AI & ML enabled technology for transaction monitoring and complying with the stipulated AML guidelines.

3.0 Contemporary fraud risk models: Leveraging AI & ML

AI & ML facilitate continuous advancement of computing through exposure to new scenarios, testing and adaption, while employing pattern and trend detection for improved decisions in subsequent (though not identical) situations. Also, ML includes techniques, approach and tools that produce actionable insights from the data that can be used by an investigator for further investigation, which can lead to reporting a suspicious transaction or identifying a new fraud pattern. This enables the capability to update the rules to identify and monitor suspicious transactions on a real time basis.

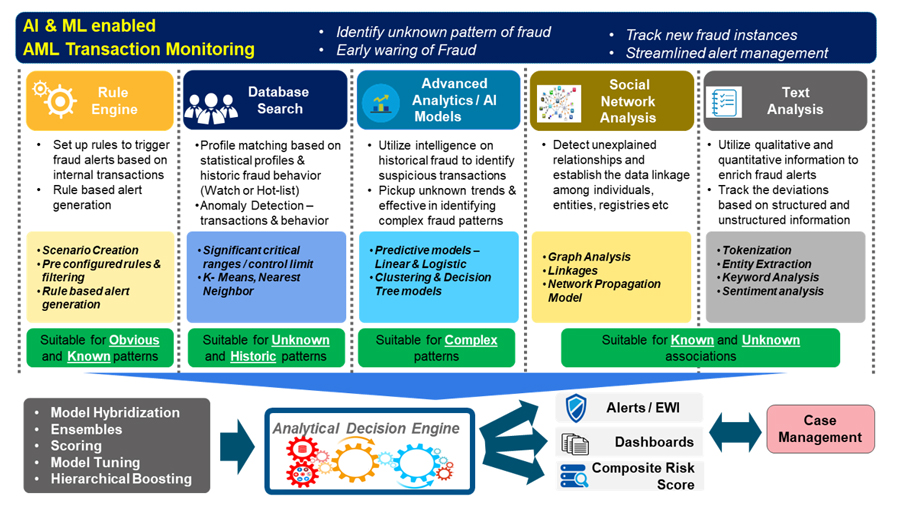

Figure 1: Proposed fraud risk model

4.0 Research Methodology and Case: A consultative approach adopted by 3 MNC banks

This case elucidates the AML and fraud risk deployment story of 3 reputed multinational banks that have been carrying out consumer banking activities perinstructions by the RBI. These banks had faced huge reputational and financial impact on account of non-compliance with financial crime guidelines. Due to restrictions in usage of customer data, privacy and confidentiality clauses, we have not illustrated the exact implementation details of the proposed approach. However, we have shared a holistic view within the permissible level of disclosures.

In this paper, we illustrate, through case studies, how a global IT and consulting firm efficiently incorporated AI & ML enabled fraud score and financial crime prevention models for three multinational banking clients, and achieved compliance with guidelines stipulated by the RBI.

4.1 Business Challenges

4.2 Solution Deployed

Considering the fast evolution and new number of ways / techniques emerging for money laundering by fraudsters, there is an urgent need to constantly evaluate the trans actions and external factors and identify new scenarios. Any delay in the detection mechanism would result in the system’s inability to detect the suspicious transaction; thus resulting in non-compliance of the regulatory prescribed guidelines.

Adopted approach:

4.3 Business Benefits

The new system provided greater flexibilities with limited resources to support the end-to-end financial crime transaction monitoring process.

Easy navigation, money laundering patterns analysis with several pre / custom-built visualization and identity relationship and resolutions patterns, integrated case management and reporting, rules repository, online rules definition capability etc. enriched the operations.

Figure 2: Deployed AI & ML enabled financial crime management system at the respective banks

4.4 Advantages

Easy navigation, money laundering patterns analysis with several pre / custom-built visualization and identity relationship and resolutions patterns, integrated case management and reporting, rules repository, online rules definition capability etc. enriched the operations.

4.5 Challenges faced during implementation process

5.0 Conclusion and Recommendations

Across the world, regulators are holding financial institutions answerable for the magnitude of failures in management of financial crime. Averting money laundering is no easy feat, not with both the criminal environment, and product and service risks posing as main hindrances4. Risk managers and data scientists with limited practical research experience might not foresee the challenges in implementing a sturdy financial crime management system and protocols in combating modern day techniques of fraud risk and money laundering adopted by hackers and criminals. One, these issues become intensified in the context of adaptation of a machine learning enabled risk management system, fraud prediction models and scorecards. Two, in response to a RTI filed in 2020, the RBI stated that the total number of frauds reported by scheduled commercial banks and select FIs during Financial Year 2019-20 was 84,545 and the amount involved therein was INR 1,858 Bn. However, RBI did not have any information about the number of bank employees involved in fraud cases and the amount involved. Irrespective of the predictive power of these models, it is essential to have a control mechanism over internal stakeholders (including staff, contract employees etc.) as a major proportion of such crimes happen due to lapses in internal systems; including staff. Three, it is high time financial institutions reconfigure their alert and transaction monitoring programs to identify the rudimentary to super-complex, multi-dimensional money laundering and terrorism finance methods that are defeating today’s rules-based detection scenarios. Adopting an actor-centric hybrid threat finance (HTF) model can cut compliance costs, reduce risk, improve regulatory relations, and increase the usefulness of suspicious activity reports5 Four, it may be too idealistic to ask financial institutions to balance two roles (execution of a seamless and lightning-fast customer resolution versus having a dynamic financial crime and anti-fraud management process in the background). It is an arduous task to meet compelling customer demands, provide 24*7 surveillance, deploy advanced cyber forensics, and at the end of the day save money and retain customers.

References

Chiranjibi Panda

Chiranjibi was inducted in Wipro as a Senior Member in Wipro DMTS (Distinguished Member of Technical Staff) class of 2019. An ex-banker, he has over 12 years of diverse experience in the BFSI sector with focus on Risk Analytics and Consulting. Chiranjibi presently leads the Risk & Compliance Practice for Wipro's India Geo and is responsible for business & competency development as well as enterprise-level implementation across Basel & Regulatory Guidelines, Financial crime and Integrated Risk Management.

Chiranjibi can be reached at chiranjibi.panda@wipro.com